Navigating the world of tax deductions can feel overwhelming, especially when it comes to vehicle expenses. However, mastering the art of vehicle deductions can significantly impact your bottom line. This guide will help you understand mileage and actual expense deductions, ensuring you make the best choice for your small business. By the end, you’ll know exactly how to maximize your vehicle deductions, ultimately saving your business money.

Understanding Vehicle Deductions

As a small business owner, you’re likely aware that vehicle expenses can be a significant part of your operational costs. The IRS allows you to deduct these expenses under 26 U.S.C. § 162(a) (ordinary and necessary business expense deduction). However, you must choose between two methods: the standard mileage rate or actual expenses. Making the right choice is crucial, as it can affect your tax liability and cash flow.

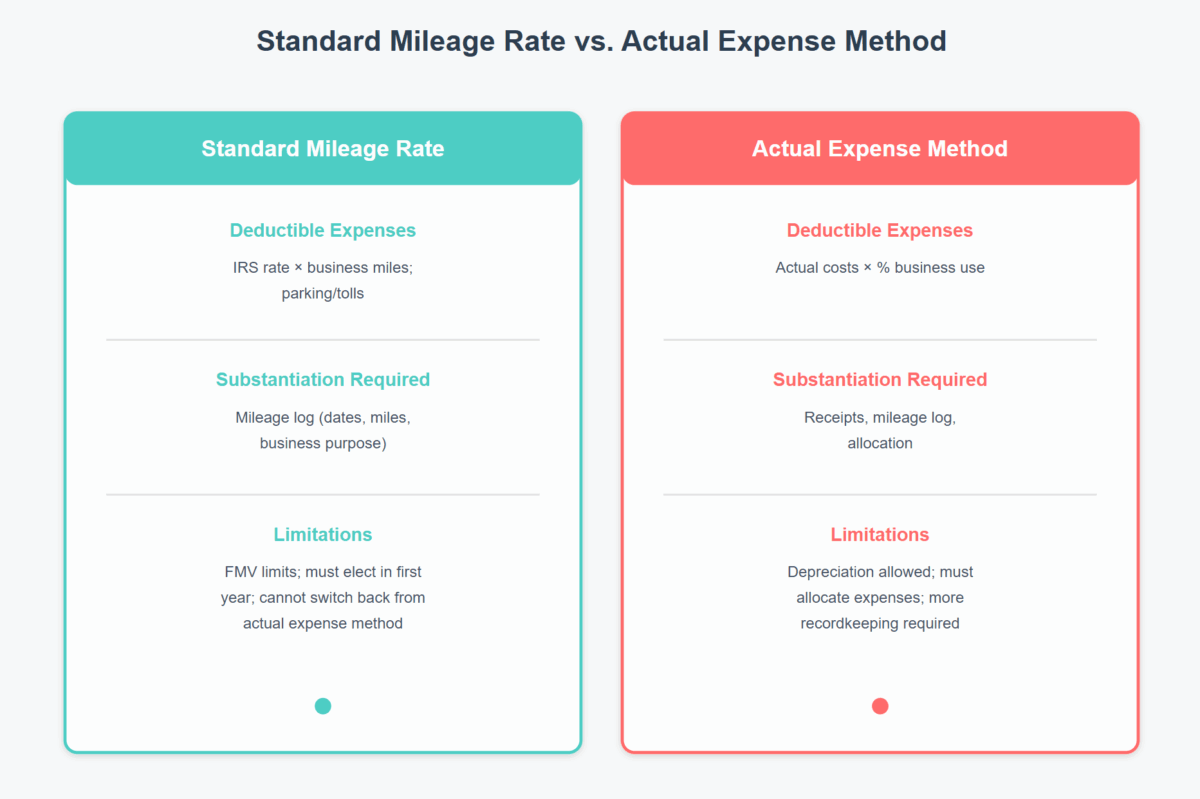

Standard Mileage Rate vs. Actual Expense Method

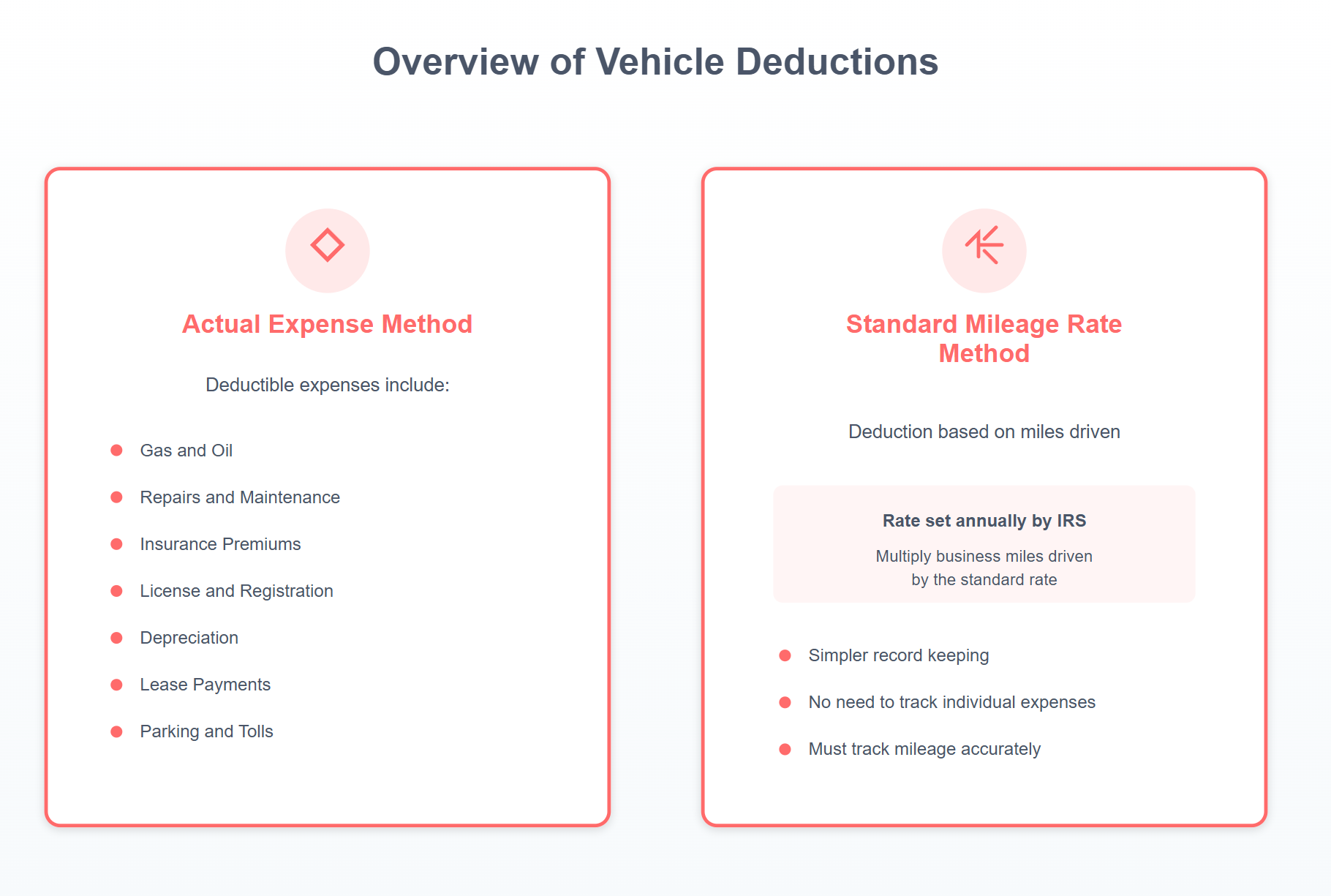

Overview of Vehicle Deductions

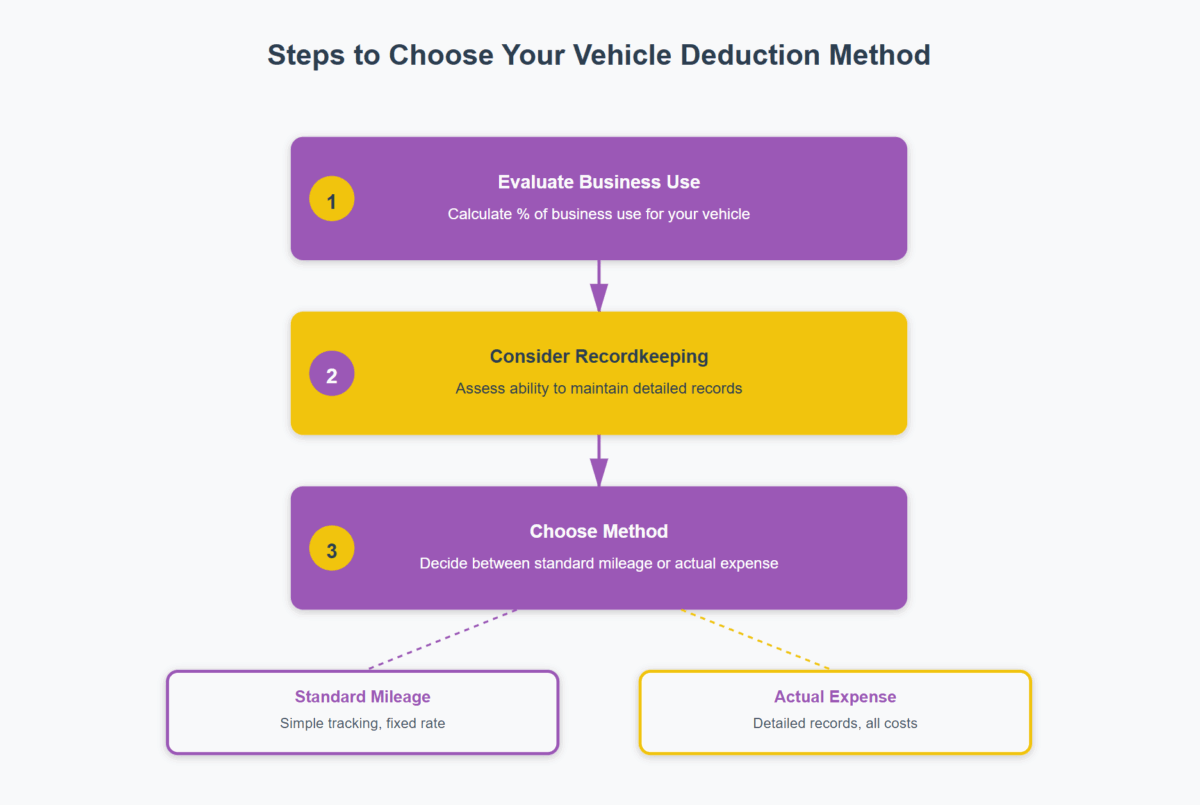

When it comes to vehicle deductions, you have two primary options. The standard mileage rate involves multiplying the miles driven for business by a predetermined rate. In contrast, the actual expense method requires you to add up all the costs associated with operating your vehicle. Both options have their pros and cons, and understanding them is key to making an informed decision.

Substantiation Requirements

