Understanding the Accounts Receivable Process Flow in QuickBooks Online

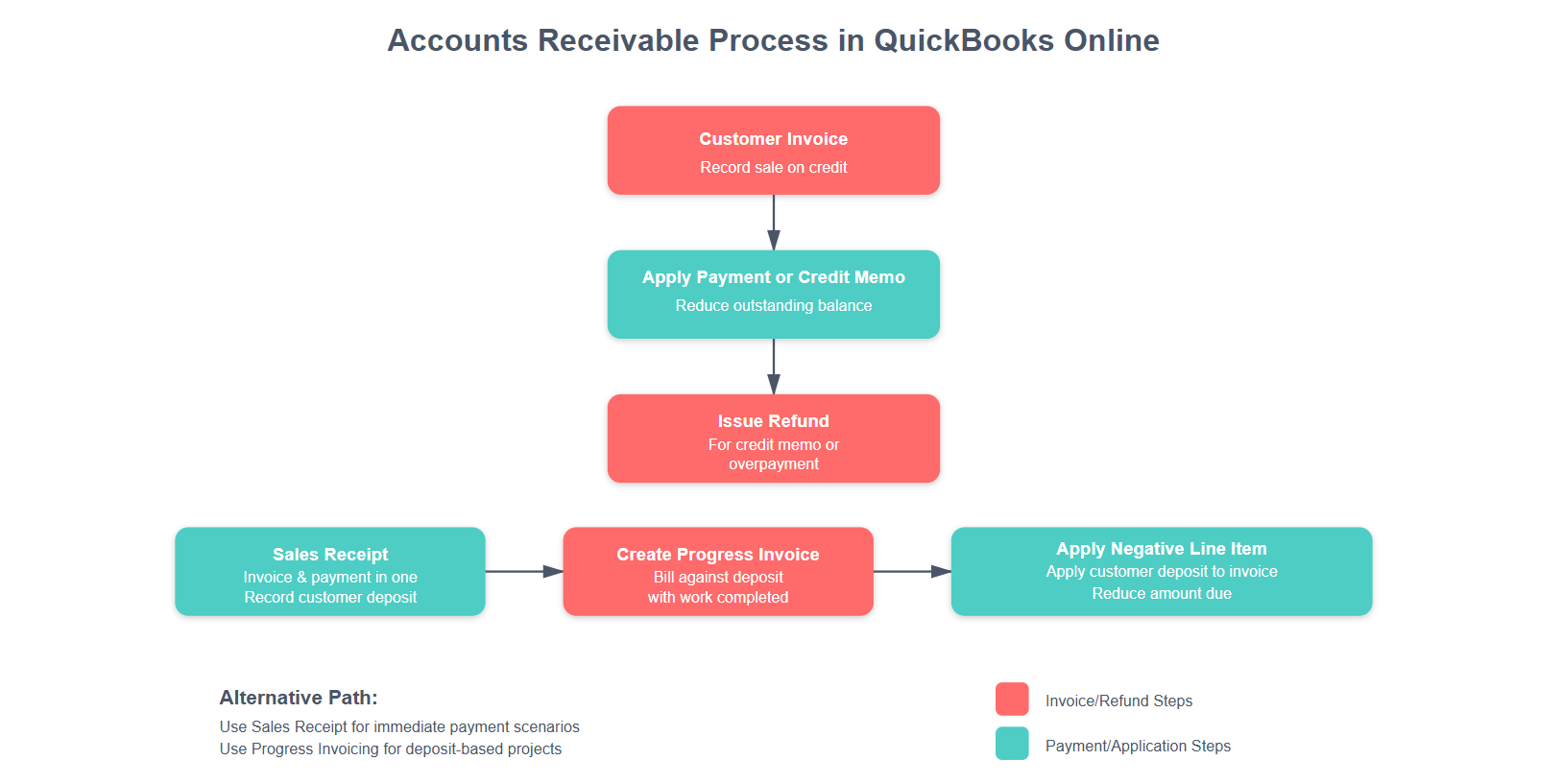

This guide provides a complete walkthrough of the Accounts Receivable (A/R) process flow in QuickBooks Online. You will learn how to create invoices, record customer deposits as liabilities, apply those deposits to progress invoices, manage customer overpayments, issue refunds, and reconcile Accounts Receivable to ensure your financial statements remain accurate and up to date.

Accurately managing your A/R process is essential for understanding what your customers owe, when payments are due, and how your sales activity impacts your Profit and Loss and Balance Sheet. Following the correct process flow also helps prevent common reporting errors such as unapplied cash payment income, negative customer balances, or overstated revenue.

By the end of this guide, you will understand how each transaction—from a customer deposit to a final payment—flows through QuickBooks Online, how it affects your financial statements, and how to ensure your books reflect the true financial health of your business.

