Discover how to effectively manage sales tax tracking in QuickBooks Online with our helpful guide. Learn setup tips, tracking methods, and best practices to ensure compliance and streamline your business operations.

Unlock the Power of QuickBooks Online for Sales Tax Tracking

Are sales tax tracking headaches keeping you up at night? QuickBooks Online offers robust solutions to streamline this process. With the right setup and strategies, you can manage sales tax with ease, ensuring compliance and saving valuable time.

Introduction to QuickBooks Online Sales Tax Tracking

For small business owners, staying on top of sales tax obligations is crucial.

Yet, navigating the complexities of sales tax can be daunting. QuickBooks Online offers tools specifically designed to simplify this task. By understanding these tools, you can minimize errors and focus more on growing your business.

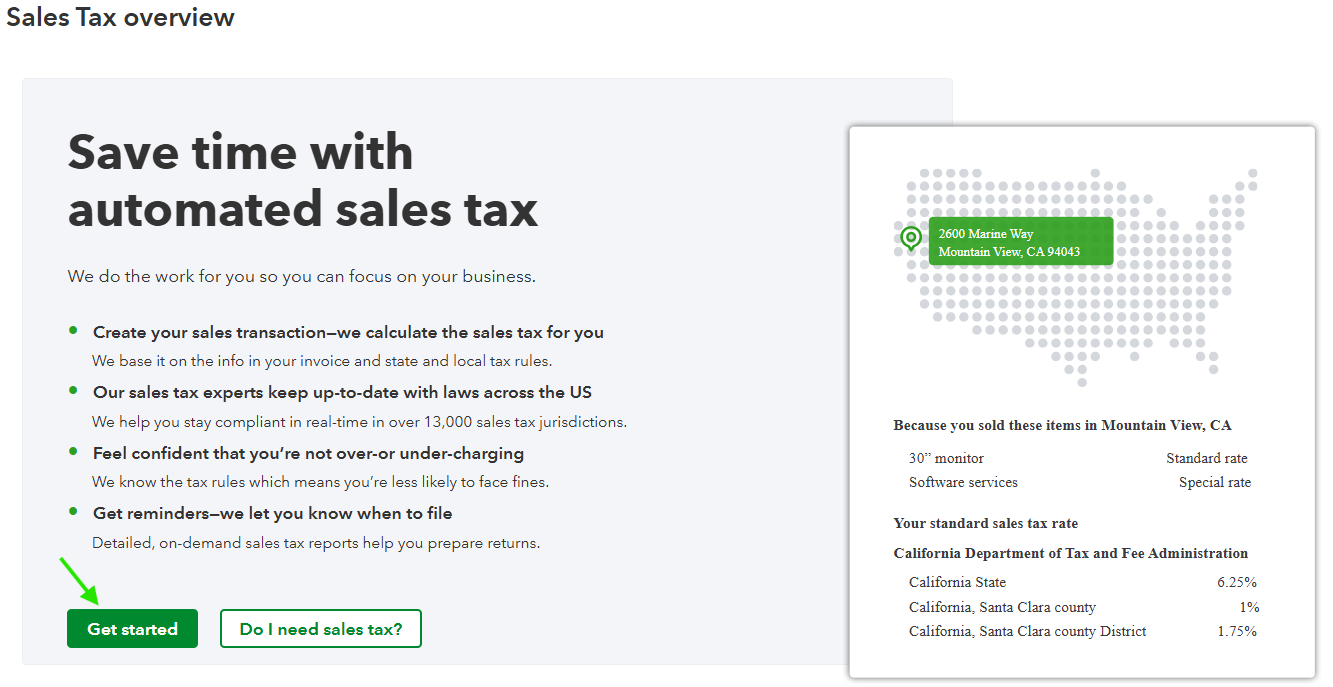

In QuickBooks Online, From the Left Menu bar Select Sales Tax and Overview

The QuickBooks Online Automated Sales Tax Center is a game changer. It not only tracks sales tax but also helps you file and pay it accurately. In this guide, we’ll walk you through the essentials of setting up and managing sales tax in QuickBooks Online.

Understanding the Automated Sales Tax Center

What Is the Automated Sales Tax Center?

The Automated Sales Tax Center in QuickBooks Online is designed to streamline your sales tax tracking. It automatically calculates sales tax rates based on your location and customer details. Thus, you avoid manual calculations and reduce the risk of errors.

