Managing your business finances can be a daunting task, especially when uncategorized expenses pile up. QuickBooks Online offers tools to help you manage these expenses, but it’s crucial to understand how to use them effectively. In this guide, you’ll learn practical strategies to efficiently categorize expenses, ensuring accurate financial records and insightful business decisions.

Understanding Uncategorized Expenses

What Are Uncategorized Expenses?

Uncategorized expenses are transactions that haven’t been assigned to a specific account in your financial records. They often occur when transactions are imported from your bank but lack sufficient detail. These uncategorized expenses can distort your financial reports and obscure your business insights. Our firm send weekly reminders on uncategorized expenses.

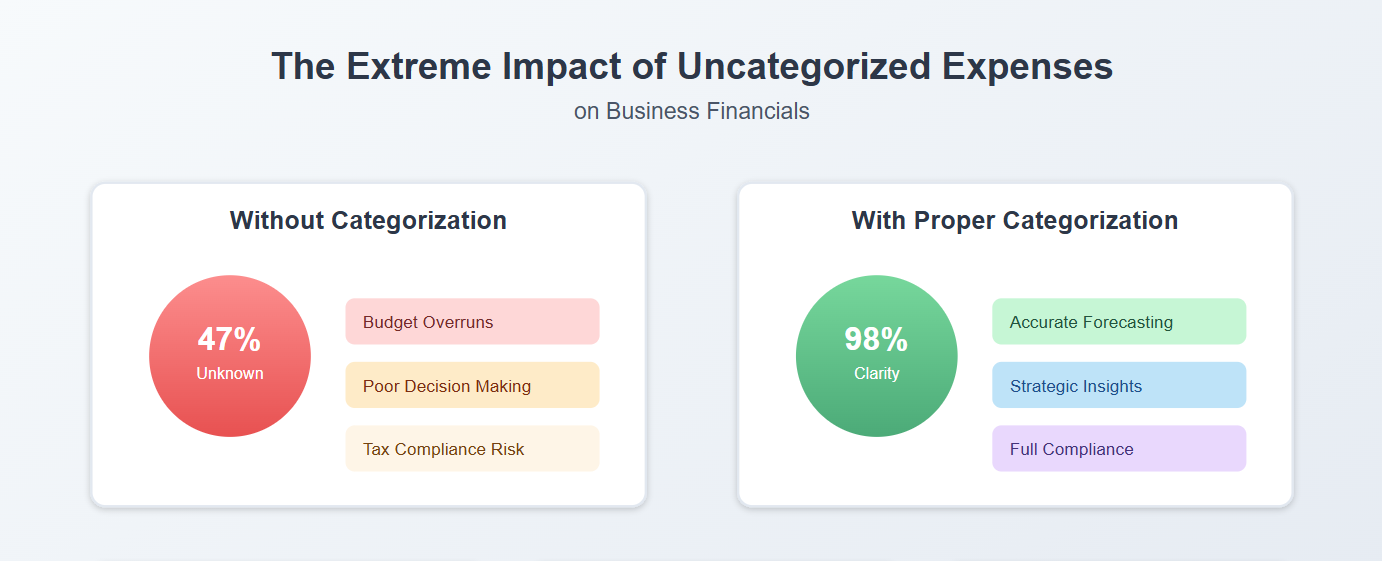

Why Expense Categorization Matters

Categorizing expenses correctly is essential for accurate financial reporting. It ensures you can track where your money goes and aids in identifying deductible expenses. It helps prevent potential issues with IRS audits. By managing uncategorized expenses promptly, you maintain clarity in your financial statements and improve your cash flow management.

💡Shareholder Equity is directly impacted by Uncategorized Expenses.

Setting Up QuickBooks for Success

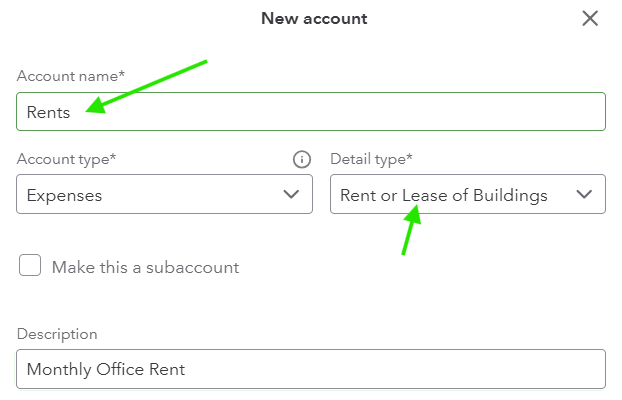

Customizing Your Chart of Accounts

First, tailor your Chart of Accounts to fit your business needs. This is where you’ll categorize transactions. To do this, go to the Chart of Accounts section in QuickBooks Online and click ‘New’ to create categories that align with your expense types. For example, if you have an office lease, setup a Rents expense account with a detail type of Rent or Lease of Buildings.

