As a small business owner, navigating the world of tax can feel like a daunting task. However, understanding your LLC’s tax classification is crucial. It affects not only how much you owe Uncle Sam but also how you manage your business finances. In this guide, we’ll break down the essentials of LLC tax classification, ensuring you feel confident come tax season.

Introduction to LLC Tax Classification

When you form a Limited Liability Company (LLC), you gain flexibility in how you’re taxed. Unlike corporations, LLCs are not taxed directly by default. Instead, the IRS allows you to choose how your LLC is classified for tax purposes. This classification can significantly impact your tax responsibilities, so it’s essential to make an informed decision.

The Importance of Tax Classification

For many entrepreneurs, choosing the right tax classification can be the difference between saving money and spending more than necessary. Additionally, it determines how you report your income and expenses. Therefore, understanding your options is key to optimizing your tax strategy.

Classification Options Overview

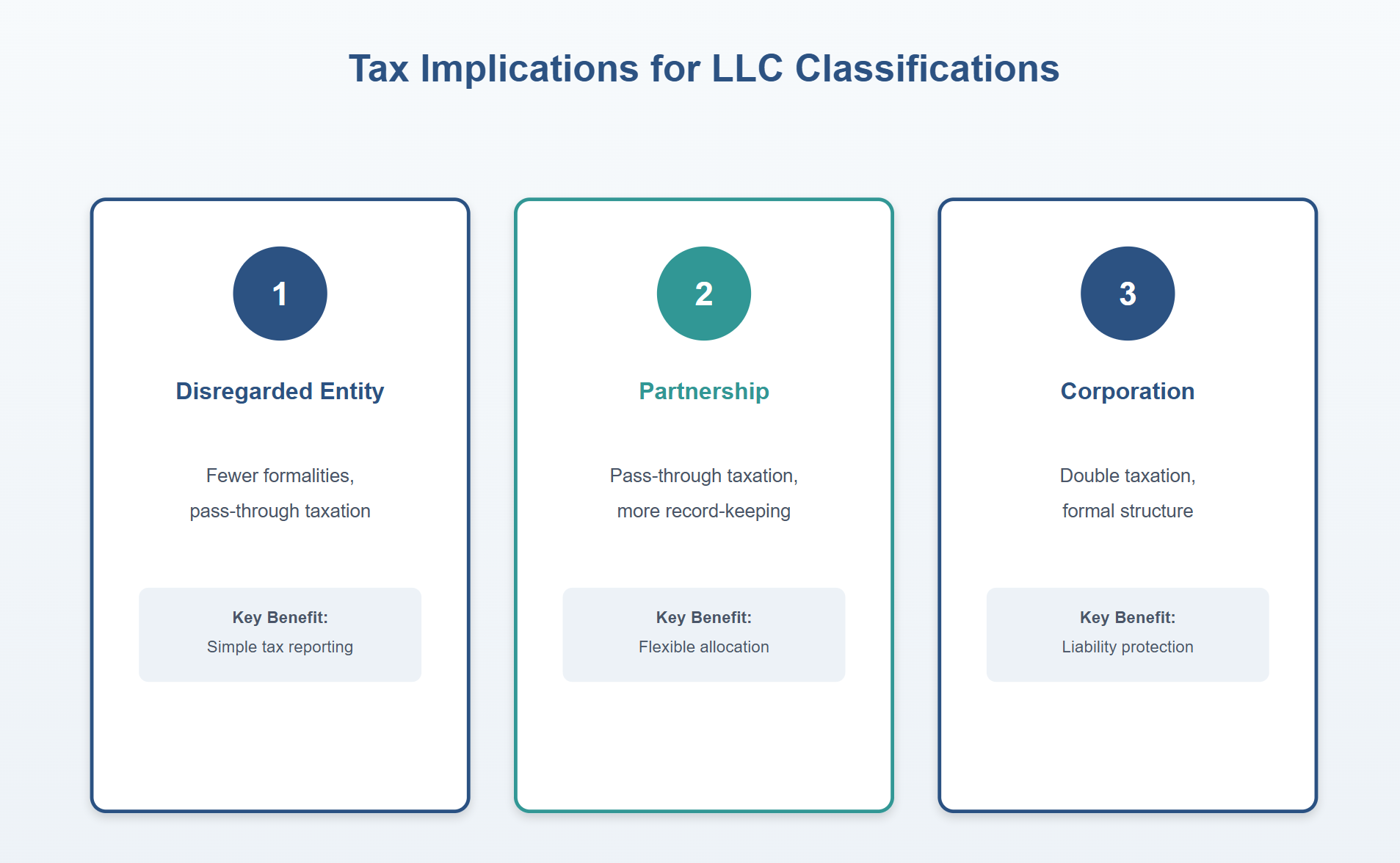

Disregarded Entity

For single-member LLCs, the IRS treats your business as a “disregarded entity” by default. This means your LLC doesn’t file a separate tax return. Instead, you report business income and expenses on your personal tax return. It’s simple and straightforward, making it an attractive choice for sole proprietors.

Partnership

If your LLC has multiple members, the IRS automatically classifies it as a partnership. You file an informational return using Form 1065, but the actual income distribution happens through individual tax returns. This setup allows you to pass profits and losses directly to your personal tax filings, potentially reducing double taxation.

Corporation

Choosing to be taxed as a corporation offers its own advantages. You can opt for either C corporation or S corporation status. C corporations face double taxation—on profits and dividends. Conversely, S corporations avoid this by passing income directly to shareholders. Each option requires careful consideration of your business goals and financial situation.

