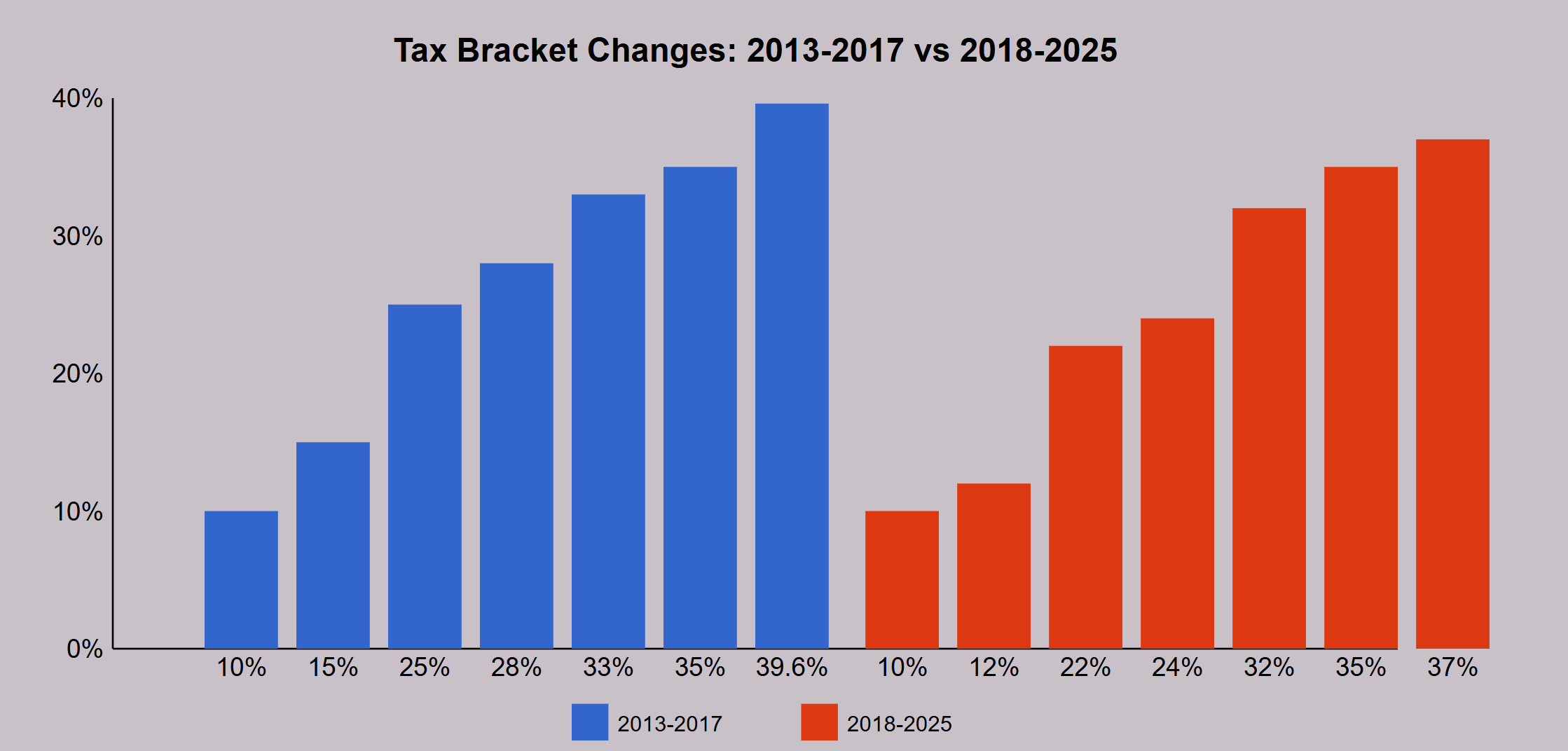

As the 2025 tax changes approach due to the expiration of key TCJA provisions, taxpayers need to be aware of upcoming increases in marginal tax rates. Notwithstanding any intervening legislation, the marginal tax brackets that were in effect prior to the TCJA (Tax Cuts and Jobs Act) are set to expire in 2025. At that time, the tax rates defined in 26 U.S.C. § 1 will become law again. This reversion to pre-TCJA tax rates will affect most U.S. taxpayers.

Understanding the Marginal Tax Rate Changes

While the actual percentage points differ per tax bracket, with the exception of the lowest tax bracket (10%), every subsequent tax bracket under the TCJA from 2018-2025 represents a lower tax burden compared to the corresponding brackets after 2025.

Currently, there are seven tax brackets, and your income determines which bracket(s) you fall into. If the TCJA expires, the higher tax rates will once again apply. Here’s what you need to know:

Who is Affected by the 2025 Tax Changes?

