Payroll mistakes happen—even in the best-run businesses. Whether it’s an incorrect tax withholding, a missing deduction, or a multi-state registration issue, fixing payroll errors in QuickBooks Online Payroll requires patience, precision, and the right information.

As an Advanced QuickBooks Online Certified ProAdvisor and Payroll Certified ProAdvisor, I’ve helped many business owners navigate these QuickBooks payroll corrections successfully. Below is a step-by-step overview of the official Intuit process, along with insight into a new automation tool we’re developing at Lend A Hand Accounting to simplify it.

Step 1 — Contact Intuit Payroll Support

Open your QuickBooks Online company file and click the blue circle with the question mark in the upper-right corner.

Tip: That small button opens the full Help & Support center where you can reach Intuit.

Click the blue circle with the “?” to open Help in QuickBooks Online.

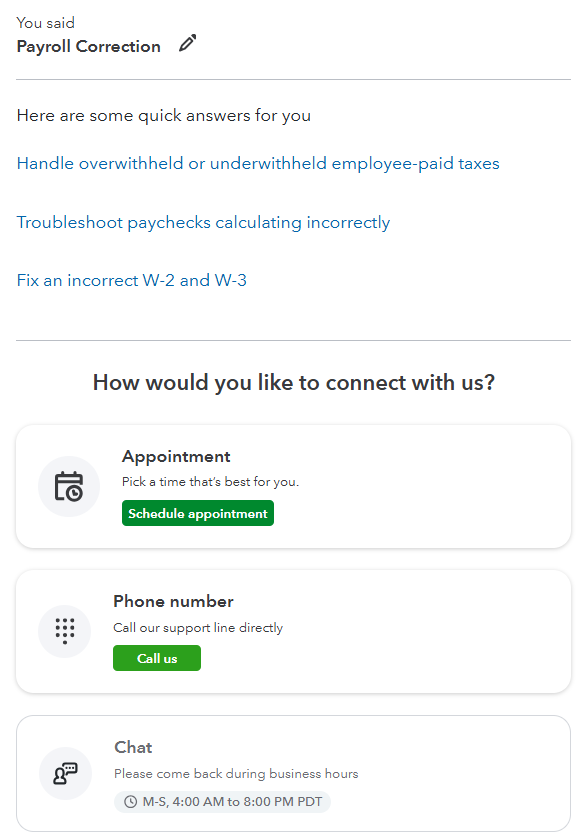

In the search field, type Payroll Correction.

At the bottom of the panel, select Contact Us, then choose:

Schedule Appointment (best option — Intuit calls you at your chosen time)

Call Us

Chat (available 4 a.m.–8 p.m. PDT)

Search “Payroll Correction” in the Help window to access Intuit’s payroll support resources.

Step 2 — Prepare Key Details Before Your Call

Have this information ready:

QuickBooks Company ID

Last four digits of the payroll bank account

Last four digits of the EIN

Last four digits of the principal officer’s SSN

Employee name(s) and pay period(s) involved

Clear description of what needs to be corrected and why

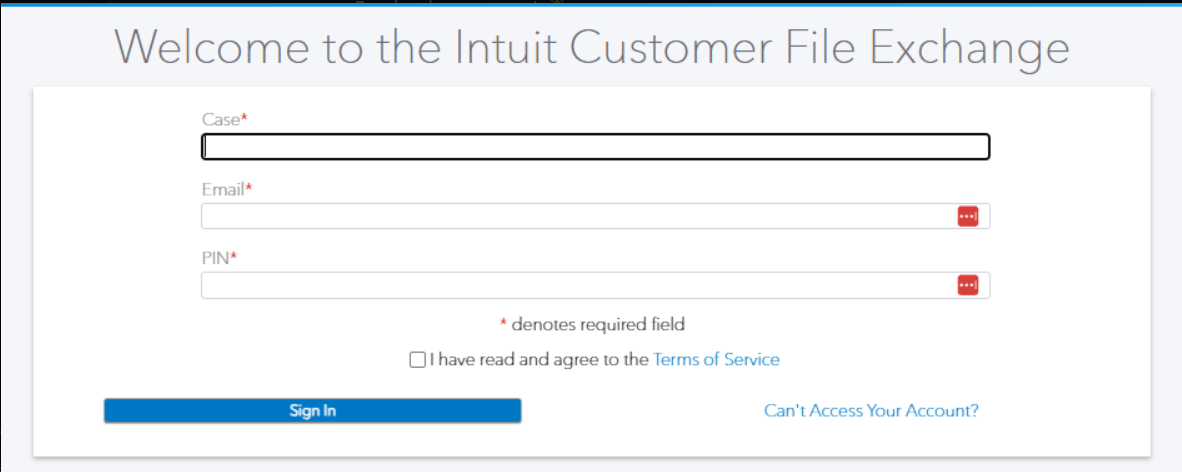

Make sure you have blocked out at least an hour for this correction. After the call, Intuit sends you a case number, a secure File Exchange link, and a PIN and email address for uploading your correction file.

The Intuit Customer File Exchange login page where you enter your Case number, Email, and PIN.

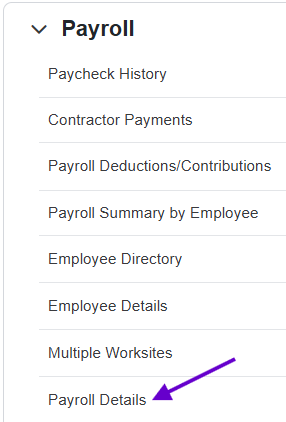

Step 3 — Download the Payroll Detail Report

Before completing the correction template, download your Payroll Detail Report from QuickBooks Online.

Payroll Details to download the report used for corrections.

This report provides every paycheck line needed to verify wages, taxes, and deductions.

Step 4 — Identify and Correct the Payroll Setup Issue

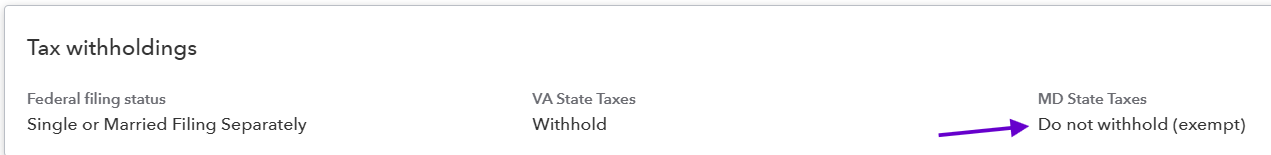

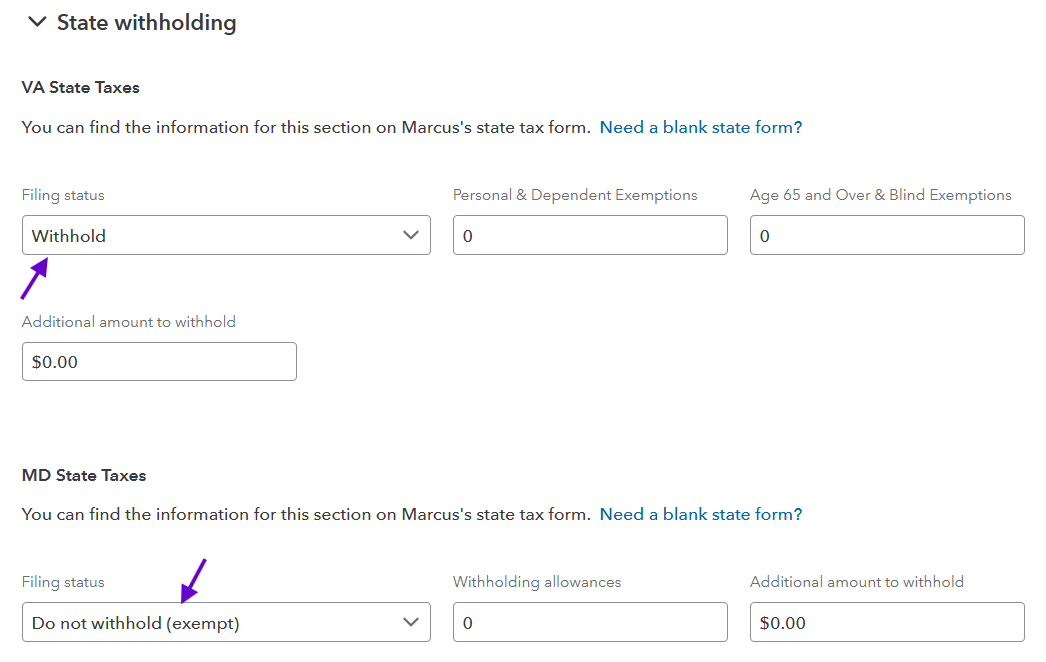

Many corrections arise from incorrect multi-state setups.