Tax Implications for LLC Classifications

Default Rules and Elections

Understanding Default Rules

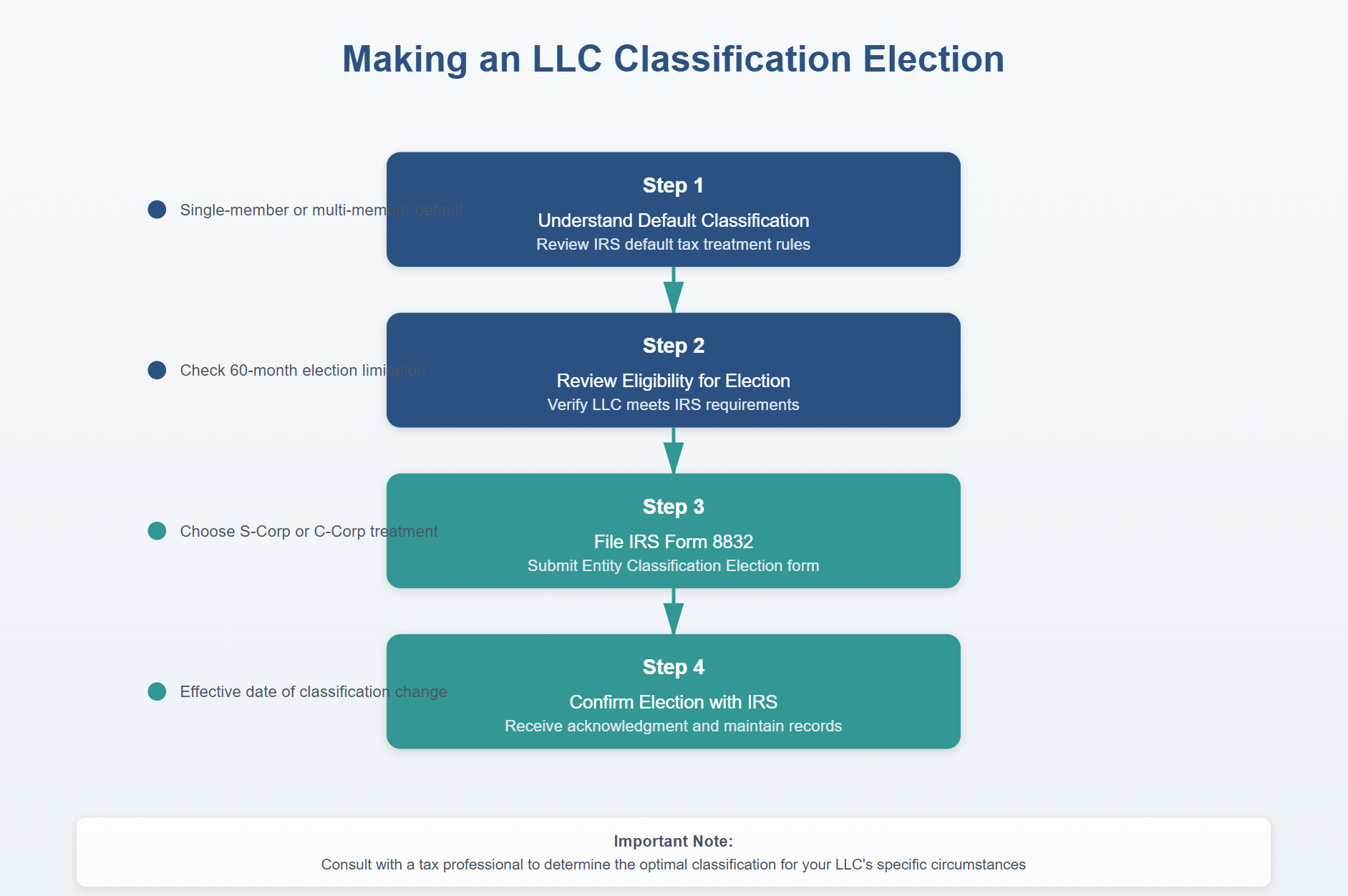

By default, single-member LLCs are treated as disregarded entities, while multi-member LLCs default to partnership status. However, if these defaults don’t align with your business strategy, you can elect to change them. The IRS provides flexibility through the “check-the-box” regulations.

Making an Election

To change your LLC’s default classification, you need to file IRS Form 8832. This form allows you to elect corporate taxation if desired. Before filing, consult with a tax advisor to weigh the pros and cons. Remember, the choice you make today can have long-term financial implications.

LLC Classification Options: Disregarded Entity, Partnership, Corporation

Primary Authority and Key Citations

IRS Guidance and Regulations

The IRS provides clear guidance under Treasury Regulations § 301.7701-1. These regulations outline how entities are classified and the implications of each classification. Additionally, IRS Notice 2004-31 offers further insights into entity classification changes and their effects.

Useful Resources

For detailed information, refer to IRS Form 8832 and the eCFR Treasury Regulations. These resources serve as valuable tools in navigating your tax classification options.

Special Considerations

State-Level Implications

While the IRS governs federal tax classification, state-level taxation can vary. Each state has its own rules and potential fees. Therefore, it’s crucial to check your state’s requirements to avoid unexpected liabilities.

Changing Your Classification

Changes to your LLC’s tax classification aren’t set in stone. However, frequent changes can raise red flags with the IRS. Make sure your reasons for changing align with your business strategy, and always document your decision-making process thoroughly.