Automating Expense Categorization

Next, take advantage of QuickBooks’ automation features. You can set up bank rules to automatically categorize known recurring expenses based on specific criteria, such as vendor name or transaction amount. This not only saves time but also reduces the chance of misclassification.

Resolving Uncategorized Expenses

Reviewing Uncategorized Expense Reports

Review entries listed under ‘Uncategorized Expense’. You can drill-down from your Profit and Loss report into the details of expenses in assigned to this account. We have built an expense categorizer tool that is connected to each one of our client’s QuickBooks Online Company books. Our tool enables you to quickly select a vendor and account and add a note about the expense. We send an automatic weekly reminder to clients about uncategorized expenses.

Correcting Uncategorized Expense Entries

For each uncategorized expense, click on the transaction to edit it. Assign the correct category and save your changes. If unsure about how to categorize, consult with your Accountant ProAdvisor for guidance. If you are using the Lend a Hand Accounting Expense Categorizer tool, your expense submissions will be reviewed by your ProAdvisor and updated in your financials for you.

Best Practices for Ongoing Management

Regularly Review Money-Out Transactions

Make it a habit to review your transactions weekly. This routine prevents a backlog of uncategorized expenses and ensures your financial data remains current. Lend a Hand Accounting makes this weekly process easy for you. If you happen to be updating your own transactions directly in QuickBooks Online, it will take less time if you make it a weekly recurring process.

Collaborate with ProAdvisor Your Accountant

Work closely with your ProAdvisor accountant to streamline your business expense categorization process. They can provide insights into tax-deductible expenses and suggest categories you might have overlooked. Additionally, they can help ensure compliance with IRS 1099 reporting guidelines.

Leveraging QuickBooks Features

Utilizing QuickBooks Online and ProAdvisor Training

QuickBooks offers extensive resources to help you master its features. Consider working with a Certified QuickBooks Online ProAdvisor that can share best practices for recording your money-out transactions. The Intuit documentation can help you learn how to use the accounting application, but your ProAdvisor Accountant can help you maintain accurate financials.

Syncing with Third-Party QuickBooks Online Apps

Integrate QuickBooks with third-party apps like the Lend a Hand Accounting Client Platform that can help you easily manage your expense categorizations. Our technology can look at your QuickBooks Company books and give you instant answers about the current state of your books. Our Good Bookkeeping Score assessment was designed to give quick insights. It is not meant to be used as a stand-alone-app without an Accountant ProAdvisor. Our firm built this QuickBooks Online connected application to make it easy to work with a dedicated ProAdvisor accountant that manages your financials.

Tips for Improved Expense Management

- Set Up Rules: Use QuickBooks to set up bank rules to automatically categorize known recurring expenses by vendor and/or amount.

- Document Transactions: Keep and organize digital copies of purchase receipts that you can attach to money-out transactions in your books. This documentation aids in verification and IRS compliance.

- Conduct Monthly Reviews: At the end of each month, conduct a thorough review of all categorized and uncategorized expenses to ensure consistency and accuracy.

- Stay Informed: Conduct periodic reviews to confirm that all recorded business expenses satisfy the IRS “ordinary and necessary” criteria.

Conclusion

Managing uncategorized expenses in QuickBooks Online doesn’t have to be overwhelming. By customizing your Chart of Accounts, utilizing automation, and regularly reviewing your transactions, you can maintain accurate financial records. Remember, investing time in keeping your business expenses current not only improves your financial management but also empowers you to make informed business decisions. Stay proactive, collaborate with professionals, and leverage technology to keep your financial processes streamlined and efficient.

QuickBooks Resources

Understanding the Chart of Accounts in QuickBooks Online

Free Downloadable Resources

Excel Template for Business Expenses Paid for with Personal Funds

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.