Starting a small business is an exciting journey, but the paperwork can be daunting. One critical step you must tackle is obtaining an Employer Identification Number (EIN). But fear not! This guide will simplify the EIN application process and help you navigate these requirements with ease. Whether you’re launching a new venture or formalizing an existing one, understanding the EIN process is crucial.

Understanding the Importance of an EIN

As a small business owner, you might wonder why an EIN is essential. Essentially, an EIN is like a Social Security number for your business. It’s used for tax reporting and is required for opening a business bank account, hiring employees, and filing taxes.

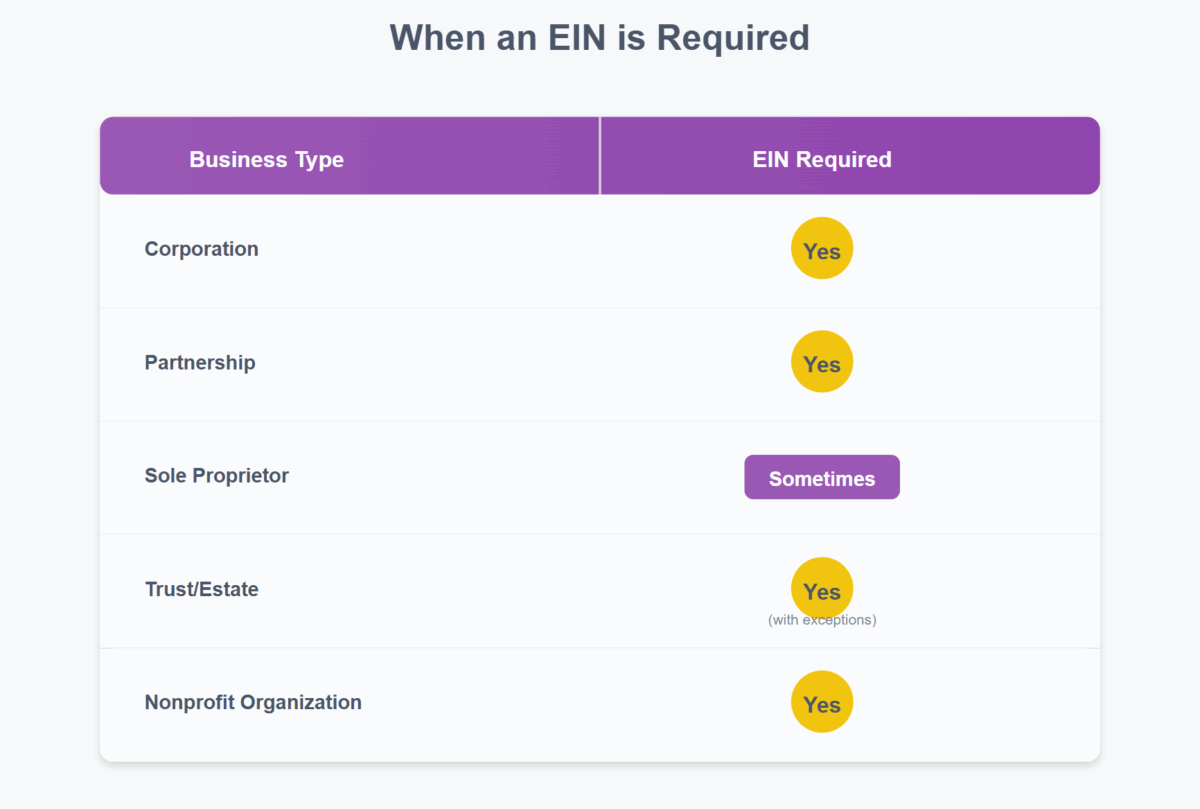

Who Needs an EIN?

Before diving into the application process, you need to determine if your business needs an EIN. Generally, if you hire employees or operate as a corporation or partnership, you need one. Even if you’re a sole proprietor, obtaining an EIN can help separate your personal and business finances.

When an EIN is Required

Benefits of Having an EIN

Why should you bother with an EIN if you’re not legally required to have one? Firstly, it enhances your business’s credibility. Secondly, it helps protect your personal information, as you won’t need to use your Social Security number for business transactions.

