Managing your business finances can feel overwhelming. However, QuickBooks Online simplifies this task by automatically creating essential accounts to get you started. These automatic accounts form the backbone of your financial records, helping you track income, expenses, and more. In this guide, you’ll learn about these 12 accounts and how to leverage them for your business success.

What Are Automatic Accounts in QuickBooks Online?

Before diving into details, let’s clarify what automatic accounts are. When you set up QuickBooks Online, the software creates these accounts by default. They help streamline your financial setup and ensure you don’t miss crucial categories. Moreover, these accounts make it easier to comply with accounting standards.

Why Automatic Accounts Matter

Automatic accounts save you time and reduce errors. By having a structured financial framework, you can focus on running your business rather than worrying about bookkeeping. Additionally, these accounts provide a clear picture of your business’s financial health, which aids in making informed decisions.

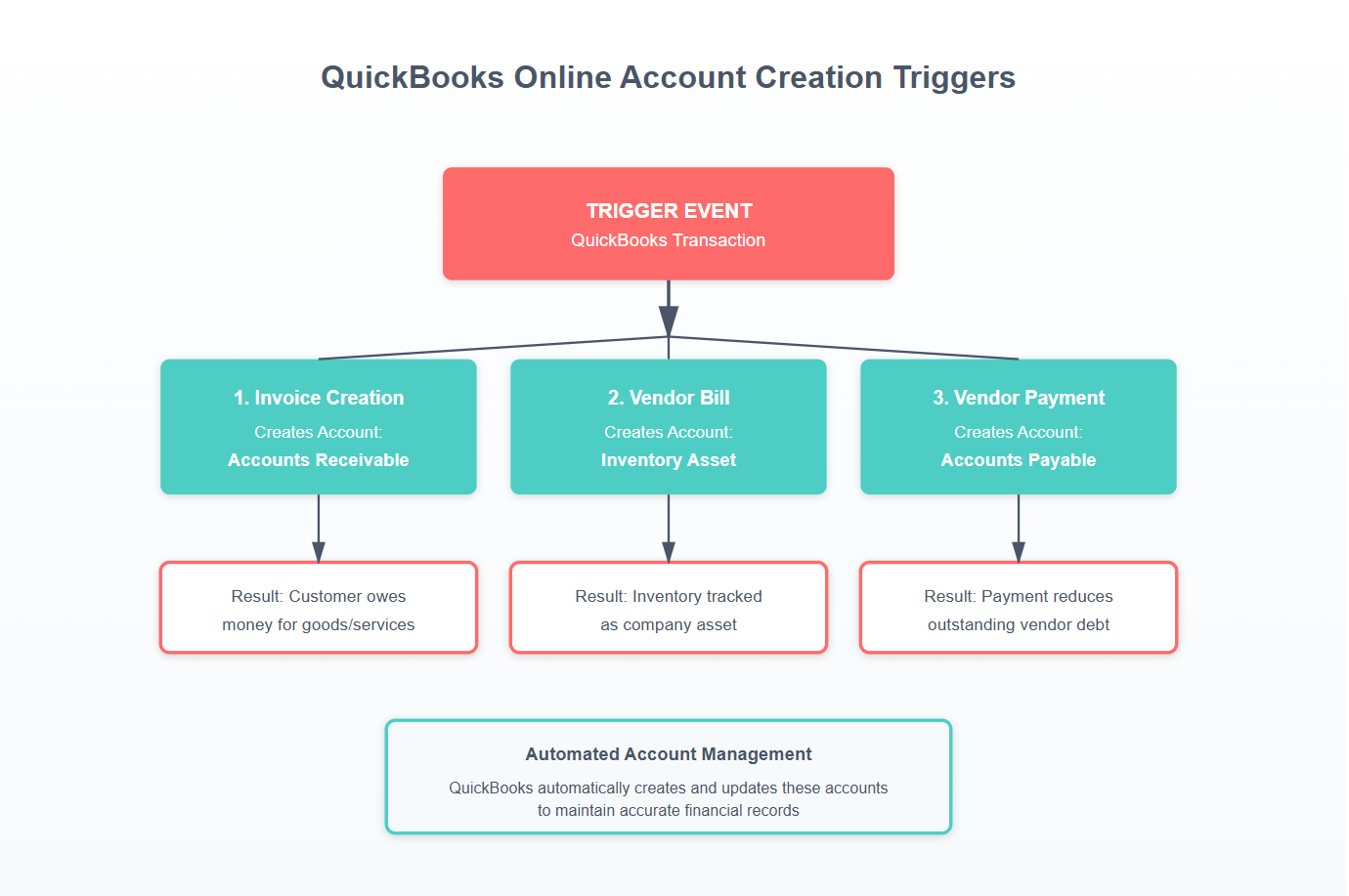

Example of Automatic Account Management Workflow

The 12 Essential Automatic Accounts

Let’s explore each of these accounts. Understanding their purpose will enhance your bookkeeping skills and boost your confidence in managing finances.