The 2025 tax changes, specifically related to the marginal tax brackets affect all citizens and residents of the United States. Determining which tax bracket you fall into for a given year involves dividing your taxable income into portions that fall within the applicable brackets, each taxed at progressively higher rates.

The Difference Between What You Pay Now and after the 2025 Tax Changes

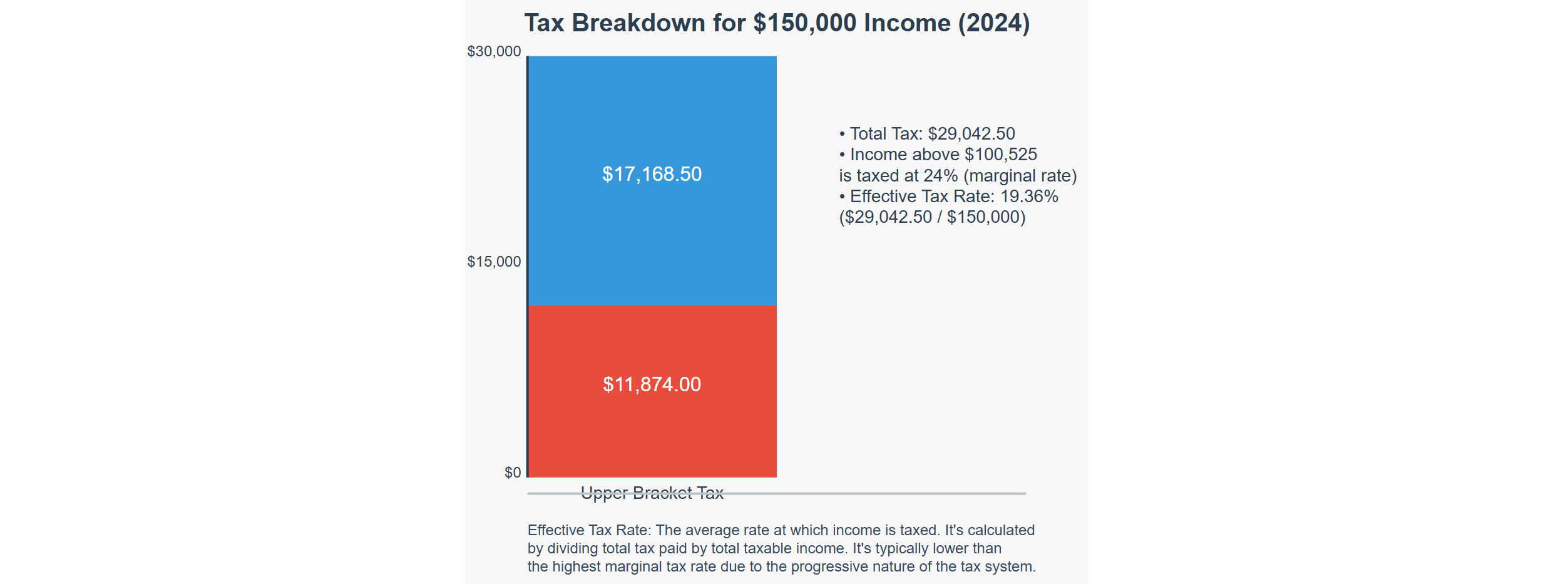

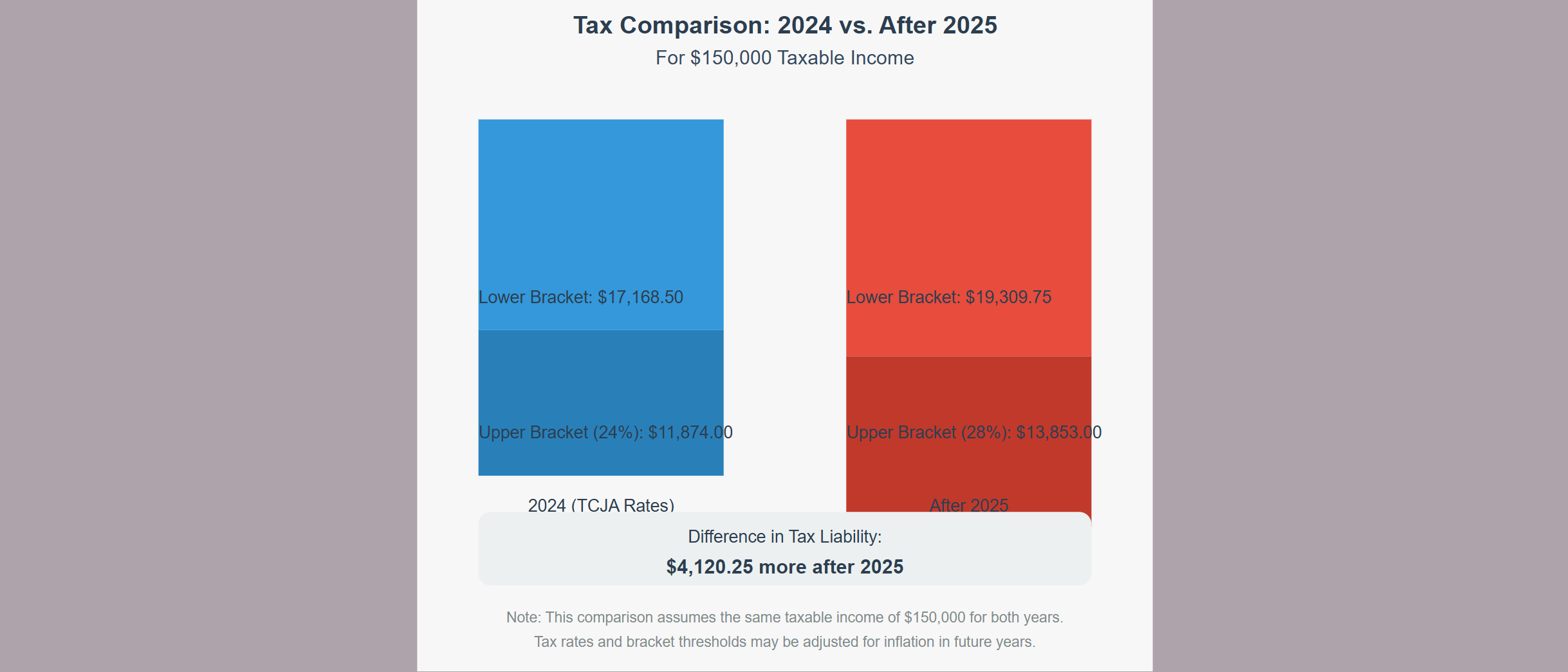

To illustrate the impact of the 2025 tax changes, let’s take a single taxpayer earning $150,000 per year in taxable income.

Rather than diving into the complexities of dividing income into each tax bracket, we will use the 2024 tax tables and compare the TCJA-era rates with pre-TCJA rates.

| Taxable Income | The Tax Is |

|---|---|

| Not over $11,600 | 10% of the taxable income |

| Over $11,600 but not over $47,150 | $1,160 plus 12% of the excess over $11,600 |

| Over $47,150 but not over $100,525 | $5,426 plus 22% of the excess over $47,150 |

| Over $100,525 but not over $191,950 | $17,168.50 plus 24% of the excess over $100,525 |

| Over $191,950 but not over $243,725 | $39,110.50 plus 32% of the excess over $191,950 |