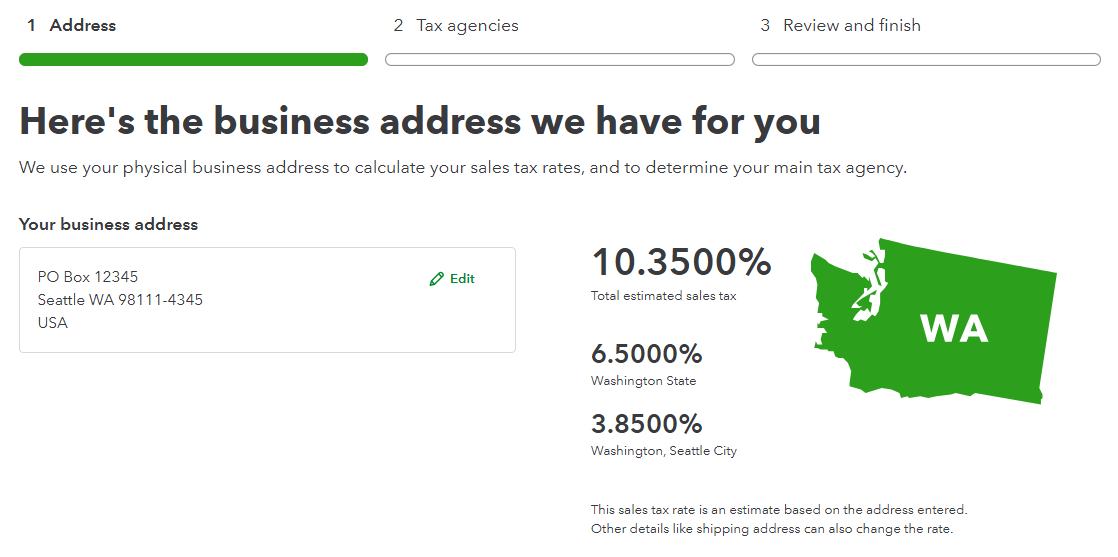

It will Automatically pull the Business Address you entered in your Company Setup.

How Does an Automated Sales Tax Workflow Benefit You?