Step-by-Step A/R Process Flow in QuickBooks Online

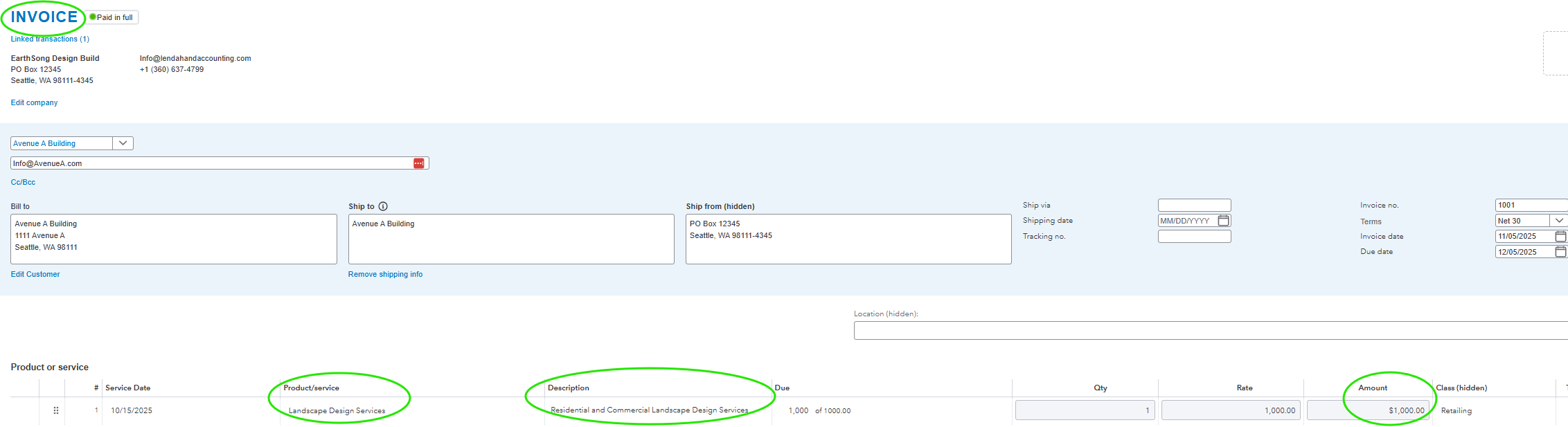

1. Creating an Invoice for Products and Services Sold

When you create an invoice in QuickBooks Online, the date you enter is very important—it tells QuickBooks when to record the sale as income and when to show that the customer owes you money. Always make sure your invoice date is accurate and that any payment you record has the same or a later date. If you enter a payment dated before the invoice, QuickBooks will count it as Unapplied Cash Payment Income, which can make your reports look like you earned income earlier than you really did. Using the correct dates helps keep your income reports accurate and your Accounts Receivable in balance.

Purpose: Record income when products or services are sold but not yet paid for.

Navigation

-

Select + New › Invoice

Steps

-

Choose the Customer (or sub-customer/job).

-

Add the Product/Service items sold.

-

Each Product/Service must be mapped to the correct Income account (e.g., Service Income or Product Sales).

-

-

Enter the Quantity, Rate, Terms, and Due Date.

-

Save and send the invoice to your customer.

Accounting Impact:

Increases Accounts Receivable on the Balance Sheet.

Records Income on the Profit and Loss report.

Example of an Invoice for Services Sold in QuickBooks Online

2. Recording a Customer Payment Received for an Invoice

When recording a customer payment in QuickBooks Online, it’s important to document what actually happened—not just that a payment was received. Always enter the correct payment date, making sure it is the same as or later than the invoice date. If you date the payment earlier than the invoice, QuickBooks will treat it as Unapplied Cash Payment Income, which can distort your Profit and Loss report.

Be sure to select the proper payment method (such as check, ACH, or credit card) and include any reference number shown on the remittance advice or customer payment confirmation. Apply the payment to the specific invoice it was meant to pay so your Accounts Receivable report matches your records and your customer’s records exactly. Taking these steps ensures your financial reports are accurate, your A/R balances are clean, and every transaction is supported by proper documentation.

Purpose: Apply a customer payment to an open invoice to clear the A/R balance.

Navigation

-

Select + New › Receive Payment

Steps

-

Choose the Customer.

-

Check the box next to the Invoice being paid.

-

Select the Deposit To account (e.g., Undeposited Funds if batching deposits, or Checking Account if received directly).

-

Record the payment method and amount.

-

Save and close.

Accounting Impact:

Reduces Accounts Receivable.

Moves funds into Undeposited Funds or Checking Account.

Example of Receiving Invoice Payment that Creates Unapplied Payment Credit Balance