| Over $243,725 but not over $609,350 | $55,678.50 plus 35% of the excess over $243,725 |

| Over $609,350 | $183,647.25 plus 37% of the excess over $609,350 |

Source: IRS, Rev. Proc. 2023-34

For a taxpayer with $150,000 of taxable income in 2024:

- Taxable income above $100,525 is taxed at 24%.

- Calculation:

$17,168.50+(150,000−100,525)×0.24=17,168.50+11,874=29,042.50

So, the total tax liability for 2024 would be $29,042.50.

Pre-TCJA Tax Rates for Unmarried Individuals (Post-2025)

Using the same taxable income range for illustrative purposes, here are the rates that were in effect prior to the TCJA and will likely return after the 2025 tax changes, assuming no new legislation is enacted:

| Taxable Income | The Tax Is |

|---|---|

| Not over $11,600 | 10% of the taxable income |

| Over $11,600 but not over $47,150 | $1,160 plus 15% of the excess over $11,600 |

| Over $47,150 but not over $100,525 | $5,9720 plus 25% of the excess over $47,150 |

| Over $100,525 but not over $191,950 | $19,309.75 plus 28% of the excess over $100,525 |

| Over $191,950 but not over $243,725 | $44,353.75 plus 33% of the excess over $191,950 |

| Over $243,725 but not over $609,350 | $61,703 plus 35% of the excess over $243,725 |

