Running a small business is no small feat. Besides managing daily operations, you must also keep a close eye on your finances. Understanding business expense deductions can significantly impact your bottom line. These deductions reduce your taxable income, ultimately saving you money. Therefore, knowing what qualifies as a deductible expense is crucial. In this guide, we explore key principles and doctrines that guide deductible expenses, ensuring you make informed decisions for your business.

Understanding Deductible Expenses

What Qualifies?

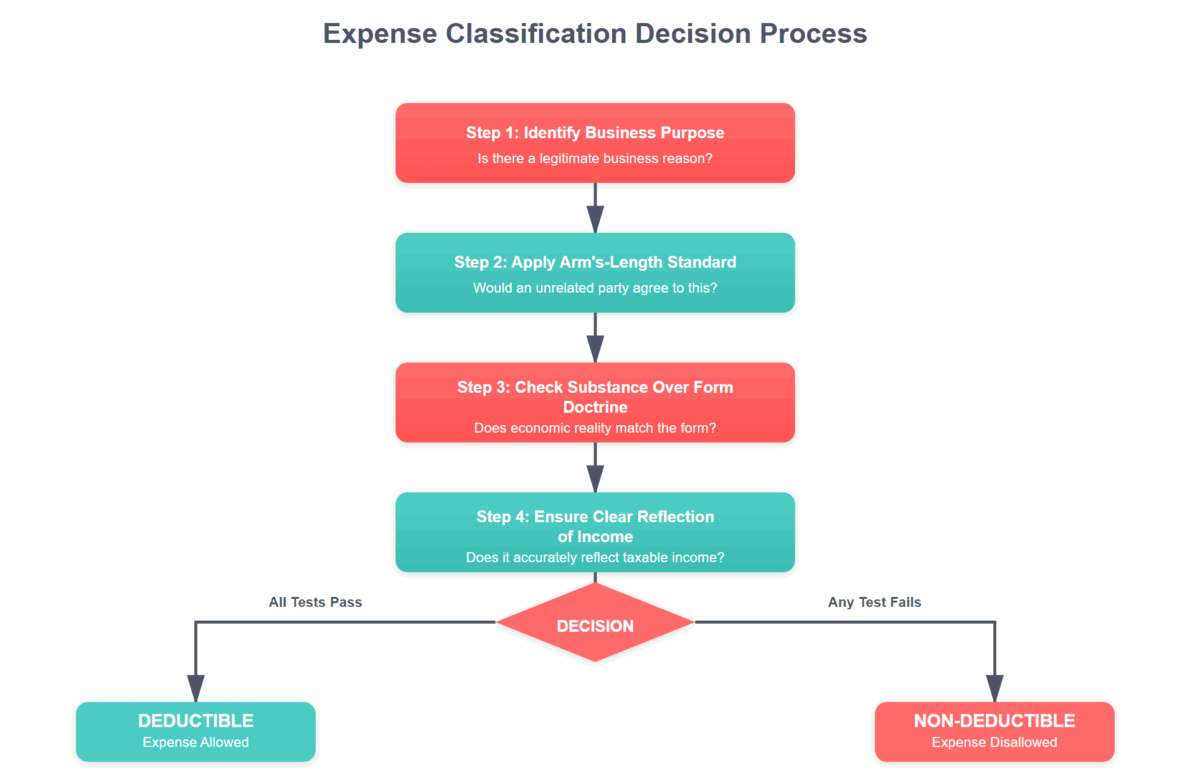

Firstly, it’s essential to define what a deductible expense is. In simple terms, deductible expenses are the costs you incur to run your business. These can include rent, utilities, salaries, and more. However, not every expense is deductible. The IRS requires that expenses be both ordinary and necessary. Ordinary expenses are common in your industry, while necessary expenses help you conduct your business.

Deductible versus non-deductible expenses

Practical Examples

For example, if you run a bakery, purchasing flour and sugar is both ordinary and necessary. On the other hand, buying a luxury car for occasional deliveries may not pass the IRS’s scrutiny. To ensure you deduct correctly, keep detailed records of all transactions. Use accounting software to categorize expenses, making it easier to identify deductible items.