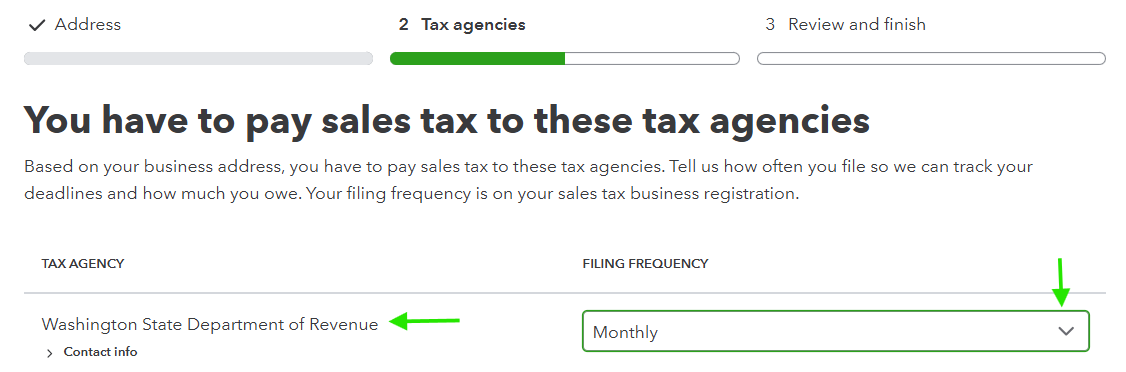

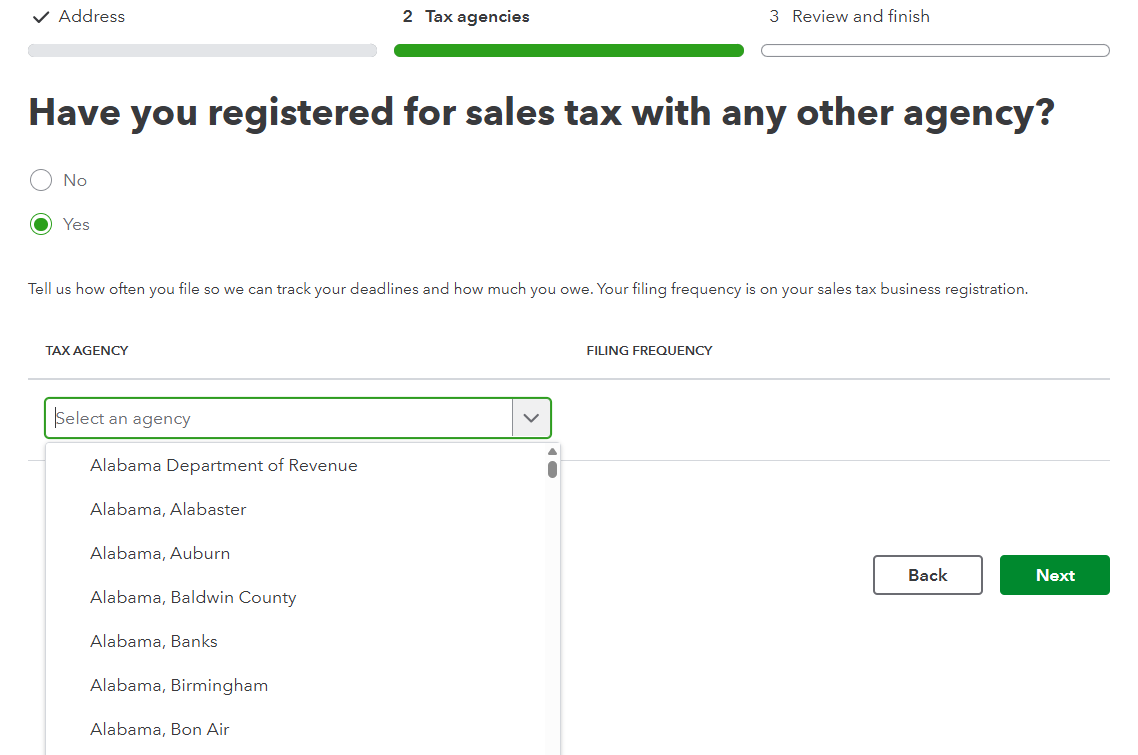

With automated tracking, you ensure compliance without the hassle. The system updates tax rates automatically, so you don’t have to worry about keeping up with changing laws. This feature provides peace of mind and frees you to focus on your core business activities. You can setup each State Tax Agency, Tax Rate, and Filing Frequency to automatically track your Sales Tax Liability by Location.

Setting Up Customer Profiles Correctly

Importance of Accurate Customer Profiles with correct exemption status or tax rate

Accurate customer profiles are the backbone of correct sales tax calculations. When you input precise location data, QuickBooks Online can apply the correct tax rate. This step is critical in avoiding overcharging or undercharging your customers.

Actionable Steps for Setup of your Customer Profiles and tax rates

- Enter Complete Address Information: Ensure that every customer profile includes a full address. This detail ensures the system uses the correct tax rate.

- Verify Resale Certificates: If a customer has a resale certificate, mark their profile appropriately to exempt them from sales tax.

Marking Products and Services as Taxable or Non-Taxable

Why Sales Tax Classifications Matters

Not all products or services are subject to sales tax. Properly marking items as taxable or non-taxable avoids incorrect tax calculations. Misclassification can lead to compliance issues and customer dissatisfaction.

Steps to Classify Your Taxable Vs Nontaxable Products

- Review Product Listings: Go through your inventory and service list to determine taxability.

- Update Each Item: In QuickBooks, mark the items as taxable or non-taxable based on your findings.

Using Classes and Locations for Taxable Sales Tracking

Enhance Your Sales Tax Tracking with Classes and Locations

QuickBooks Online allows you to use classes and locations to better track taxable sales. This feature helps you organize sales data by department, location, or any other category that suits your business needs.

Implementing Classes and Locations for your Taxable Vs Nontaxable Item Sales

- Create Classes: Define specific classes that align with your taxable sales categories.

- Assign Locations: Use location tracking to segment sales data for accurate reporting and analysis.

Reviewing and Reconciling Sales Tax Reports

The Importance of Regular Sales Tax Liability Report Reviews

Regularly reviewing your sales tax reports ensures accuracy and compliance. It helps identify discrepancies before they become issues. A monthly review provides insights into your sales patterns and tax liability.

Filing and Paying Sales Tax in Each State

Navigate State-Specific Requirements with Ease

Each state has unique sales tax rules and deadlines. QuickBooks Online helps you manage these variations by organizing your tax data. This organization enables you to file accurately and on time, avoiding penalties.

Steps to Streamline Filing and Payment of Sales Tax by State

- Check State Requirements: Understand the filing requirements for each state where you operate.

- Use QuickBooks to File: Utilize the platform’s tools to submit your returns efficiently.

