Managing payroll can be a daunting task for small business owners, especially when it comes to health insurance deductions. However, QuickBooks Online offers tools to simplify this process. By accurately reconciling health insurance deductions and employer contributions, you can prevent costly payroll mistakes. In this guide, you’ll learn how to ensure precision in your payroll through effective reconciliation methods.

Health Insurance Deduction Reconciliations

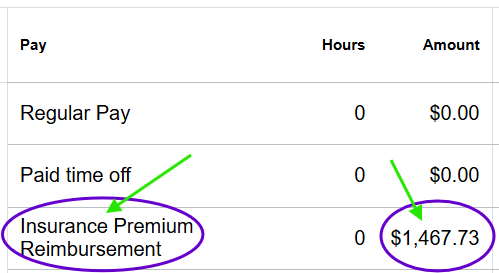

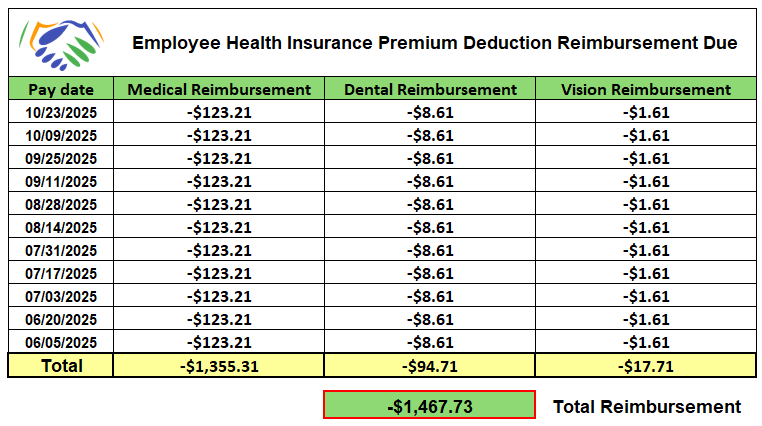

Errors in payroll can lead to significant financial repercussions. For instance, incorrect health insurance deductions might result in compliance issues or employee dissatisfaction. Reconciling, reimbursing employees, and correcting these setup figures in QuickBooks Online employee profiles is crucial. Note it is best to issue a stand-alone reimbursement check for overpaid premiums so that the exact amount of the overpayment is returned to the employee.

Intuit QuickBooks Payroll Correction Template

Intuit QuickBooks Payroll Check for Insurance Premium Reimbursement Only

What is Deduction Reconciliation?

Reconciliation is the process of verifying that your financial records match actual transactions. In payroll, this means ensuring that the amounts deducted and contributed for an employee’s health insurance accurately reflect what your employees and your company owe.

Why Deduction Reconciliations Matters to You

Accurate reconciliation not only prevents errors but also ensures legal compliance. After all, no business owner wants to deal with legal issues or frustrated employees. By dedicating time to this task, you protect your business’s financial health.

Setting Up Insurance Deductions Correctly

Before you begin, make sure your QuickBooks Online is set up correctly. This involves configuring payroll settings and understanding the tools available to you. It’s important to understand how to correctly setup Payroll Items.