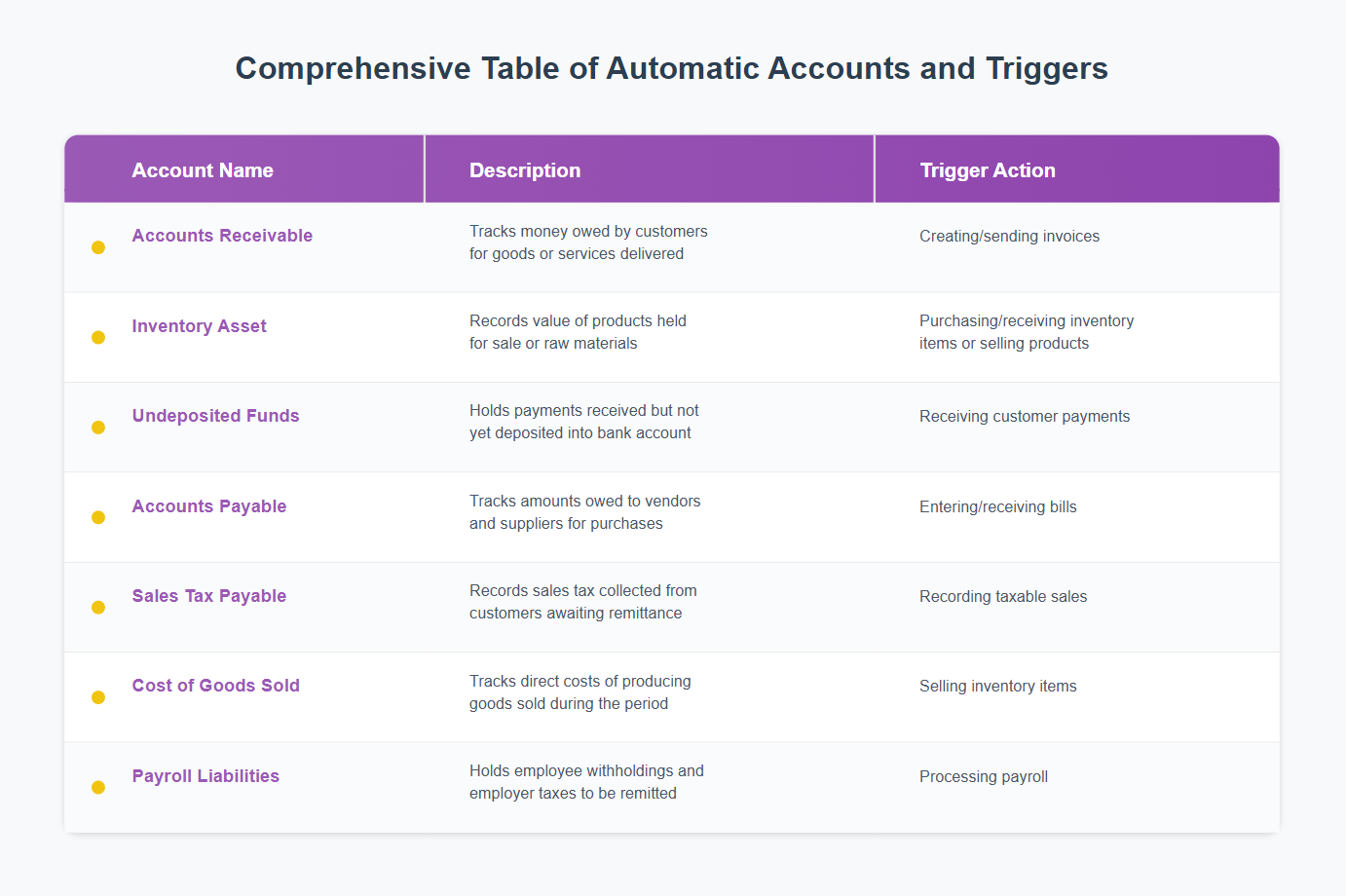

1. Accounts Receivable

Accounts Receivable (A/R) is where you track money owed by customers. For instance, when you invoice a client, this account records the expected income. Monitoring A/R ensures you follow up on overdue payments promptly.

2. Accounts Payable

Conversely, Accounts Payable (A/P) tracks what you owe to suppliers. This account helps you manage cash flow by keeping tabs on upcoming liabilities. Paying bills on time maintains good relationships with vendors.

3. Undeposited Funds

Undeposited Funds act as a holding account for payments received but not yet deposited. Think of it as a temporary resting place for checks or cash until you bank them. This ensures your books match your bank statements accurately.

4. Opening Balance Equity

Opening Balance Equity is crucial when transitioning to QuickBooks Online. It captures the starting point of your financial data. Over time, this account should balance out as you reconcile other accounts.

Understanding Income and Expense Accounts

As you track your business’s performance, income and expense accounts play a pivotal role.

5. Sales

Sales accounts record your business’s revenue from products or services sold. Regularly review this account to understand your revenue streams. This allows you to identify high-performing areas and potential growth opportunities.

6. Cost of Goods Sold

Cost of Goods Sold (COGS) reflects the direct expenses of producing goods or services. For example, if you sell handmade jewelry, COGS includes materials and labor. Keeping COGS in check is crucial for maintaining profitability.

7. Expenses

Expenses account for your business’s operational costs. From rent to utilities, these outflows impact your bottom line. By categorizing expenses accurately, you gain insights into areas where you can cut costs.

8. Other Income