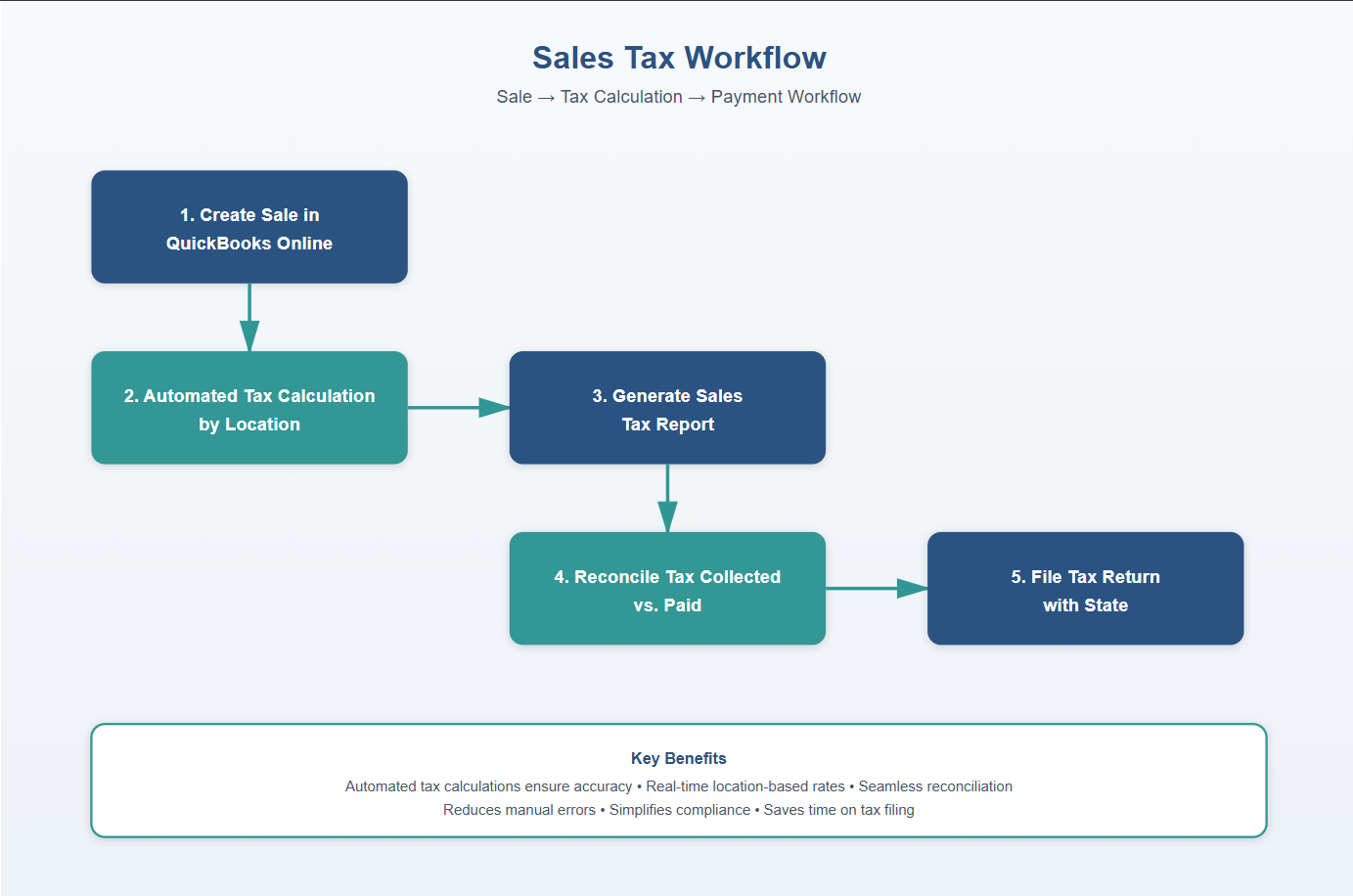

Workflow for Recording and Calculating Sales Tax in QuickBooks Online

ProAdvisor Tips and Best Practices

Maximize Your QuickBooks Online Experience

Working with a QuickBooks ProAdvisor can further enhance your sales tax tracking. ProAdvisors offer expert guidance tailored to your business needs. They help you optimize settings and ensure compliance.

Best Practices for Success

- Regular Training: Keep your skills sharp by attending QuickBooks webinars and training sessions.

- Leverage Automation: Use as many automated features as possible to reduce manual workload.

- Choose Reporting Method: You must choose whether to report and pay your sales tax on an Accrual or Cash basis each period.

Sales Tax Setup Checklist for QuickBooks Online

💡You can overpay sales tax on an Accrual Basis if an Invoice becomes uncollectible.

Conclusion: Take Control of Your Sales Tax Today

Efficient sales tax tracking in QuickBooks Online is within your reach. By setting up customer profiles, classifying products, and using advanced tracking features, you can streamline your sales tax obligations.

