One of the first signs that you need our Good Bookkeeping Audit and Clean-Up Service™is when your Bank Balance does not match your In QuickBooks Balance. You can easily see this when logging into to your QuickBooks Online account and selecting the Banking tab on your left menu bar. When there is a significant difference between these dollar amounts, it means that the bookkeeping is not current, and should be audited. Keeping your books clean will help prepare you for tax time. Another telling sign that you need an audit and clean-up of your books is when you have numerous uncategorized transactions in QuickBooks Online.

We Do a Deep-Dive into 12-Months of Accounting Transactions

With this service, your accountant will do a deep dive into all accounting transactions for up to 12 months. We can audit beyond 12 months for an additional fee. There are so many things that can go wrong in QuickBooks Online when you don’t have an experienced person managing your bookkeeping. Our accountants are Members of the QuickBooks ProAdvisor Program that know what to look for and can easily fix both simple and complex errors. Your accountant will review transactions against your account statements and correct every error until your books are in perfect order for the audit period. This service does not include doing prior period transactional accounting work such as categorizing and matching transactions that were left in the connected bank feeds. Catch-up accounting work requires a one-time prepaid fee in addition to the 12-month audit fee.

We will Carefully Review Account Statements for the Audit Period

All supporting documentation for the audit period should be provided to your accountant to review against the transaction history in your QuickBooks Online account. This includes bank, credit card, POS (Point-Of-Sale) reports, and loan statements. You should also provide fixed asset purchase documentation and advise on any owner equity transactions that have occurred. Owner equity transactions are recorded when you put money into or take money out of your business. You can easily upload documents into a folder within your secure document upload portal or email them directly to your accountant. We ask that you send multiple files being uploaded to a compressed zipped folder so that they can be downloaded by your accountant all at once.

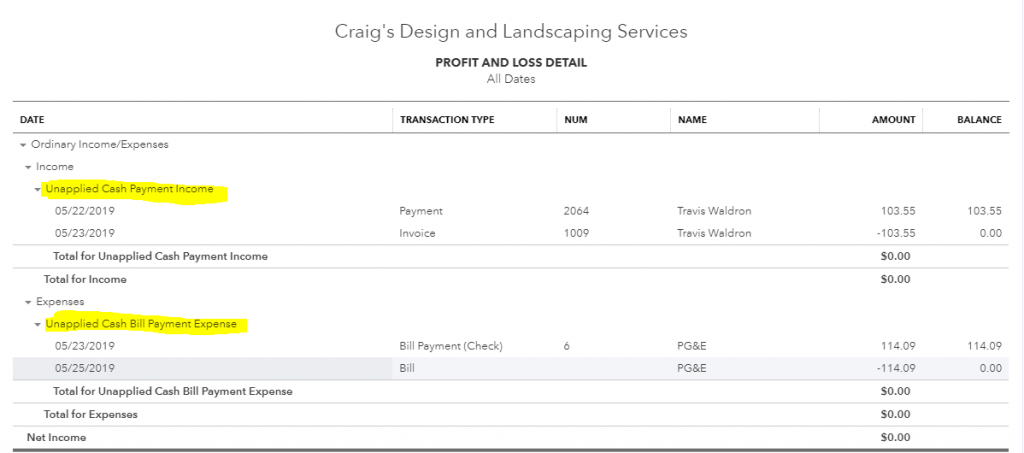

We will Audit Your Accounts, Income Statement and Balance Sheet

With this service, your accountant will audit the transactions you’ve already added in your QuickBooks Online account. They will also review your Profit & Loss Report and Balance Sheet reports in detail for the audit period to ensure that any transaction errors are identified for correction following the audit. If we find Accounts Receivable or Accounts Payable errors, we will recommend project accounting services for a one-time fixed fee to research and correct these errors for you. Your accountant will focus on Accounts Receivable cleanup work as a first priority. Any undeposited funds are cleared with one-time Accounts Receivable work.

We will Provide Professional Insights regarding the Audit Findings

It is important to maintain accurate accounting records, as this saves you time and money throughout the year. When you are a business owner it is essential to know the true net profits of your business. You may need to process a reasonable S Corp Owner Salary per the IRS rules or calculate and pay Quarterly Estimated Self-Employment Taxes to the IRS based on your bottom-line net profits on a recurring basis depending on your Entity formation. If your transactional accounting has not been done correctly, you may overpay or underpay your taxes. Once your accountant reviews your books for the audit period, they will communicate their Audit Findings and share a draft of your business financials to review before finalizing them. They may also recommend and ask for your approval for additional one-time project accounting work based on their deep-dive audit findings.

We will Record Your Loan Liabilities & Related Interest Expenses

A common oversight we find during the Good-Bookkeeping Audit™process is the absence of business loan liabilities and related interest expenses on the Balance Sheet and Profit and Loss Report. When business owners setup their QuickBooks Online accounts, they are understandably focused on connecting accounts and setting up customers, products and services, and vendors. For this reason, liabilities and related interest expenses may be overlooked. Your accountant will review your business loan statements and verify your loan payments, balances, and interest expenses are recorded.

We will Record Your Businesses Fixed & Other Current Assets

Most small business owners will get help from their accountant to record the fixed and other current assets for their business. If you have been in business for some time and have filed income tax returns for your business in prior years, it is likely that these assets are recorded. With the Good-Bookkeeping Clean-Up™ service we will add any additional business assets that were not previously recorded so that they are accurately reflected on your Balance Sheet. This includes recording inventory stock value, investments and loans to shareholders.

We will Prepare Updated Financial & Transaction Detail Reports

Once your accountant has completed the Good Bookkeeping Clean-Up™, they will create a new set of Financial Reports and additional Transaction Detail Report that will be accessible directly within your QuickBooks Online Reports menu under Custom Reports. You should expect to find that your register balances match your bank and credit card account balances when this service is complete.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.