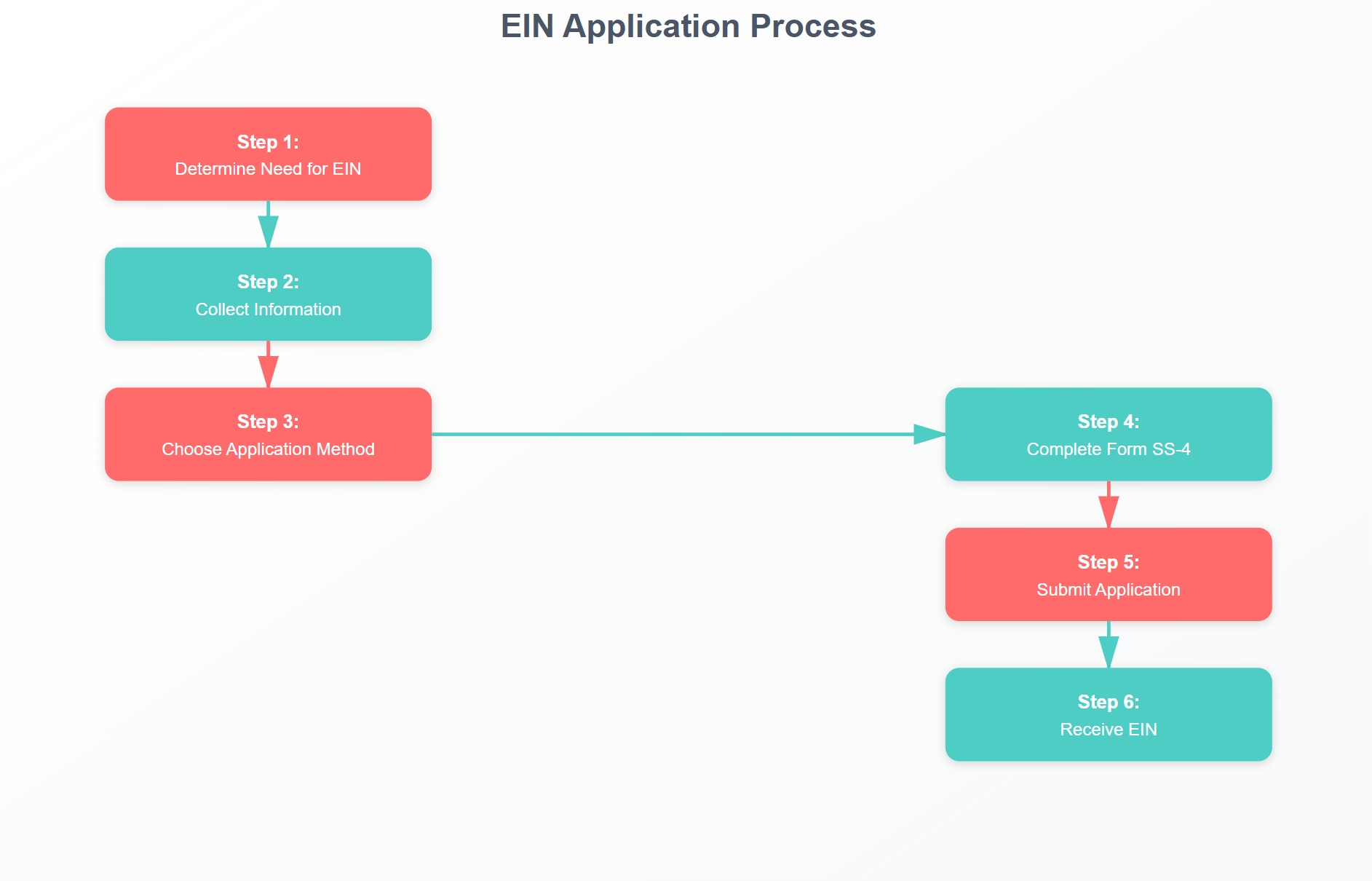

Navigating the EIN Application Process

Ready to apply for your EIN? Let’s break down the steps. Fortunately, the process is straightforward and can be completed online, by fax, mail, or phone.

Step 1: Gather Necessary Information

Before you start, gather all required information. This includes your Social Security number, business name, and principal business address. If applying for a corporation or partnership, you’ll need details about the responsible party.

Step 2: Choose Your Application Method

The fastest way to apply is online through the IRS EIN Online Application. Alternatively, you can submit IRS Form SS-4 via fax or mail. Although less common, applying by phone is an option for international applicants.

Step 3: Complete the Application

When you’re ready, fill out the application. Make sure all information is accurate to avoid delays. If completing it online, you’ll receive your EIN immediately upon completion. For other methods, processing times vary.

Detailed EIN application process

Common Mistakes and How to Avoid Them

Even with a clear process, mistakes can happen. Avoid these common pitfalls to ensure a smooth application.

Incorrect or Incomplete Information

One of the most common errors is providing incorrect or incomplete information. Double-check all entries before submitting, especially the spelling of your business name.

Selecting the Wrong Business Structure

Your business structure affects your EIN application. Ensure you accurately identify your business as a sole proprietorship, partnership, corporation, or other entity type.