Practical Steps for LLC Owners

Evaluate Your Business Goals

First, assess your short and long-term business goals. Are you looking to minimize taxes, or do you need to reinvest profits back into the business? Your answers will help guide your tax classification decision.

Consult a Tax Professional

Next, consult with a tax advisor or accountant. They provide personalized advice based on your unique situation. With their help, you can navigate the complexities of tax law with confidence.

Make an Informed Decision

Finally, make your decision and file the necessary paperwork. If you choose to change your classification, complete IRS Form 8832 accurately. Keep copies of all submissions for your records.

Making an LLC Classification Election

Frequently Asked Questions

What Happens if I Don’t Choose a Classification?

If you don’t actively choose, your LLC defaults based on its membership structure. Single-member LLCs become disregarded entities, while multi-member LLCs default to partnerships.

Can I Change My Classification Later?

Yes, you can change your classification by filing IRS Form 8832. However, consider the potential tax implications before making any changes.

How Often Can I Change My Classification?

While you can change your classification, avoid doing so frequently. The IRS may scrutinize frequent changes, so ensure each decision aligns with your business strategy.

Free Downloadable Resources

LLC Tax Classification Cheat-Sheet

Conclusion

In conclusion, understanding LLC tax classification is crucial for your business’s financial health. By choosing the right classification, you can optimize your tax obligations and focus on growing your business. Now, take action—evaluate your options, consult a professional, and make an informed choice. For more information, explore the resources linked throughout this guide. Empower yourself with knowledge and steer your business toward success.