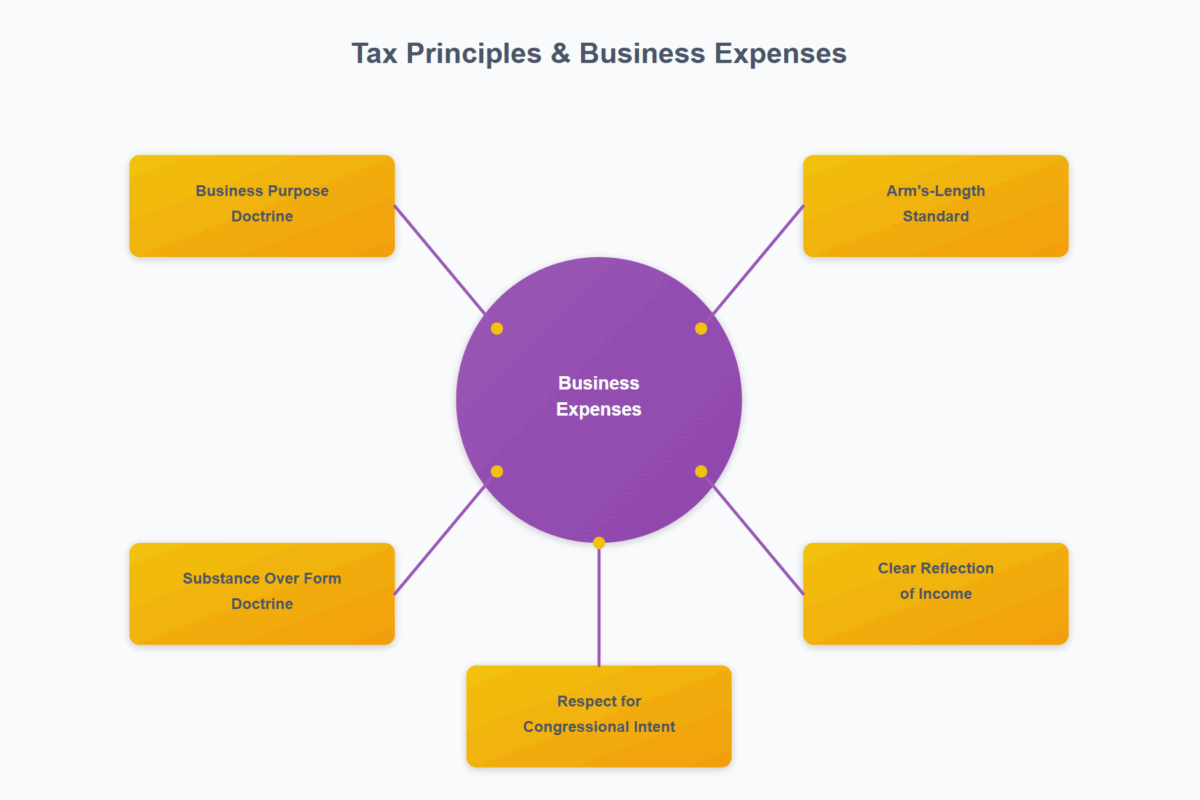

Arm’s-Length Standard

Maintaining Objectivity

The Arm’s-Length Standard is vital in ensuring fair transactions. This principle dictates that business transactions should be conducted as if the parties involved are unrelated. In other words, you should not favor or disadvantage any party due to personal relationships. This standard applies to pricing goods, setting salaries, and more.

Actionable Tips

To comply, always justify your pricing and salary decisions with market data. For instance, when setting a salary for a family member, compare it to industry standards. This approach protects you from IRS penalties and maintains your business’s integrity. Additionally, consider consulting a tax professional to review your transactions for compliance.

Business Purpose Doctrine

Justifying Your Expenses

The Business Purpose Doctrine requires that expenses have a legitimate business reason. This doctrine prevents deductions for expenses that primarily serve personal interests. Therefore, always document the business purpose of each expense. This practice not only keeps you organized but also prepares you for potential audits.

Practical Application

For example, if you travel for a business conference, ensure you keep records of the event’s agenda and your participation. This documentation supports your claim that the travel expenses were business-related. By maintaining thorough records, you strengthen your deductions and reduce audit risks.

Substance Over Form Doctrine

Focus on Reality

The Substance Over Form Doctrine emphasizes the importance of the economic reality of transactions over their legal form. Essentially, the IRS looks beyond how transactions are labeled to their actual substance. Thus, you cannot disguise personal expenses as business deductions.

Examples to Consider

For example, labeling a personal vacation as a business trip will not hold up under scrutiny. Instead, ensure that all your claimed deductions genuinely relate to business activities. Regularly review your expenses to verify that they align with this principle. Moreover, consult with a tax advisor if you’re unsure about specific deductions.

Clear Reflection of Income

Accurate Financial Reporting

A clear reflection of income ensures that your financial records accurately represent your business activities. The IRS expects businesses to use consistent accounting methods, such as cash or accrual, to reflect income clearly. This consistency helps in making fair deductions and maintaining transparency.

Implementation Strategies

To achieve this, select an accounting method that best suits your business model and stick to it. For instance, retail businesses often use the accrual method to match revenues with expenses. Additionally, regularly review your financial statements to ensure accuracy and completeness. This practice not only aids in tax preparation but also supports strategic decision-making.

Respect for Congressional Intent

Align with Legislative Goals

Congressional intent refers to the purpose behind tax laws. When making deductions, align your actions with these legislative goals. The IRS monitors deductions to ensure they align with the intended tax benefits for businesses. Therefore, understanding the rationale behind tax laws helps you make compliant decisions.

How to Stay Compliant

Stay informed about changes in tax laws and regulations. Consider subscribing to updates from the IRS or consulting tax professionals regularly. For instance, if Congress introduces tax credits for sustainable business practices, explore how your business can benefit. By aligning with congressional intent, you not only maximize deductions but also contribute to broader economic goals.

👉🏾 Free Downloadable Slideshow on Small Buisness Deductions

Common Mistakes in Deductions

Avoiding Pitfalls

Small business owners often make common mistakes when claiming deductions. One frequent error is mixing personal and business expenses. This confusion can lead to disallowed deductions and penalties. Therefore, maintain separate bank accounts and credit cards for business transactions.

Additional Tips

Another mistake is neglecting to keep adequate documentation. Always keep receipts, invoices, and other supporting documents. Additionally, avoid overestimating expenses or claiming non-deductible items. Lastly, review IRS Publication 535 for detailed guidance. These resources provide valuable insights into permissible deductions and help you avoid costly mistakes.

Classifying expenses as deductible or non-deductible

In conclusion, understanding business expense deductions is crucial for small business owners. By adhering to key principles and doctrines, you ensure compliance and optimize your tax benefits. Remember, clear documentation and a thorough understanding of tax laws are your best allies. Should you need further assistance, consider consulting a tax professional. They can provide tailored advice to help you navigate the complexities of business deductions.