Navigating the financial landscape of owning a small business or being an S-Corporation shareholder can be complex, especially when it comes to managing tax responsibilities. One crucial aspect that often requires attention is estimated tax payments. Understanding and mastering the nuances of these payments can help avoid penalties, manage cash flow more effectively, and ensure regulatory compliance. In this blog post, we’ll delve into everything you need to know about estimated tax payments, providing you with strategies, insights, and practical tips to manage them efficiently.

Introduction to Estimated Tax Payments

Estimated tax payments are periodic installments made to the Internal Revenue Service (IRS) on income not subject to withholding. For small business owners and S-Corporation shareholders, this typically includes income from self-employment, dividends, interest, and other earnings. These payments are a critical part of your tax planning strategy, ensuring that you pay taxes on income as you earn it, rather than facing a hefty bill at the end of the year.

Making accurate estimated tax payments can protect you from underpayment penalties and assist in maintaining a healthy cash flow throughout the year. For S-Corporation shareholders, understanding these payments is equally vital, as your share of the corporation’s income, deductions, and credits directly affects your tax obligations.

Understanding Deadlines and Penalties

Key Deadlines

Estimated tax payments are generally due four times a year:

- April 15: For income earned from January 1 to March 31

- June 15: For income earned from April 1 to May 31

- September 15: For income earned from June 1 to August 31

- January 15 (of the following year): For income earned from September 1 to December 31

Meeting these deadlines is crucial to avoid penalties. It’s important to note that if a due date falls on a weekend or holiday, the deadline is extended to the next business day.