Configuring Deductions in Payroll Settings

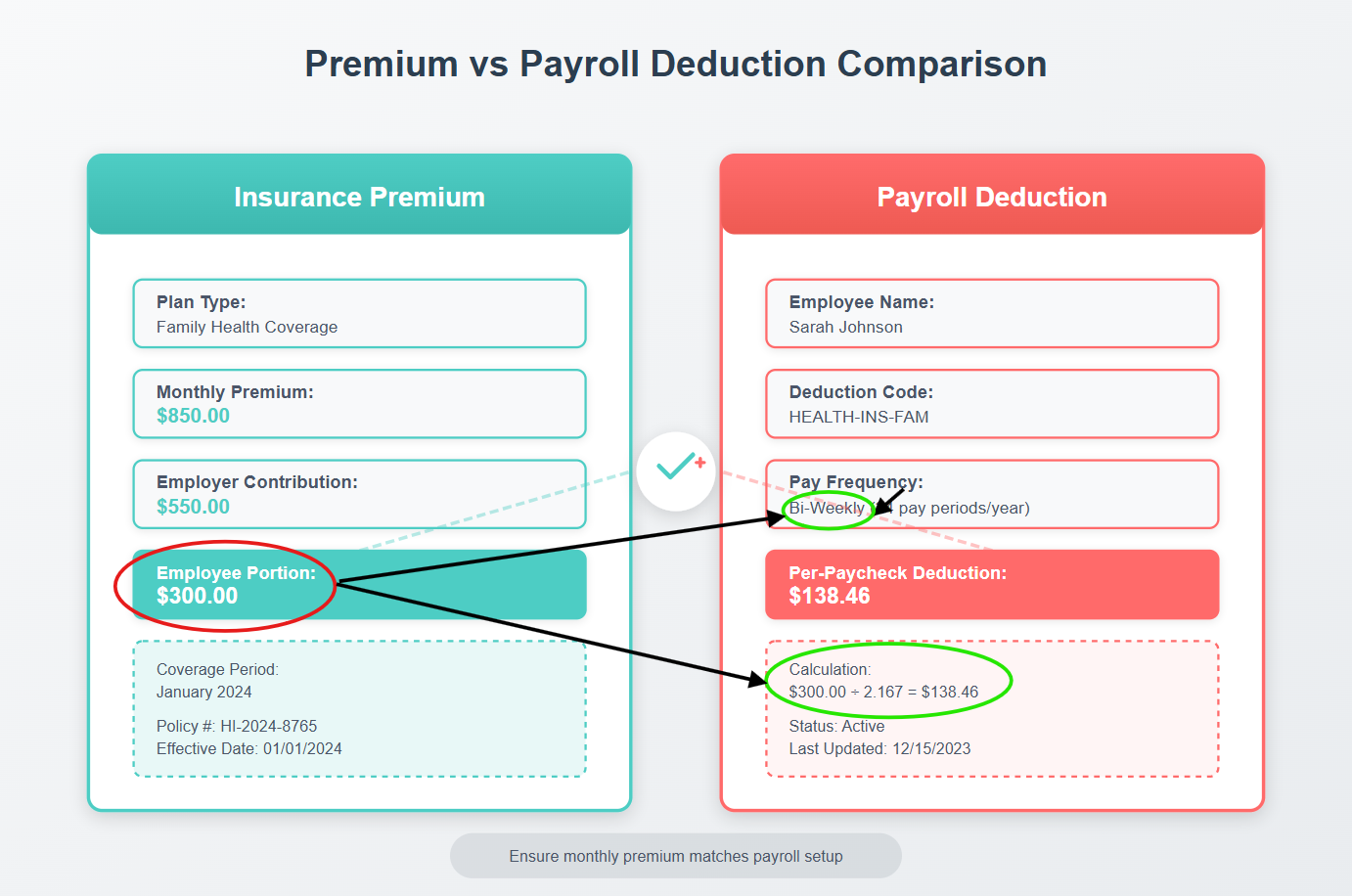

Start by ensuring that your payroll settings are current. This includes verifying that the health insurance deduction amounts are correctly entered in your QuickBooks account according to the companies’ benefits program offering. Double-check these against your insurance provider’s invoices.

Utilize QuickBooks Payroll Detail and Deduction Reports

QuickBooks Online offers several reports to help with reconciliation. Utilize the Payroll Summary or Detail Report to get the specifics of all deductions and contributions by employee and date range. The Payroll Deductions and Contributions report can provide focused insights by insurance type and employee, allowing you to pinpoint any discrepancies.