3. Recording Customer Deposits as a Liability

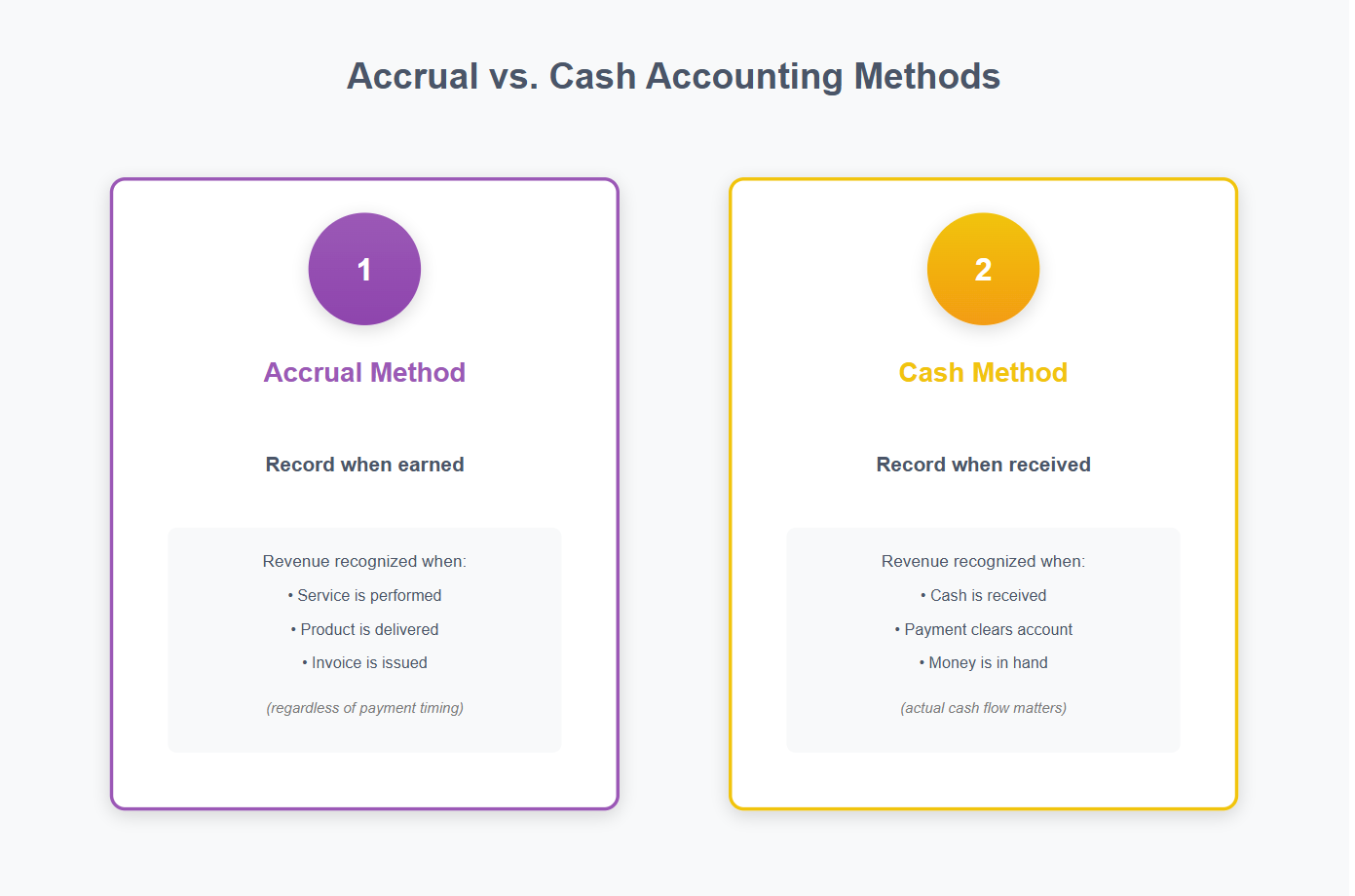

When a customer pays you in advance for products or services that haven’t yet been delivered, the payment represents a liability, not income. Whether your books are kept on a cash or accrual basis, the deposit should be recorded as a Customer Deposit or Unearned Revenue liability because your business still owes the customer goods or services—or a refund if the work doesn’t proceed. Recording it as income too early can overstate your revenue and misrepresent your financial position. Once the work begins or the product is delivered, you’ll apply the deposit to an invoice, which clears the liability and recognizes the income at the correct time.

A comparison of the Cash Vs the Accrual Methods of Accounting

When a customer pays you in advance for work that hasn’t started or for products not yet delivered, that money isn’t income yet—it’s a deposit you’re holding until you’ve earned it. In QuickBooks Online, deposits should be recorded as a liability, not as income, because your business still owes the customer goods or services. Once the job starts or the product is delivered, you’ll apply the deposit to an invoice, which converts it from a liability into earned income. This method keeps your reports accurate and prevents income from being recognized too early.

Purpose: Capture customer prepayments or job deposits that are not yet earned revenue.

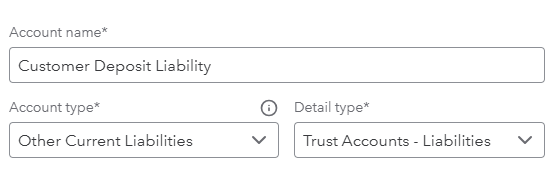

Step A: Create a Liability Item for Deposits

-

Go to Settings › Products and Services › New.

-

Select Service or Non-inventory.

-

Name the item Customer Deposit or Job Deposit.

-

Under Income account, select or create a Customer Deposits Liability account.

-

Save and close.

Example of Account Setup in QuickBooks Online for Deposit Liabilities on the Balance Sheet

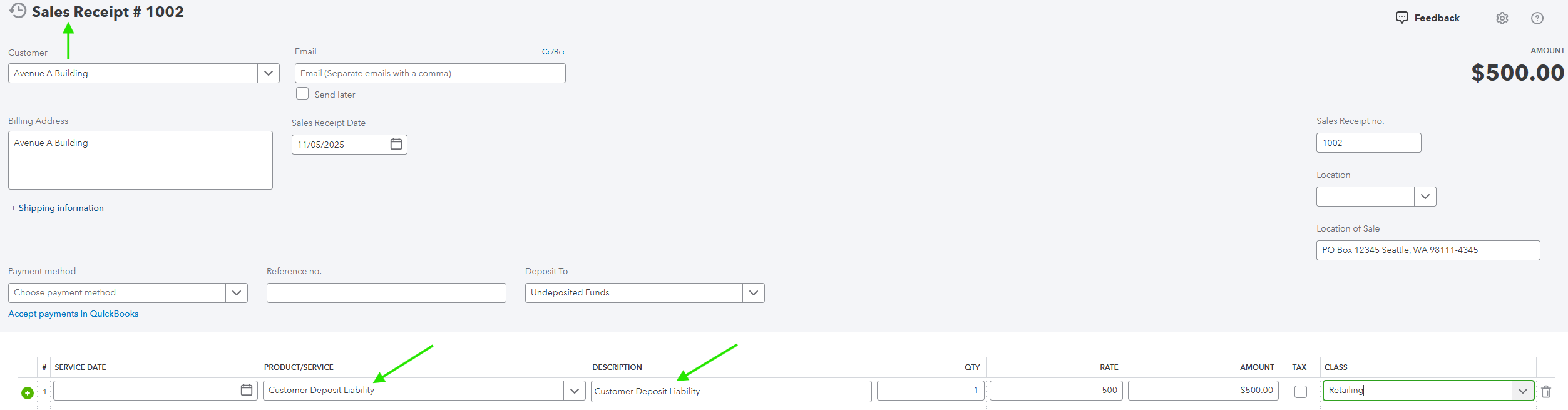

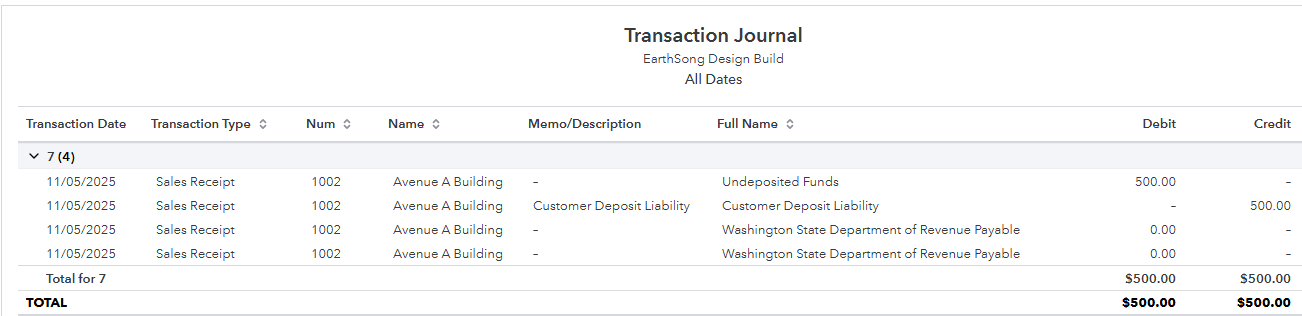

Step B: Record a Deposit Payment

-

Go to + New › Sales Receipt.