Consequences of Underpayment

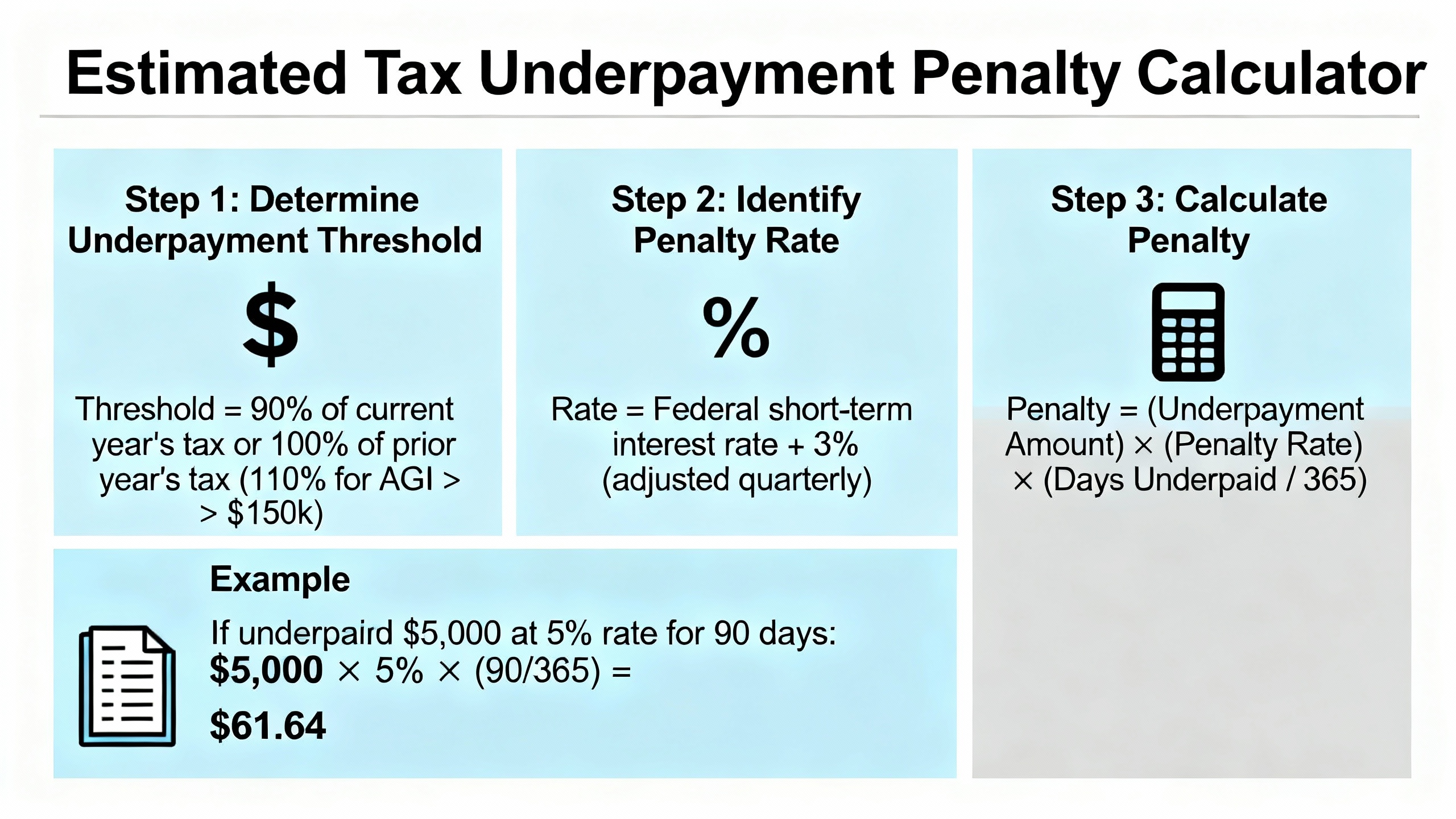

Failing to pay enough tax throughout the year can result in an underpayment penalty. The IRS calculates this penalty based on the amount you should have paid each quarter. To avoid this, you must pay at least 90% of your current year’s tax liability or 100% of the previous year’s tax (110% for higher income earners) by the end of the year.

Calculating estimated taxes

How Estimated Tax Payments Serve as a Planning Tool

Estimated tax payments aren’t just a regulatory requirement—they can also be an effective financial planning tool. By aligning these payments with your income fluctuations, you can manage your cash flow more effectively and avoid a large tax bill at year-end.

Strategic Planning

- Monitor Your Income: Regularly review your income statements to adjust your estimated tax payments accordingly. This helps you avoid overpaying or underpaying throughout the year.

- Utilize Accounting Software: Leverage accounting tools to forecast your tax liabilities and automate reminders for due dates.

- Consult a Tax Professional: Working with a tax professional (Enrolled Agent) can provide personalized strategies tailored to your business’s financial situation.

Case Studies

Case Study 1: The Boutique Bakery

Sarah owns a small bakery with fluctuating monthly income due to seasonal demands. By diligently monitoring her monthly earnings and adjusting her estimated tax payments quarterly, she avoids underpayment penalties and maintains a steady cash flow even during off-peak months.

Case Study 2: The Tech Startup

Jason, an S-Corp shareholder in a tech startup, found himself facing a significant tax bill after the first year of operations. By consulting with a tax professional and implementing a structured payment plan, he ensured future estimated tax payments were aligned with the company’s financial growth, avoiding any further surprises.