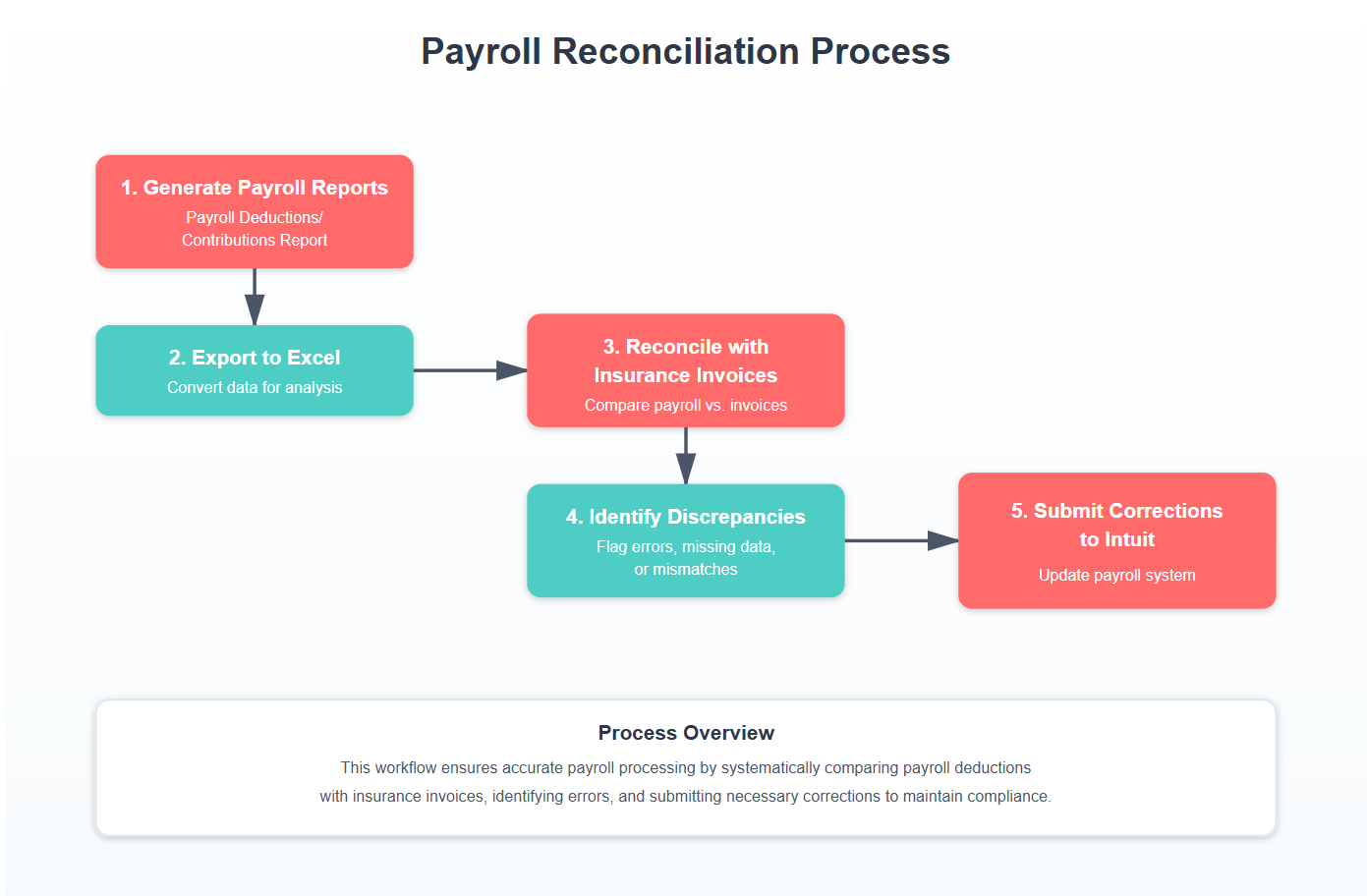

Monthly Payroll Health Insurance Deduction Reconciliation Workflow

Steps to Reconcile Health Insurance Deductions

Now that your QuickBooks is ready, you can proceed with reconciliation. Follow these steps to streamline the process.

Step 1: Gather Necessary Statements and Reports

Begin by collecting all relevant documents. These include your QuickBooks payroll Deductions and Contributions and Detail reports by date range and employee, insurance provider invoices, and any manual records you maintain. Having all data at your fingertips will make reconciliation smoother.

Step 2: Use Excel for Reconciliation of Deductions

Excel can be an invaluable tool in this process. Export your QuickBooks payroll data into Excel. Create a spreadsheet that lists all employees, their respective health insurance deductions, and employer contributions. By comparing these figures to your provider’s invoices, you can easily spot inconsistencies.

Step 3: Adjust in QuickBooks and Issue Reimbursement

Upon identifying discrepancies, promptly adjust your records in QuickBooks. Use the Intuit Payroll Correction Form if necessary, to correct any errors. Consistent adjustments ensure your payroll remains accurate.

Common Mistakes and How to Avoid Them

Despite careful preparation, errors can still occur. Therefore, understanding common pitfalls will help you avoid them.

Miscommunication with Health Insurance Providers

Often, discrepancies arise from miscommunication with insurance providers. To prevent this, maintain regular contact and confirm deduction amounts periodically. Moreover, keeping a clear record of all communications can prove invaluable.

Ensuring Payroll Compliance and Accuracy

Compliance is non-negotiable. Therefore, maintaining accurate records is key to staying compliant with federal and state regulations.

Regular Insurance Deduction and Contribution Audits

Conducting regular audits of your payroll system can help identify and correct errors before they escalate. You should complete these audits quarterly, at a minimum to ensure ongoing accuracy. Though monthly audits are best.

Reconciling Health Insurance Deduction Premium Statement to Payroll Deduction Setup

Conclusion

Reconciling health insurance deductions in QuickBooks Online is essential for preventing costly payroll errors. By following the steps outlined, you can maintain accuracy and compliance. Start today by reviewing your payroll settings and utilizing QuickBooks Online reports with a purpose-built Excel template. Remember, proactive reconciliation safeguards your business’s payroll compliance and overall financial health.

Example of Excel Template for Insurance Deduction Overpayment Reconciliation

Monthly Payroll Reconciliation Checklist

In conclusion, by mastering payroll reconciliation, you protect your business and ensure a smoother payroll process. Are you ready to take control of your payroll accuracy? Begin implementing these practices and see the difference they make.

Free Downloadable Resources

Monthly Payroll Reconciliation Checklist

Review What You’ve Learned Reconciling Deductions

Quiz Your Knowledge on Reconciling Payroll Deductions

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.