Key Takeaways

- Utilize Automated Tools: Take full advantage of the Automated Tax Center in QuickBooks Online.

- Stay Organized: Regularly review and reconcile your sales tax reports.

- Seek Expert Help: Consider consulting with a ProAdvisor for personalized advice.

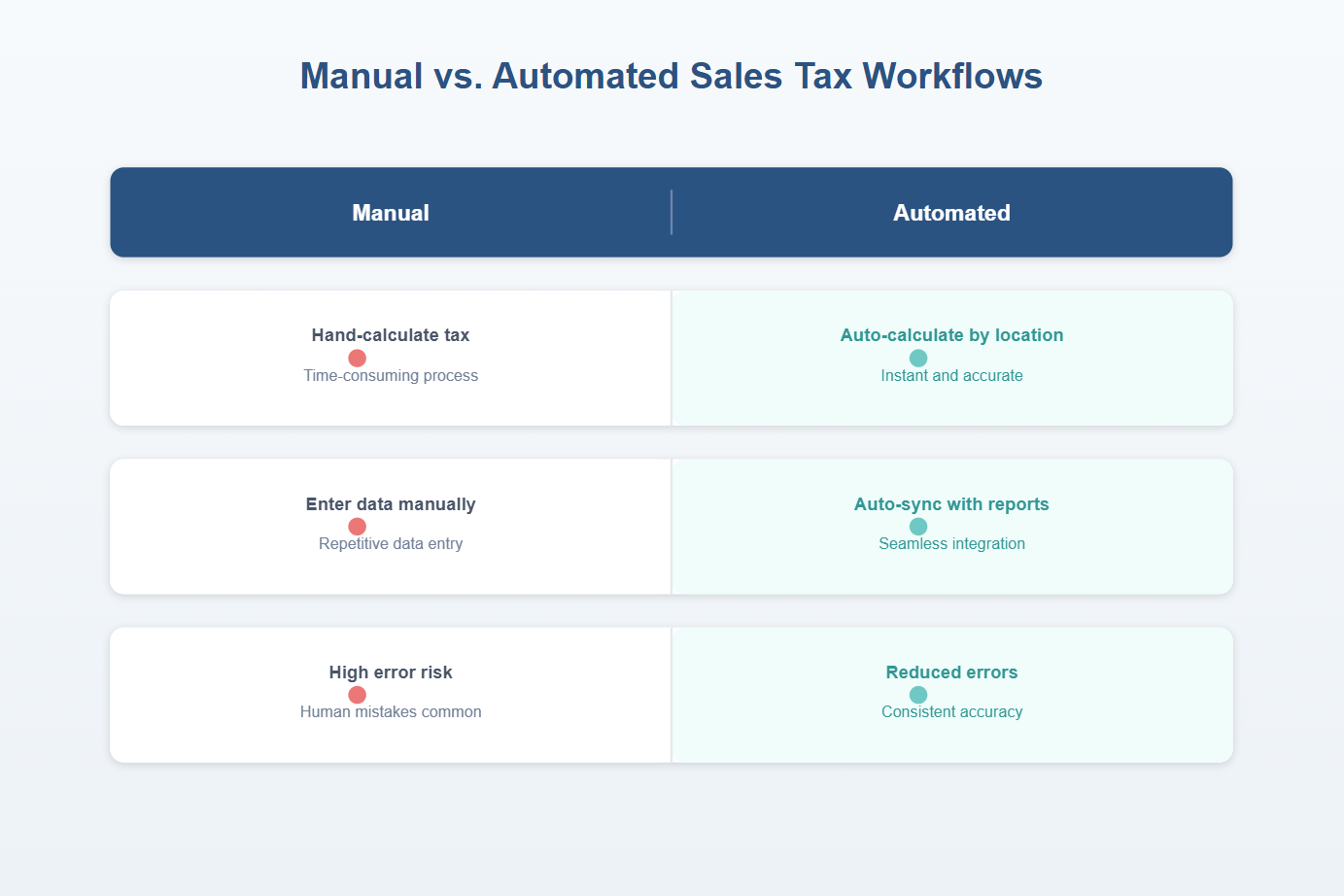

Comparison of a Manual Versus Automated Sales Tax Workflow

Now is the time to simplify your sales tax process. Dive into QuickBooks Online and transform how you manage sales tax, allowing you to focus on what you do best—growing your business.

QuickBooks Resources

Setup your sales tax in QuickBooks Online

Free Downloadable Resources

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.