Meet Diana, who runs a small design and print shop. For the past year, she’s been eyeing a new wide-format printer and some much-needed office furniture—but she kept putting it off, waiting for “the right time.”

Well… that time is now.

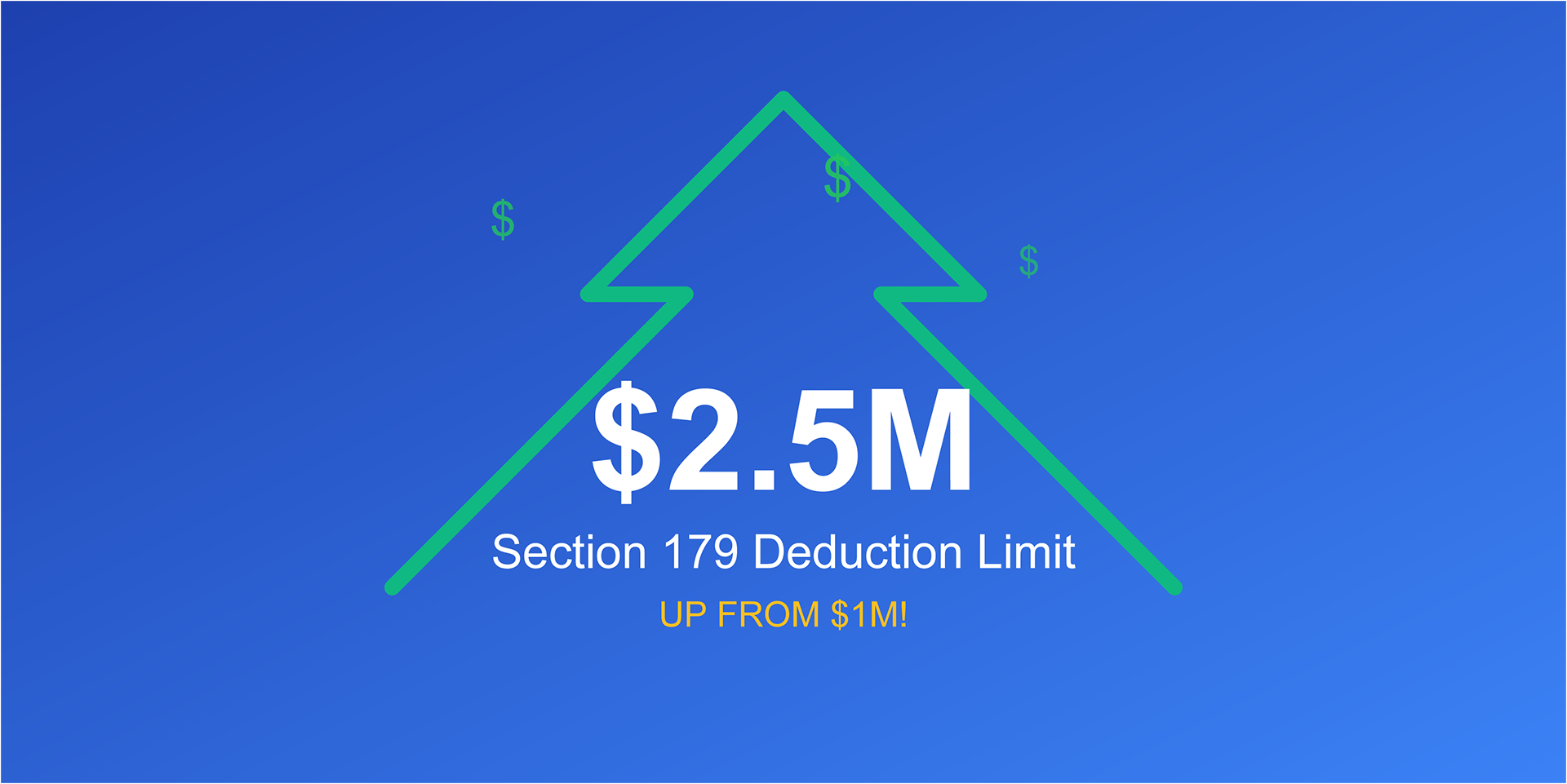

Under the new One Big Beautiful Bill Act (OBBA), the Section 179 deduction limit has jumped to $2.5 million—up from roughly $1 million in 2024. That means small businesses like Diana’s can deduct the full cost of qualifying equipment and furniture purchases right away, instead of depreciating them over several years.