-

Select the Customer.

-

Add the Customer Deposit item.

-

Enter the deposit amount and deposit to Undeposited Funds or Checking Account.

-

Save and close.

Accounting Impact:

Increases Customer Deposits Liability on the Balance Sheet.

Does not affect Income until applied to a future invoice.

Example of Sales Receipt Created to Record Customer Job Deposit.

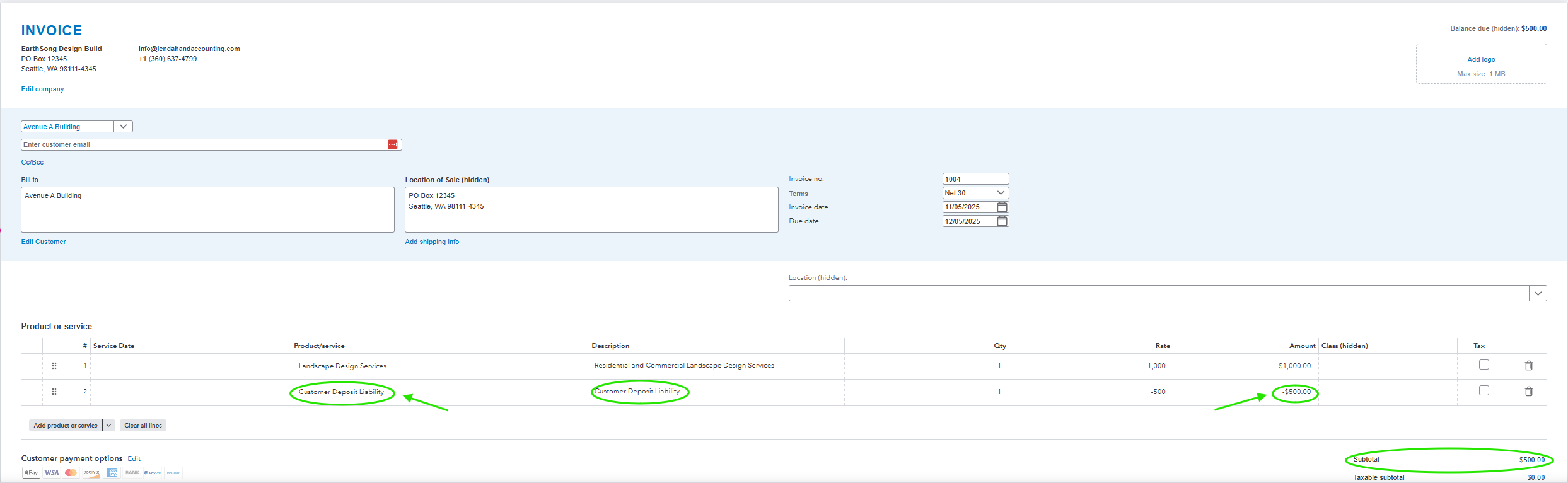

4. Applying a Customer Deposit to a Progress Invoice

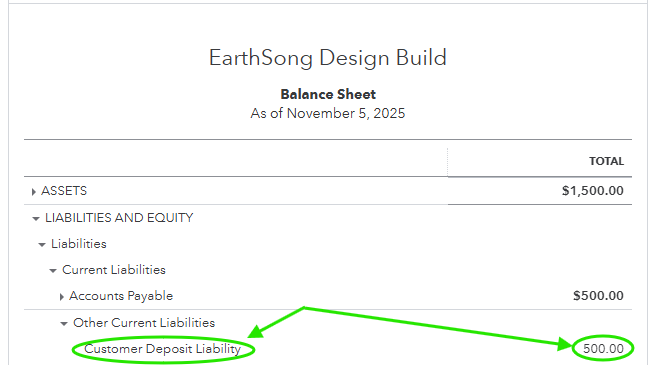

When a customer pays a deposit before work begins, that payment is recorded as a liability because your business has not yet earned the revenue. The deposit appears on your Balance Sheet under a liability account such as Customer Deposits or Unearned Revenue.

Once the project reaches a stage where revenue can be recognized—such as when materials are delivered or services have begun—the deposit must be applied to a Progress Invoice. In QuickBooks Online, this is done by adding the Customer Deposit item as a negative line item on the invoice. Doing this reduces the liability balance and moves the amount into income, showing that part of the work has now been completed and earned.

This graphic illustrates how customer deposits move from cash to liability when received, and from liability to income when applied to an invoice.

Purpose: Convert a customer deposit from a liability to earned income as work begins or materials are delivered.

Understanding the Balance Sheet Impact

To see how this works in your books, review the Balance Sheet before and after the deposit is applied:

Before Applying the Deposit

-

The deposit appears as a liability under Customer Deposits.

-

No income is yet recognized.

-

Cash (or Undeposited Funds) increases because you received money.

After Applying the Deposit to an Invoice

-

The liability in Customer Deposits decreases.

-

Income on the Profit and Loss report increases by the same amount.

-

Cash remains the same—only the classification of the funds changes from liability to revenue.

Example of a Customer Deposit Liability on a Balance Sheet

Navigation

-

Select + New › Invoice

Steps

-

Create a new invoice for the customer.

-

Add products or services provided.

-

On a new line, add the Customer Deposit item created earlier.

-

Enter the deposit as a negative amount (e.g., -500.00).

-

Save and send.

Accounting Impact:

Reduces Customer Deposits Liability on the Balance Sheet.

Offsets Income recognized on the invoice.