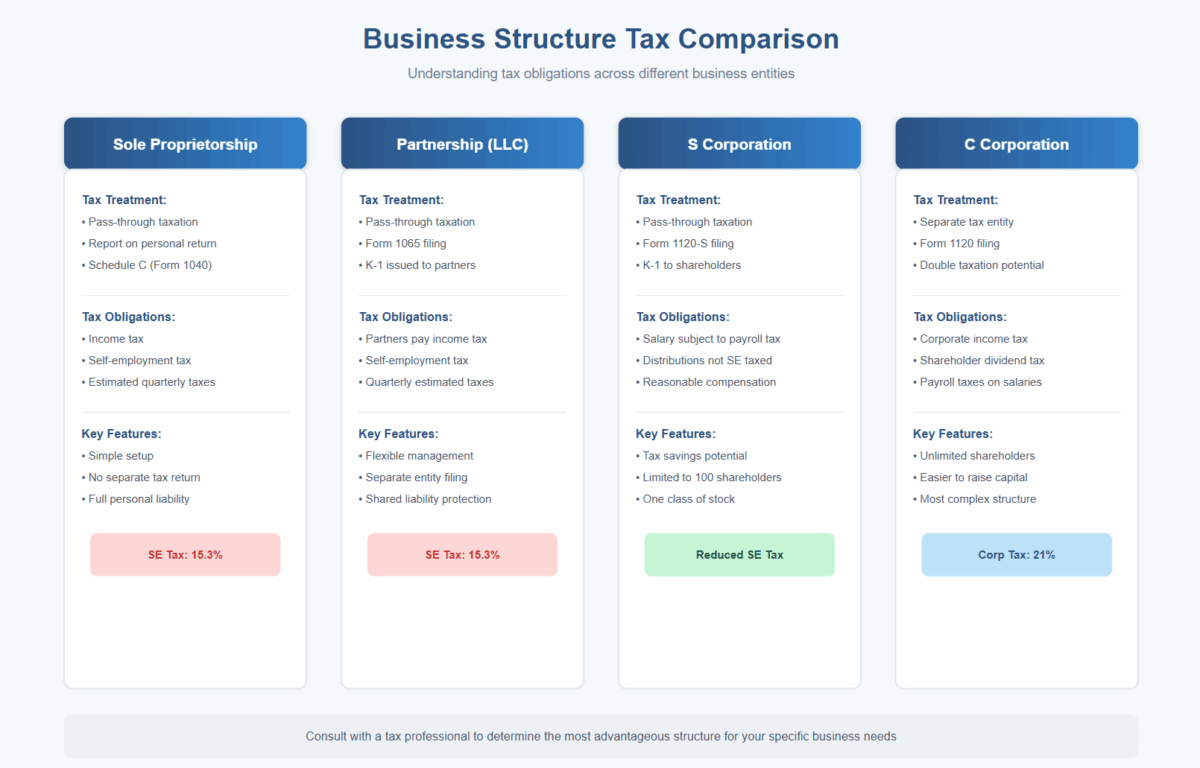

Different business structures and their respective tax obligations

Common Mistakes and How to Avoid Them

Mistake 1: Ignoring Income Variability

Solution: Regularly review and adjust your estimated payments to reflect income changes, ensuring you remain compliant and avoid penalties.

Mistake 2: Missing Deadlines

Solution: Set up automatic reminders or use accounting software to help track payment due dates.

Mistake 3: Underestimating Tax Liability

Solution: Use the IRS Safe Harbor rule, which involves paying 100% of your previous year’s tax liability (or 110% for higher incomes) to safeguard against penalties.

FAQs

Q: What happens if I overpay my estimated taxes?

A: If you overpay, the excess amount can be applied to future tax liabilities, or you can request a refund when you file your annual return.

Q: Can estimated tax payments be made electronically?

A: Yes, the IRS offers several electronic payment options, including the Electronic Federal Tax Payment System (EFTPS). Learn more here.

Q: How do I calculate my estimated tax payments?

A: The IRS provides Form 1040-ES, which includes a worksheet to help you calculate your estimated tax payments based on your expected income, deductions, and credits.

Free Downloadable Resources

A fillable PDF cheat-sheet titled ‘Estimated Tax Payment Due Dates & Penalty Information’

estimated_tax_due_date_cheatsheets

Conclusion

Managing estimated tax payments effectively is essential for small business owners and S-Corp shareholders. By understanding the rules, meeting deadlines, and using these payments as a financial planning tool, you can ensure compliance and maintain a healthy financial standing. For more information, visit the IRS Estimated Taxes page or consult the SBA Tax Guide for Small Business.

By taking proactive steps and seeking professional advice when needed, you’ll be well-equipped to handle your tax obligations and focus on what truly matters—growing your business.