| Over $609,350 | $201,742.75 plus 39.6% of the excess over $609,350 |

Source: IRS, Rev. Proc. 2016-55

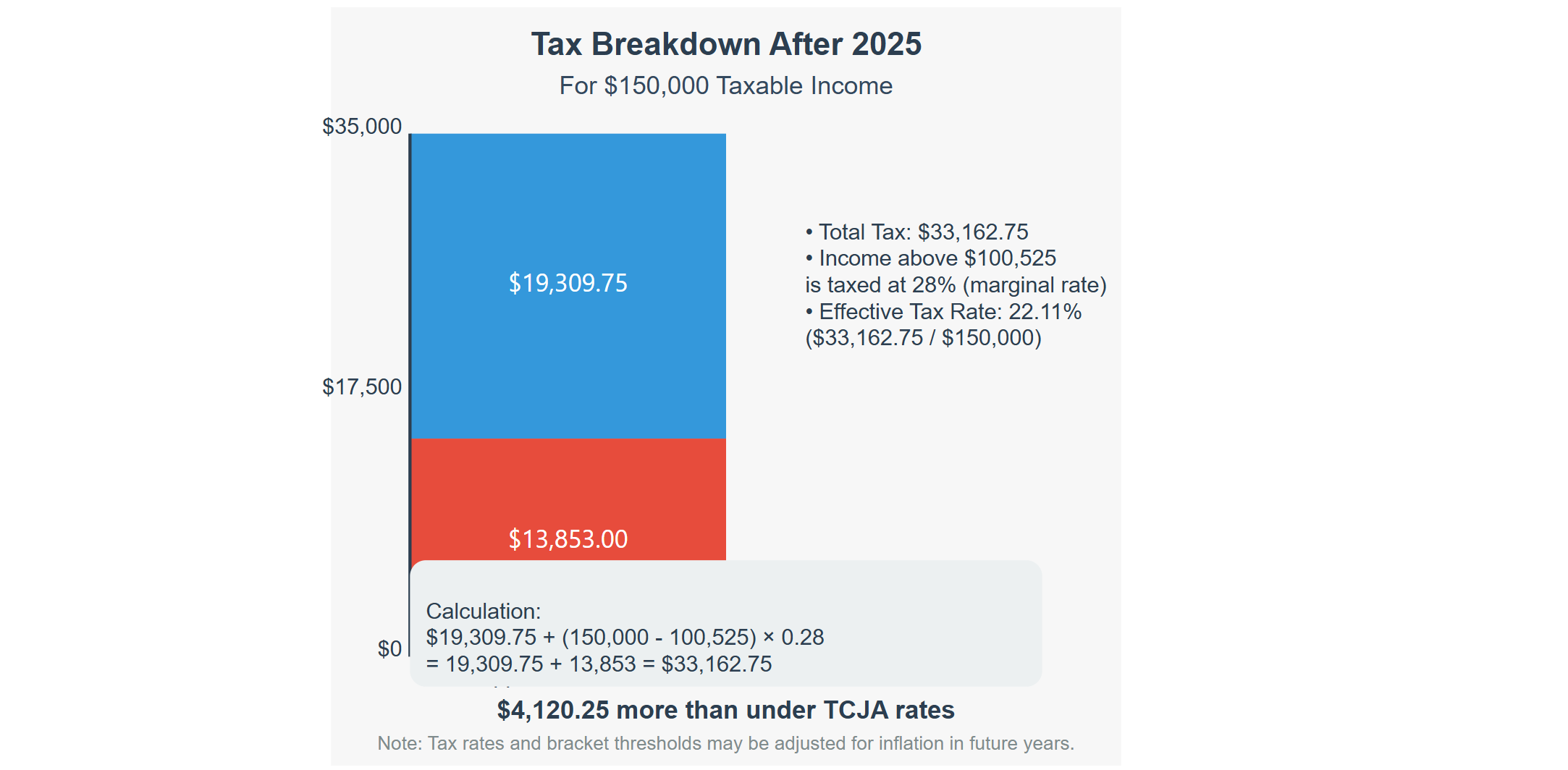

For a taxpayer with $150,000 of taxable income after 2025:

- Taxable income above $100,525 is taxed at 28%.

- Calculation:

$19,309.75+(150,000−100,525)×0.28=19,309.75+13,853=33,162.75

After the 2025 tax changes, the same taxpayer could pay $33,162.75, which is $4,120.25 more than under the TCJA rates.

Other Factors Affecting Your Tax Liability

Keep in mind that marginal tax rates aren’t the only factors that affect your overall tax liability. Other considerations include:

- Adjustments to income (e.g., deductions)

- Tax credits (e.g., Child Tax Credit, Earned Income Tax Credit)

These adjustments can help lower your taxable income, but the overall rate increase based on the 2025 tax changes will still impact the total tax owed.

Tips for Preparing for the 2025 Tax Changes

While 2025 may seem far away, now is the time to start planning for higher taxes. Here are some steps you can take:

- Review your withholding: Make sure you’re not underpaying on your taxes to avoid a larger bill in the future.

- Maximize retirement contributions: Consider contributing more to tax-deferred retirement accounts like a 401(k) or IRA to reduce your taxable income.

- Seek professional advice: Consulting with a tax professional can help you navigate these changes and develop strategies to minimize your tax burden.