Sample of Applying Customer Deposit Liability to Progress Invoice

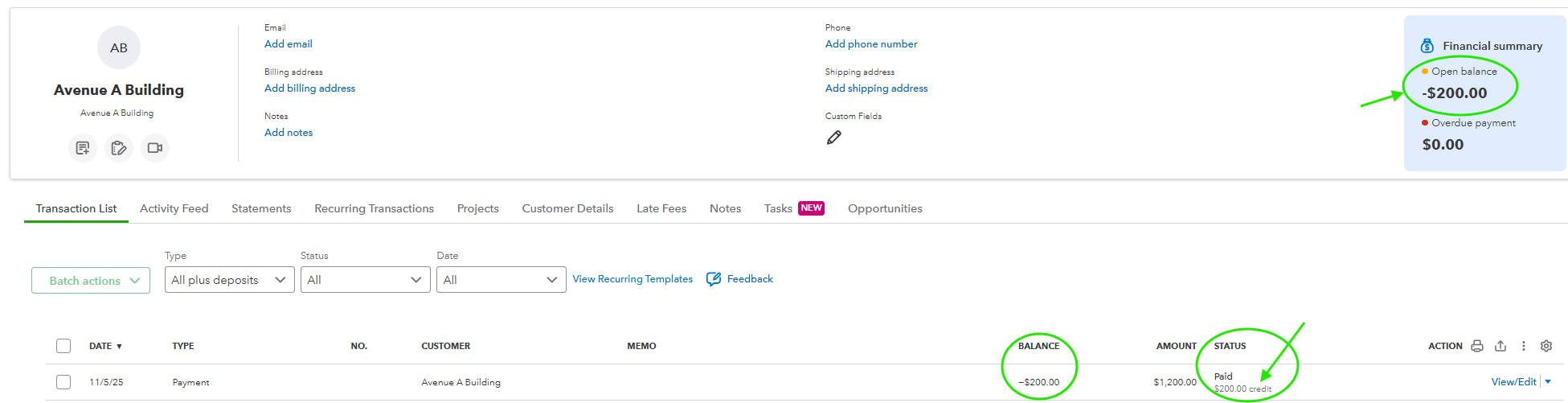

5. Handling Customer Overpayments and Unapplied Cash Payment Income

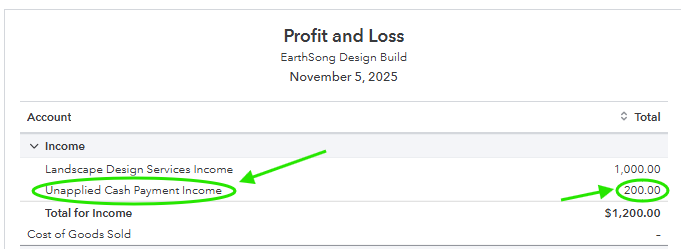

Occasionally, customers pay more than the amount due on their invoice or submit a payment before an invoice is created. When this happens, QuickBooks Online records the difference as an overpayment or unapplied cash payment. These transactions can temporarily inflate income and distort Accounts Receivable if not handled properly. Understanding how to identify and correct unapplied cash ensures accurate Profit and Loss reporting and prevents negative balances on the A/R Aging report. This section explains how overpayments occur, how to record refunds or credits, and how to apply unapplied cash payments correctly to maintain clean, reconciled books.

Example of Customer Transaction List with Open Unapplied Overpayment Credit Balance

Purpose: Address payments received in excess of the amount due or not yet matched to an invoice.

Overpayment Example

If a customer pays more than the invoice amount:

-

The excess amount creates an unapplied payment (negative A/R balance).

-

It appears as Unapplied Cash Payment Income on the Profit and Loss report until applied.

Example of Profit and Loss report with Unapplied Cash Payment Income

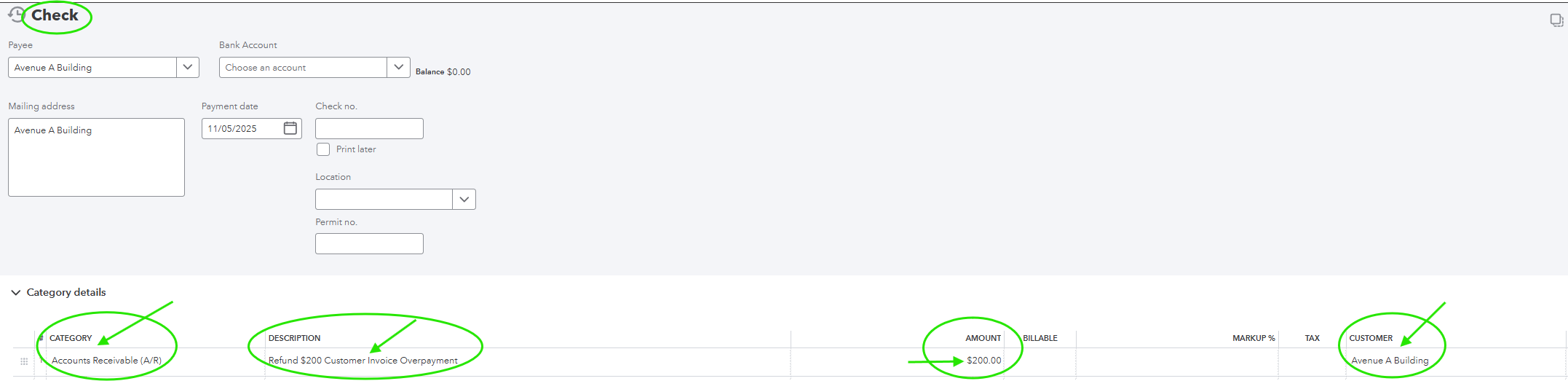

To Refund an Overpayment

-

Go to + New › Check.

-

Select the Customer in the Payee field.

-

Under Category, select Accounts Receivable.

-

Enter the refund amount and save.

Then:

-

Go to + New › Receive Payment.

-

Select the same Customer.

-

Apply the refund check to the unapplied payment or credit.

-

Save and close.

Accounting Impact:

Clears negative A/R balance.

Reduces Checking Account and Accounts Receivable.

Example of Check Created Under Accounts Receivable and Customer Name to Clear the Unapplied Cash Payment in Customer Transaction List.

