As a small business owner, understanding sales tax obligations can seem daunting, especially when using marketplace platforms. However, it is crucial for your success. Marketplace facilitator sales tax can impact your bottom line, and knowing the ins and outs can save you time and money.

What is a Marketplace Facilitator?

Marketplace facilitators are platforms that connect buyers and sellers. Examples include Amazon, Etsy, and DoorDash. These platforms simplify the selling process by handling payments, listings, and even logistics. However, they also have responsibilities regarding sales tax collection.

The Role of Marketplace Facilitators

Marketplace facilitators are required to collect and remit sales tax on behalf of sellers on their platform. This is due to legislation designed to streamline tax collection. As a seller, this means you might not have to handle sales tax directly. Yet, you still need to understand how it affects your business.

Why It Matters to You

Understanding marketplace facilitator sales tax is essential. Although facilitators manage tax collection, you remain responsible for ensuring compliance. You must know which states have these rules and how they affect your tax filings. Keeping informed helps you avoid penalties and ensures accurate financial records.

Understanding Nexus and Its Implications

Nexus is a legal term indicating a business presence in a state. This presence obligates you to collect sales tax within that state. Nexus can be physical, like a store or warehouse, or economic, based on sales volume.

Physical vs. Economic Nexus

Physical nexus is straightforward. If you have a location in a state, you have nexus there. Economic nexus, however, is determined by sales thresholds. For example, if your sales exceed $100,000 or 200 transactions in a state, you likely have economic nexus.

How Nexus Affects You

Knowing where you have nexus is crucial. It determines where you must collect sales tax. Marketplace facilitators usually handle this, but you should verify compliance. Check each state’s rules to ensure you’re meeting all requirements.

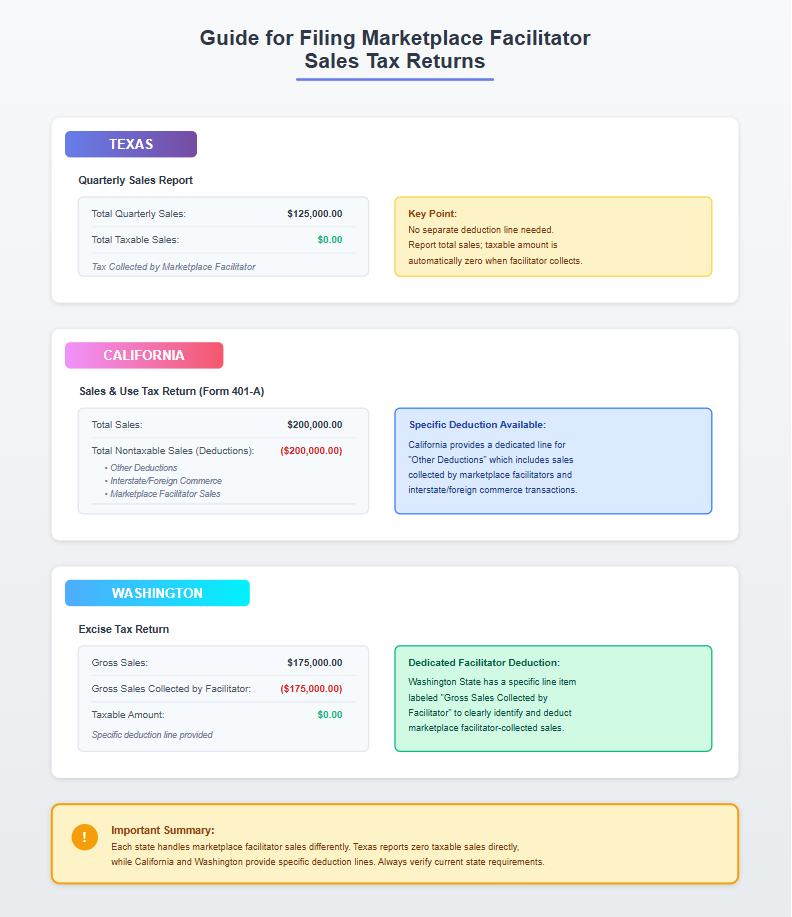

State Sales Tax Thresholds and Deductions

Every state has its own sales tax rules, including thresholds and potential deductions. These thresholds determine when you must start collecting sales tax.

Understanding Thresholds

Thresholds vary significantly. Some states set a low bar, while others have higher limits. For instance, South Dakota requires tax collection after $100,000 in sales or 200 transactions. Knowing these details helps you plan and comply with local laws.

State Specific Sales Tax Threshold Examples

Deductions You Can Use

Some states offer deductions or exemptions. These can reduce your taxable sales and lower the taxes you owe. Common deductions include sales to resellers or certain goods like groceries. Research available deductions in states where you have nexus to maximize savings.

Filing Sales Tax Returns: A Step-by-Step Guide

Filing sales tax returns is a critical part of staying compliant. Fortunately, breaking down the process into steps can simplify it.

Step 1: Gather Your Data

First, collect all sales data for the period. This includes total sales, taxable sales, and sales tax collected. Platforms like Amazon often provide this information in reports.

Step 2: Understand State Requirements

Next, review state-specific filing requirements. Deadlines and forms vary, so check the state’s revenue department website.

Step 3: File Your Return

Once you have your data and know the requirements, complete the necessary forms. Many states offer online filing, which can simplify the process. Be sure to double-check your entries for accuracy.

Common FAQs About Marketplace Facilitator Sales Tax

Understanding marketplace facilitator sales tax can raise questions. Let’s address some common concerns.

Do I Still Need a Sales Tax Permit?

You may still need a sales tax permit, even if a facilitator collects tax. It ensures compliance and can be necessary for filing returns. Check your state’s requirements for specifics.

What If a Facilitator Fails to Collect Tax?

If a marketplace facilitator fails to collect sales tax, you might still be liable. Monitor your sales and tax collection closely. Contact the platform if you notice discrepancies.

How Can I Automate Sales Tax Compliance?

Automation tools like TaxJar can simplify compliance. They track sales, calculate taxes, and even file returns. Using automation reduces errors and saves time. TaxJar connects to many platforms such as Shopify.

Helpful Resources to Review

Marketplace facilitator laws, explained

Marketplace Facilitator Laws: Past, Present, and a Better Future

Conclusion: Stay Informed and Compliant

Marketplace facilitator sales tax is a crucial aspect of selling on platforms like Amazon, Etsy, and DoorDash. By understanding your obligations, you ensure compliance and avoid costly penalties. Stay informed about changing laws, use available resources, and consider automation to streamline the process.

Free Downloadable Resources

Nexus and State Sales Tax Thresholds Essential Cheat-Sheet

Test Your Knowledge: Take Our Marketplace Facilitator Sales Tax Quiz

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.