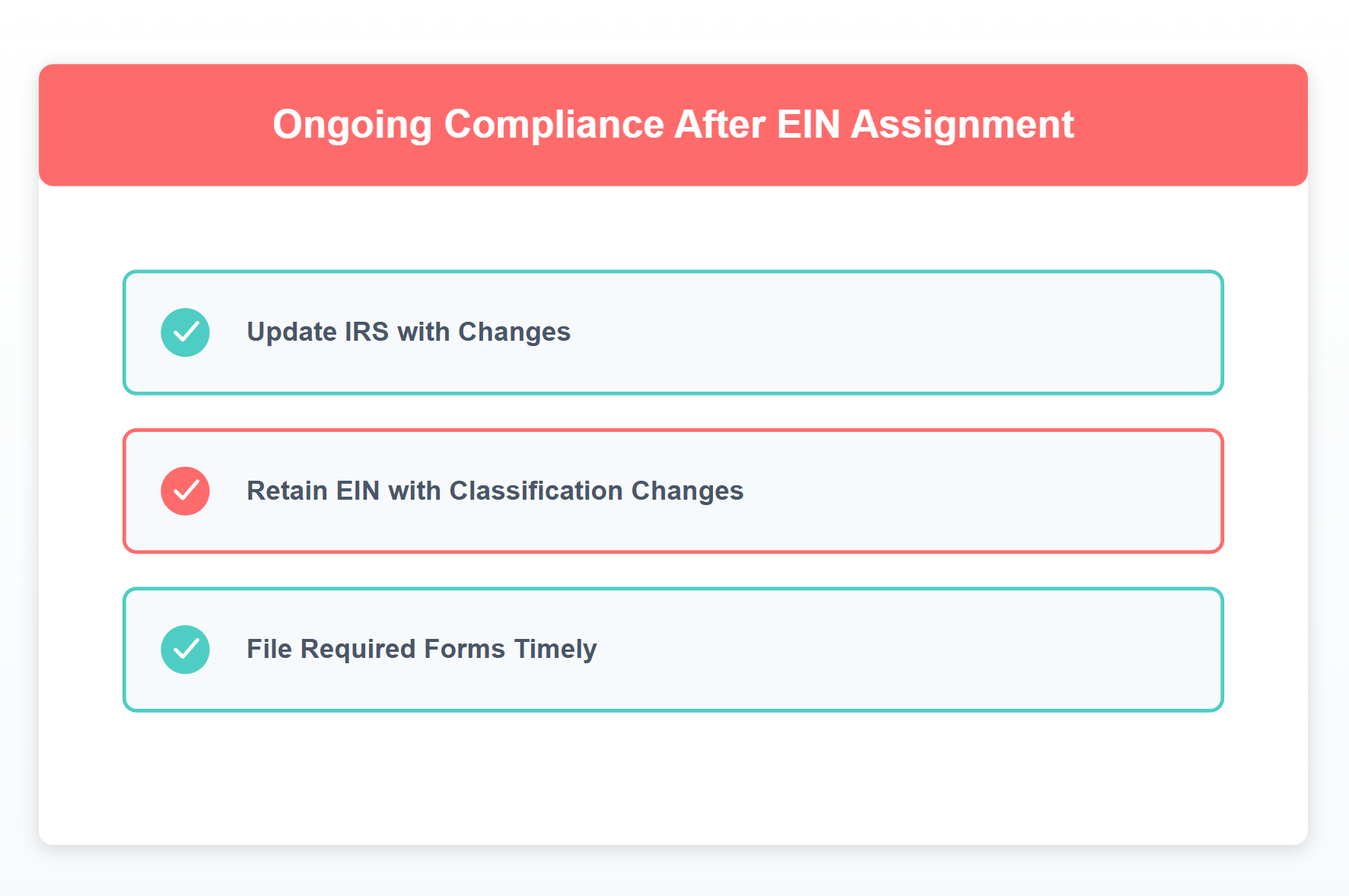

Ongoing Requirements After Obtaining an EIN

Once you have your EIN, your responsibilities don’t end. You need to understand ongoing requirements to maintain compliance.

Filing Taxes

Your EIN is crucial for filing federal taxes. Be sure to include it on all tax documents and keep it handy for future reference.

Updating Information

If your business information changes, such as your address or structure, update your EIN details with the IRS. Keeping your information current helps avoid complications.

Ongoing Compliance After EIN Assignment

Conclusion: Taking the Next Steps

Applying for an EIN is a pivotal step in establishing your business’s identity. By following these steps and avoiding common mistakes, you’ll streamline the process. Ready to take action? Visit the IRS EIN Online Application and get started today.

Remember, having an EIN is not just a formality. It’s a crucial part of your business operations. Keep your information updated, and consult resources like the IRS Form SS-4 if you have questions. By staying informed, you’ll set your business up for success.

With this guide, you’re now equipped to tackle the EIN application with confidence. Good luck as you embark on your entrepreneurial journey!

Free Slide Deck on the EIN Process

Test Your Knowledge: Take Our Business EIN Quiz

Free Downloadable Resources

Quick Reference Guide: EIN Essentials for Small Business Owners