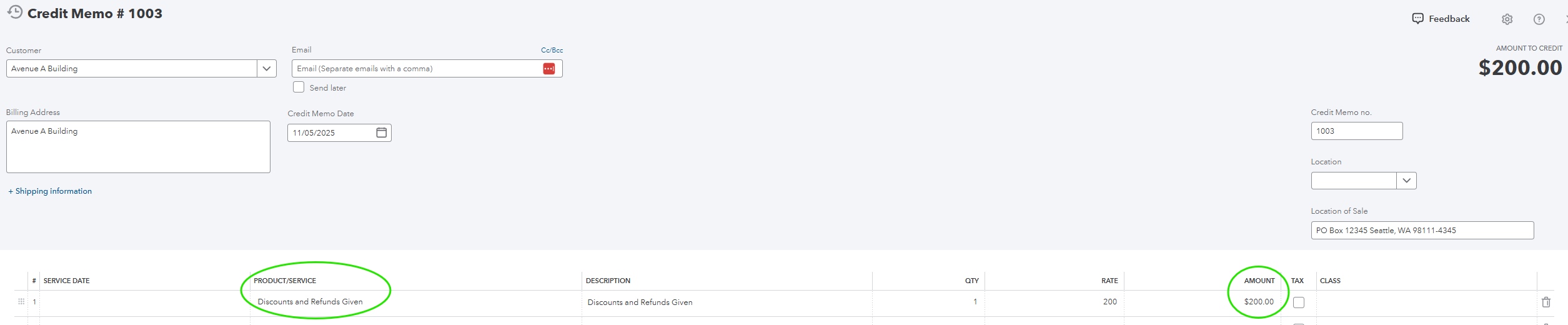

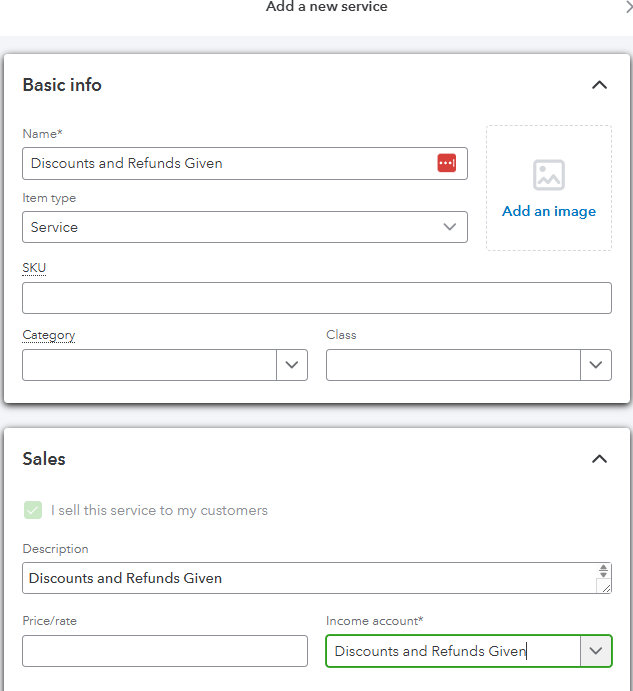

6. Issuing a Credit Memo for Future Use

In some cases, a customer who regularly does business with you may have an overpayment or returned product that you both agree to apply toward future invoices instead of issuing a refund. In QuickBooks Online, this is handled by creating a Credit Memo. A credit memo reduces the customer’s balance owed and creates a credit in their account that can be applied to future invoices. This keeps your Accounts Receivable accurate and ensures your customer’s records match yours.

Purpose: Provide a customer with credit toward future purchases rather than a refund.

Navigation

-

Select + New › Credit Memo

Steps

-

Choose the Customer.

-

Enter the amount and relevant product/service items.

-

Save and close.

To Apply the Credit to an Invoice

-

Go to + New › Receive Payment.

-

Select the Customer.

-

Check both the open invoice and the available credit memo.

-

Save and close.

Accounting Impact:

Reduces Accounts Receivable.

Adjusts Income as appropriate based on items credited.

Example of Credit Memo Created to Apply to Future Invoices and Using the Discounts and Refunds Given Item and Account