Other Income captures earnings outside regular business activities. For instance, interest from a savings account belongs here. Tracking this income separately provides a clearer view of your core business performance.

Managing Assets and Liabilities

Assets and liabilities represent what your business owns and owes. QuickBooks Online automatically sets up accounts to track these.

9. Inventory Asset

If you sell physical products, the Inventory Asset account is vital. It tracks the value of goods you plan to sell. Regularly updating it helps avoid stockouts or overstocking, impacting your cash flow.

10. Payroll Liabilities

Payroll Liabilities account records amounts you owe for employee deductions. This includes taxes and benefits. Ensuring this account is accurate prevents legal issues and keeps employees satisfied.

11. Retained Earnings

Retained Earnings track accumulated profits not distributed to owners. It’s an indicator of your business’s financial health over time. Reviewing this account helps in planning future investments or distributions.

12. Uncategorized Income/Expense

Sometimes, transactions don’t fit neatly into existing categories. Uncategorized Income/Expense accounts temporarily hold these until they’re properly classified. Regularly review and allocate these to maintain accurate books.

Descriptions of Automatic Accounts in QuickBooks Online with Trigger Actions

Practical Tips for Managing QuickBooks Online Automatic Accounts

Now that you understand the accounts, let’s delve into practical ways to manage them effectively.

Reconcile Accounts Monthly

Reconciliation ensures your QuickBooks records match your bank statements. This practice catches discrepancies early, preventing bigger issues later.

Regularly Review Reports

QuickBooks offers powerful reporting features. Utilize them to track performance, identify trends, and make informed decisions. Reports like Profit and Loss and Balance Sheets are invaluable.