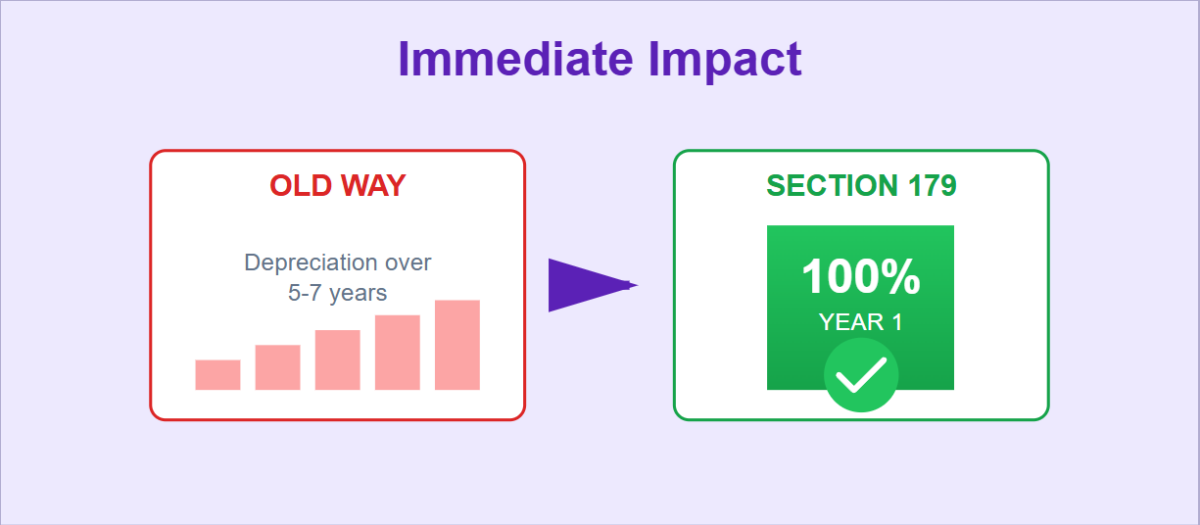

Before vs After Comparison – Old way vs Section 179 immediate deduction

If Diana buys that new printer, a set of standing desks, or even a company work truck before December 31, 2025, she can likely deduct the entire purchase this tax year.

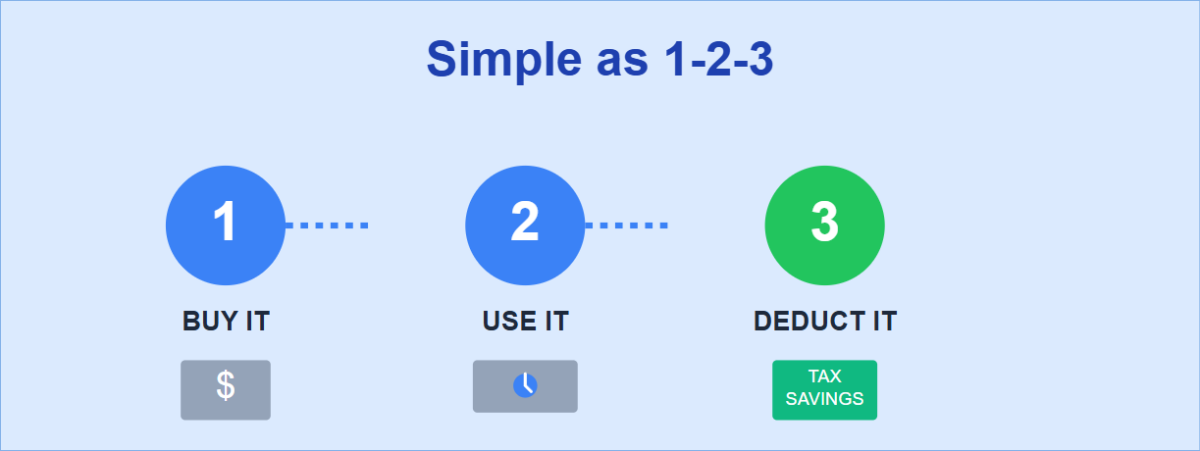

Simple 3-Step Process – Buy It, Use It, Deduct It

What Qualifies

Most tangible business gear fits under Section 179, including:

-

Office furniture and fixtures (desks, chairs, cabinets)

-

Computers, printers, and off-the-shelf software

-

Work trucks, vans, and certain heavy vehicles

-

Equipment and tools used in your trade or business

-

Building improvements such as HVAC, roofs, or fire-suppression systems

Qualifying Equipment Grid – Visual icons of all eligible purchases

And yes—items put into service in December qualify just like those purchased in January. You don’t have to prorate the deduction.

Why This Matters

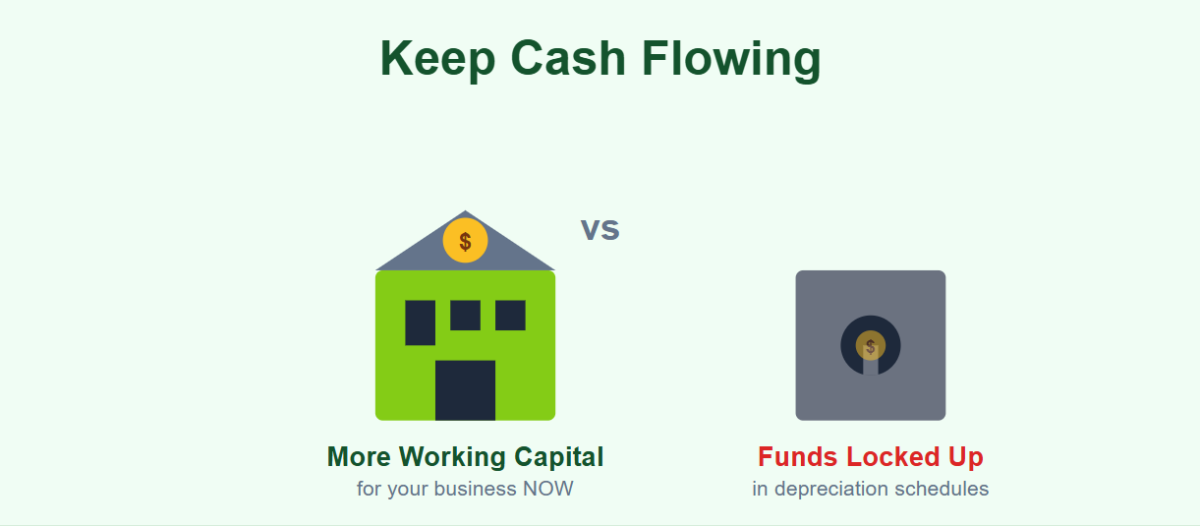

Immediate expensing means better cash flow.

When you deduct the full purchase price now, more money stays in your business to cover payroll, materials, or marketing.

Cash Flow Visualization – Working capital vs locked-up funds

It’s one of the few tax breaks that feels like a real-world reward for investing in yourself.

Quick FAQs

1. Can I finance equipment and still take Section 179?

Yes. If the equipment is purchased and placed in service by year-end, you can take the deduction even if you financed it. Many small businesses use equipment financing or leases to take the write-off now while spreading out payments.

2. Does used equipment qualify?

Also yes—so long as it’s new to you and used for business. Section 179 isn’t limited to brand-new items.

Why You Shouldn’t Wait

The OBBA’s Section 179 increase is effective for 2025, but it isn’t guaranteed forever. Lawmakers can adjust these limits again in future years.

So if you’ve been putting off buying that delivery van, upgrading computers, or outfitting your office, this is your sign to act before December 31.

Buy it. Place it in service. Deduct it.

That’s Section 179 in plain English.

December 31 deadline for increased Section 179 expensing.

Ready to See What You Can Deduct?

If you’re not sure which purchases qualify or how much you can safely write off, reach out to your tax advisor before year-end. A short planning conversation could mean thousands in savings—and one less thing to stress about come tax time.