Example of Product Service Item for Discounts and Refunds Given

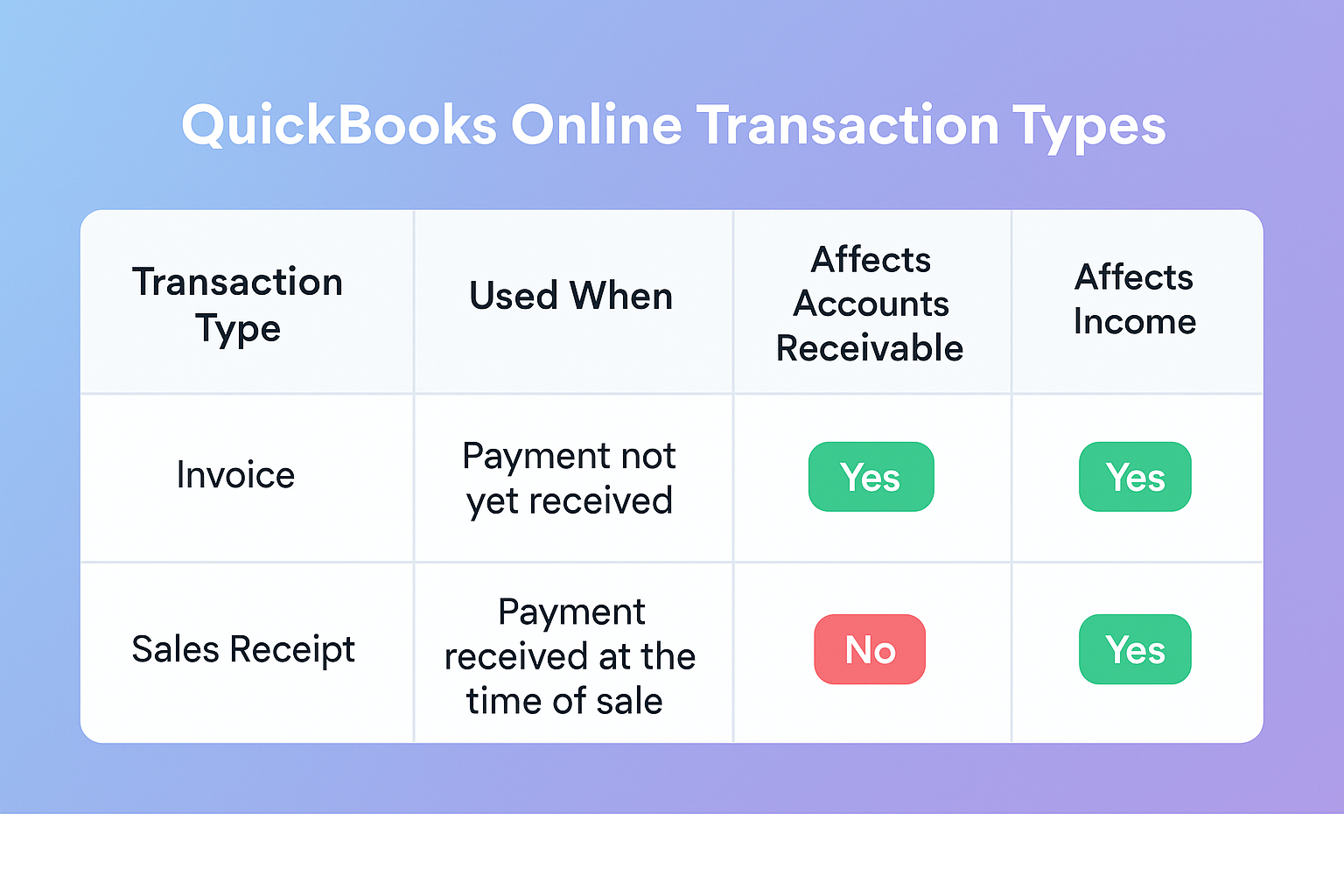

7. Understanding Invoices vs. Sales Receipts

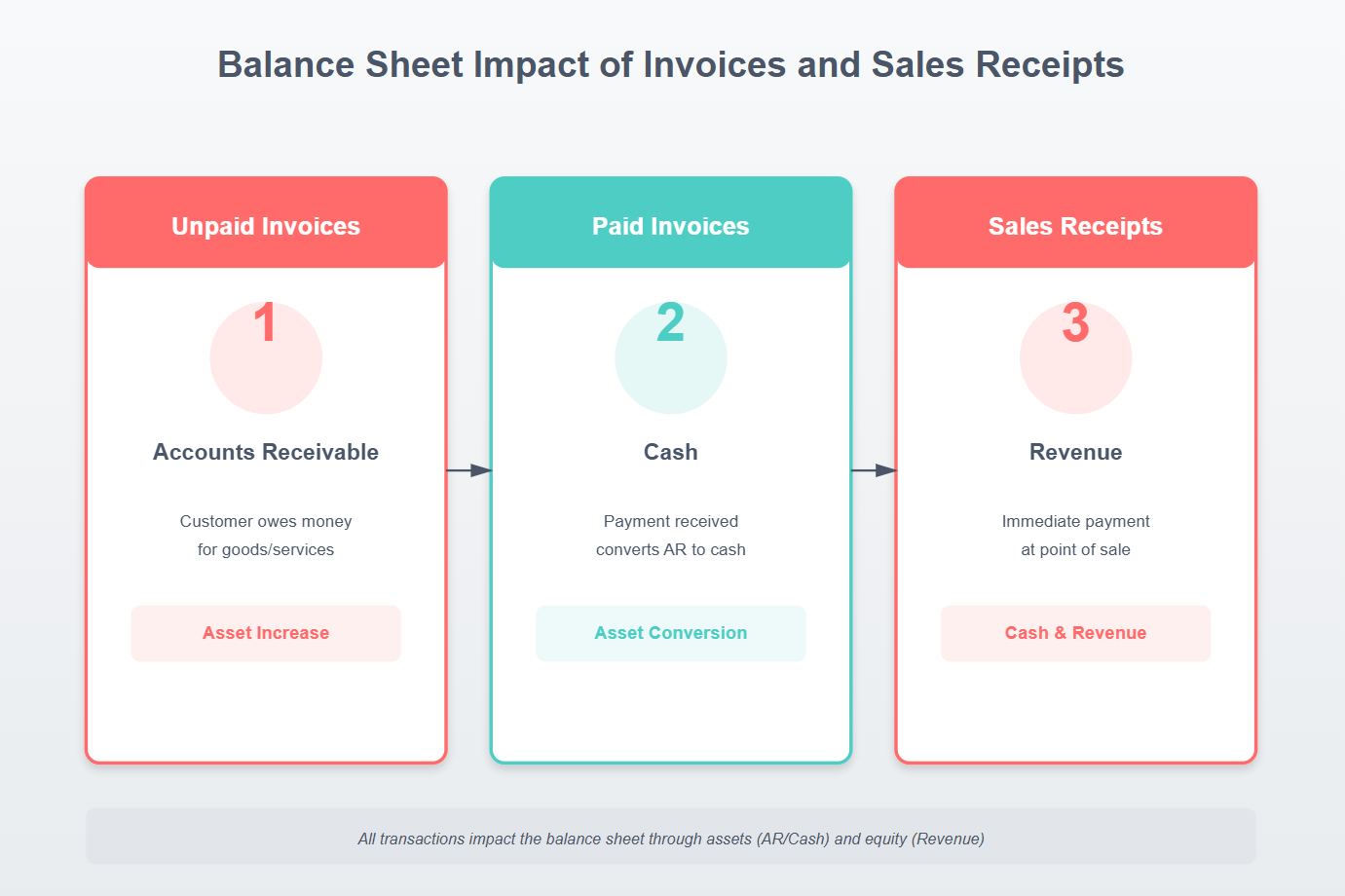

In QuickBooks Online, both invoices and sales receipts record sales, but they represent different points in the Accounts Receivable process. An invoice records income when payment has not yet been received, creating an open balance in Accounts Receivable until the customer pays. A sales receipt, on the other hand, records both the sale and the payment at the same time—bypassing Accounts Receivable entirely.

Example of Transaction Journal with Debits and Credits from Customer Deposit Sales Receipt

The table below highlights when to use each transaction type and how they affect your financial statements.

- Invoices appear on the A/R Aging Report until paid.

- Sales Receipts record immediate income and do not appear on A/R reports.

This table compares invoices and sales receipts in QuickBooks Online, showing how each transaction type impacts Accounts Receivable and Income on your financial statements.