Accurate record-keeping is essential for vehicle deductions. Regardless of the method you choose, documenting your expenses is non-negotiable. For mileage deductions, you need a log of miles driven, dates, and purpose. On the other hand, actual expenses require receipts for fuel, maintenance, and insurance. You can refer to 26 CFR § 1.274-5T for detailed vehicle/listed-property substantiation and recordkeeping requirements. Therefore, maintaining organized records is crucial to avoid IRS penalties.

Overview of Vehicle Deductions.

Choosing Between Methods

Deciding between mileage and actual expenses depends on several factors. To make an informed choice, consider your vehicle’s age, fuel efficiency, and annual usage. Additionally, evaluate your ability to maintain detailed records and your comfort with tax documentation.

Mileage Method

The mileage method offers simplicity. You multiply your business miles by the IRS rate, and you’re done. For many, this is a straightforward way to handle deductions. It’s especially beneficial if you drive a lot for business and have a fuel-efficient vehicle. You can find the latest rules for the standard mileage rate in Rev. Proc. 2019‑46.

Actual Expenses Method

The actual expenses method involves more work but can yield higher deductions. You deduct all costs related to operating your vehicle, such as gas, repairs, and insurance. This method is advantageous if you have a high-cost vehicle or significant maintenance expenses. However, remember that detailed record-keeping is vital as per 26 U.S. Code § 274 – Disallowance of certain entertainment, etc..

Steps to Choose Your Vehicle Deduction Method

Employer-Provided Vehicles and Reimbursements

If your business provides vehicles to employees, understanding tax implications is crucial. Employer-provided vehicles often lead to questions about personal use and reimbursements. It’s important to establish a clear policy and maintain records to avoid hefty tax liabilities.

Personal Use of Company Vehicles

When employees use company vehicles for personal errands, you must account for this. The IRS requires you to calculate the value of personal use and report it as income. Therefore, clear policies and accurate tracking are essential.

Reimbursement Options

If employees use personal vehicles for business, reimbursements are common. Standard mileage rates simplify this process and are often preferred. You can find the 2025 standard mileage rates in IRB 2025-03. Alternatively, you can reimburse actual expenses, but this requires more documentation.

Maximizing Vehicle Deductions: A Business Owner’s Guide

Key Regulatory and Case Authority

Understanding regulatory guidelines can help you stay compliant and avoid audits. Key IRS publications, such as IRS Publication 463, provide comprehensive details on vehicle deductions. Additionally, historical tax cases offer insights into how courts interpret these regulations. Keeping informed about these resources is essential for making informed decisions.

🚚 Free Slide Deck on Business Vehicle Deductions

Conclusion

In summary, choosing the right vehicle deduction method can save your business money and reduce tax liability. By understanding your options, keeping accurate records, and consulting resources like IRS Publication 463, you can make informed decisions that benefit your bottom line. Now is the time to evaluate your vehicle expenses and choose the method that maximizes your deductions. For more on tax strategies, check out our related articles and consult with a tax professional to ensure compliance.