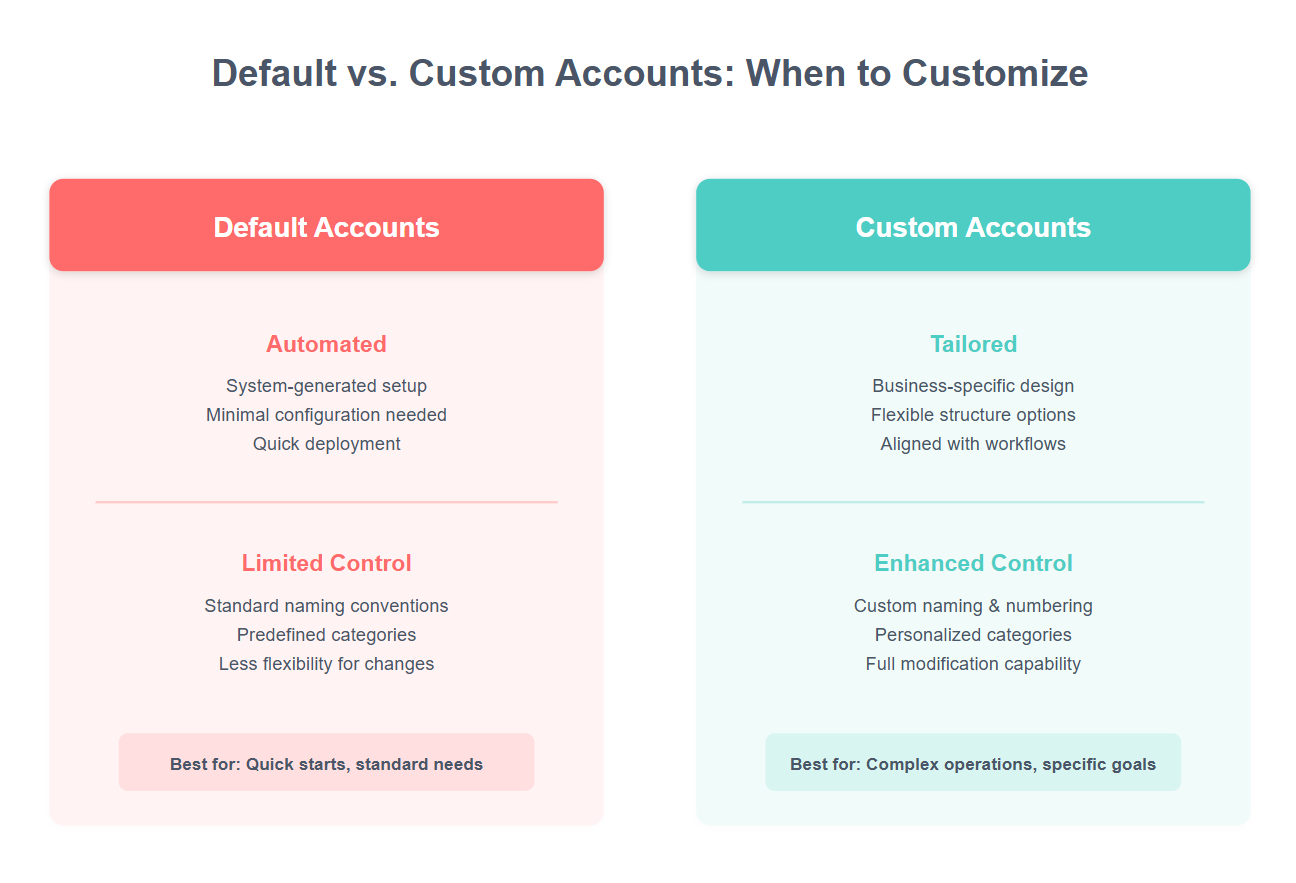

Customize Accounts for Your Business

While QuickBooks provides a solid foundation, customize accounts to fit your specific business needs. Tailoring the chart of accounts enhances relevance and usability.

Comparison and Pros and Cons of Default Vs Custom Account Names

Leverage External Resources

For further guidance, explore QuickBooks Online Support and IRS Guidelines on Accounting Methods. These resources offer valuable insights on different accounting methods, accounting processes, and compliance tips.

Enjoy Our Interactive Slideshow

Take Our Interactive Quiz

Conclusion

Understanding QuickBooks Online Automatic Accounts empowers you to take control of your business finances. By mastering these essential accounts, you’ll streamline bookkeeping, enhance decision-making, and ultimately drive your business forward. So dive in, explore these tools, and watch your financial confidence grow.

By following these insights, you’re not just maintaining books—you’re building a foundation for success. Whether you’re new to QuickBooks or looking to improve your accounting practices, these automatic accounts are your allies. Happy bookkeeping!

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.