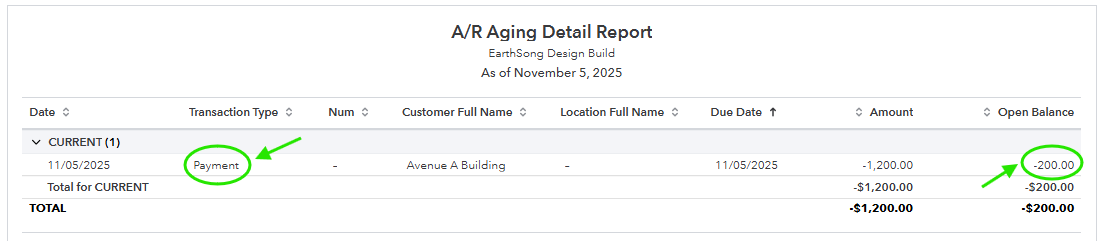

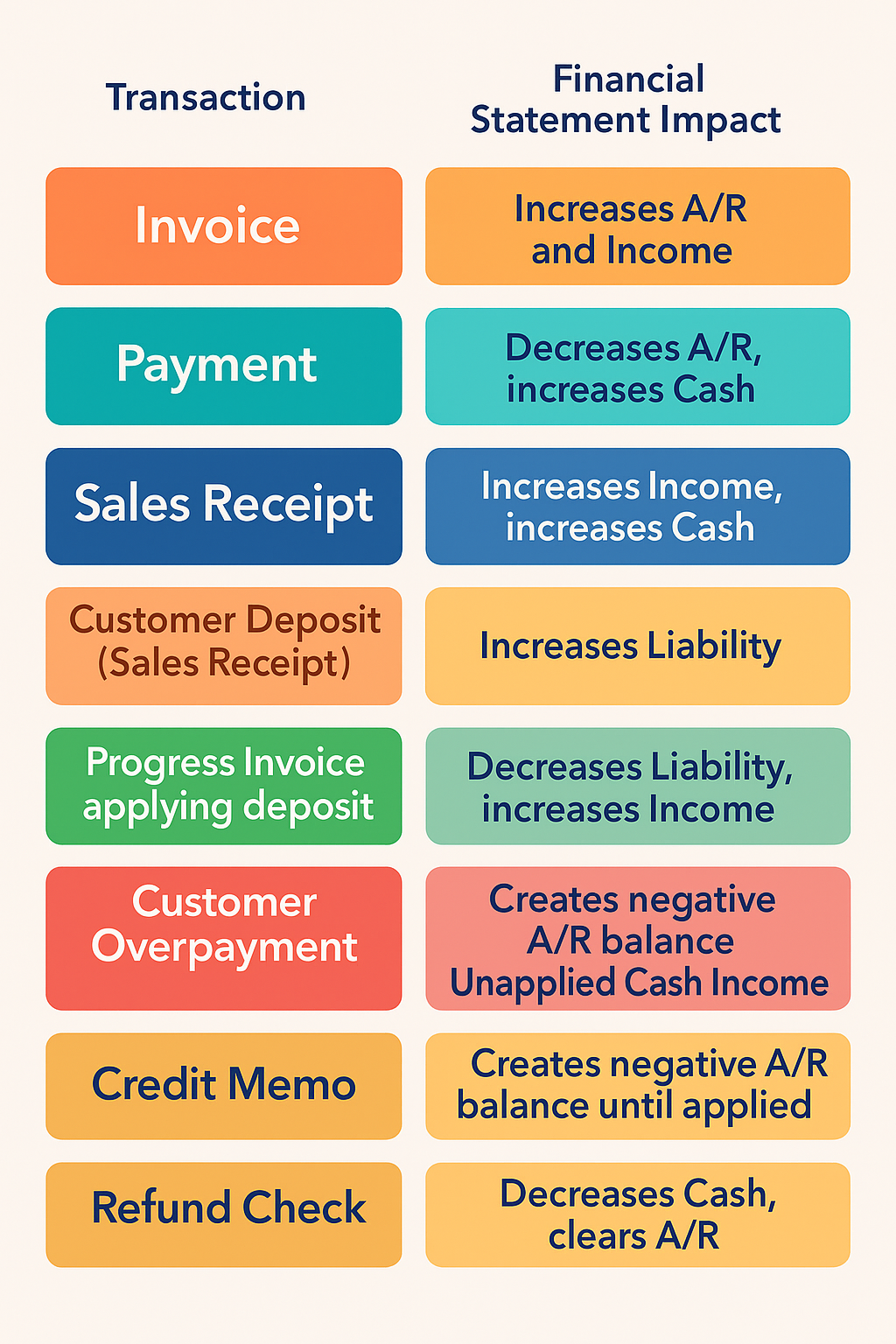

8. How Transactions Affect Financial Statements

Every transaction recorded in QuickBooks Online has a direct impact on your company’s financial statements. Understanding how each Accounts Receivable–related transaction type flows through the Profit and Loss and Balance Sheet is essential for accurate reporting, analysis, and decision-making. In the screenshot below you can see how an overpayment can create a negative Accounts Receivable balance.

Example of an Accounts Receivable Aging Detail Report with Negative Payment balance

This chart summarizes how common customer transactions—such as invoices, payments, sales receipts, customer deposits, and refunds—affect core financial accounts including Accounts Receivable, Income, Cash, and Liabilities.

By understanding where each transaction posts, you can identify why certain balances appear on reports (for example, negative A/R from overpayments or unapplied credits) and ensure all entries align with accrual accounting principles.

This chart illustrates how each customer transaction type in QuickBooks Online affects key financial accounts on the Profit and Loss and Balance Sheet, helping ensure accurate, audit-ready reporting.

Free Downloadable Assets

Accounts Receivable Process Flowchart Checklist

Review our A/R Process Slide Show

Take Our A/R Interactive Quiz

Conclusion

Managing your Accounts Receivable process correctly in QuickBooks Online helps you stay organized, keep your cash flow on track, and make sure your financial reports tell the real story of your business. When you record invoices, deposits, and payments accurately—and apply credits or refunds the right way—you create a clear record of every customer transaction. This not only makes your books easier to reconcile but also gives you confidence that your Profit and Loss and Balance Sheet truly reflect where your business stands today.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.