For example, if an employee lives in Maryland (MD) but the business only pays payroll taxes in Virginia (VA), confirm that:

VA taxes are set to “Withhold,” and

- MD taxes are set to “Do not withhold (exempt)” in the employee W-4 settings.

Verify that MD is set to “Do not withhold (exempt)” and VA is set to “Withhold.”

Detailed employee withholding setup showing VA and MD settings.

If not, QuickBooks adds MD to your Payroll Overview and withholds those taxes, holding them in Intuit escrow since no MD account exists to remit to.

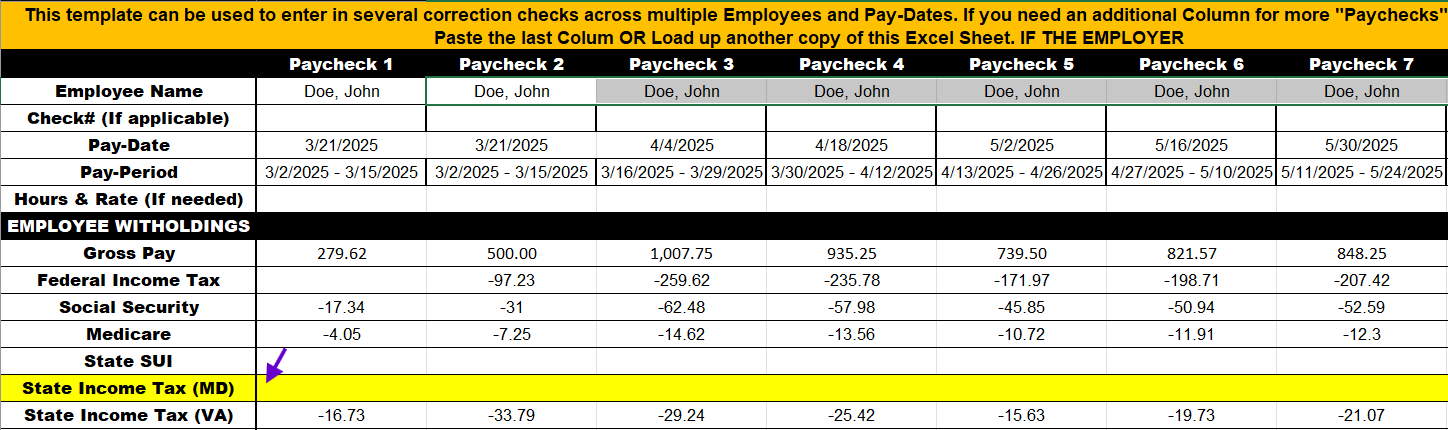

Step 5 — Complete the Intuit Payroll Correction Template

Intuit’s Excel template lists every affected paycheck with corrected amounts.

Example of Intuit’s Payroll Correction Template. The yellow MD row is left blank when removing that withholding.

LHA Tip:

Add the withheld MD tax back into Net Pay to calculate the corrected amount. Leaving the MD line blank tells Intuit to remove it entirely.Because the Payroll Detail Report is formatted differently, you may need to flip the data (rows ↔ columns) and add extra columns, so it matches the template.

Step 6 — Upload the File and Wait for Confirmation

Open the File Exchange link from Intuit.

Enter your Case number, Email, and PIN.

Upload the completed Excel file.

Intuit reviews the submission, applies the correction, and issues any applicable refund (for taxes held in escrow) to the business bank account used for processing employee payroll.

Step 7 — Prevent Future Payroll Errors

Verify employee W-4 state exemptions before running payroll.

Confirm only registered tax jurisdictions appear in Payroll Overview.

Schedule a payroll setup review with an Advanced QuickBooks Online Certified ProAdvisor to ensure compliance and avoid overpayments.

🔗 Intuit QuickBooks Help to Request an amendment for payroll

Final Thoughts

Payroll corrections can be stressful, but with the right guidance—and the right setup—they can be resolved smoothly.

If your business needs help reviewing payroll tax setup, reconciling reports, or submitting corrections, the team at Lend A Hand Accounting LLC is here to help.

Visit lendahandaccounting.com to learn more about our monthly accounting, payroll, and CFO services.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.