As a small business owner running an S-Corporation, you have many responsibilities. One critical task is ensuring your tax returns are filed on time. However, life happens, and sometimes deadlines are missed. In this post, we will explore the landscape of late S-Corporation returns penalties and relief options. By understanding these rules, you can better manage your tax obligations and potentially avoid costly fines.

General Rules for Filing S-Corporation Returns

S-Corporations must file their tax returns using IRS Form 1120-S. Typically, the deadline for this is March 15th. If you miss this date, you can request an automatic six-month extension, moving your deadline to September 15th instead. Using IRS Form 7004 helps you achieve this extension easily. It’s important to note that 26 CFR § 301.6037‑2 outlines the electronic filing requirements for certain S-corporation returns.

However, obtaining an extension to file does not extend the time to pay any taxes owed. Therefore, it’s crucial to estimate and pay any taxes due by the original deadline. For more information, you can visit the IRS Forms and Publications page.

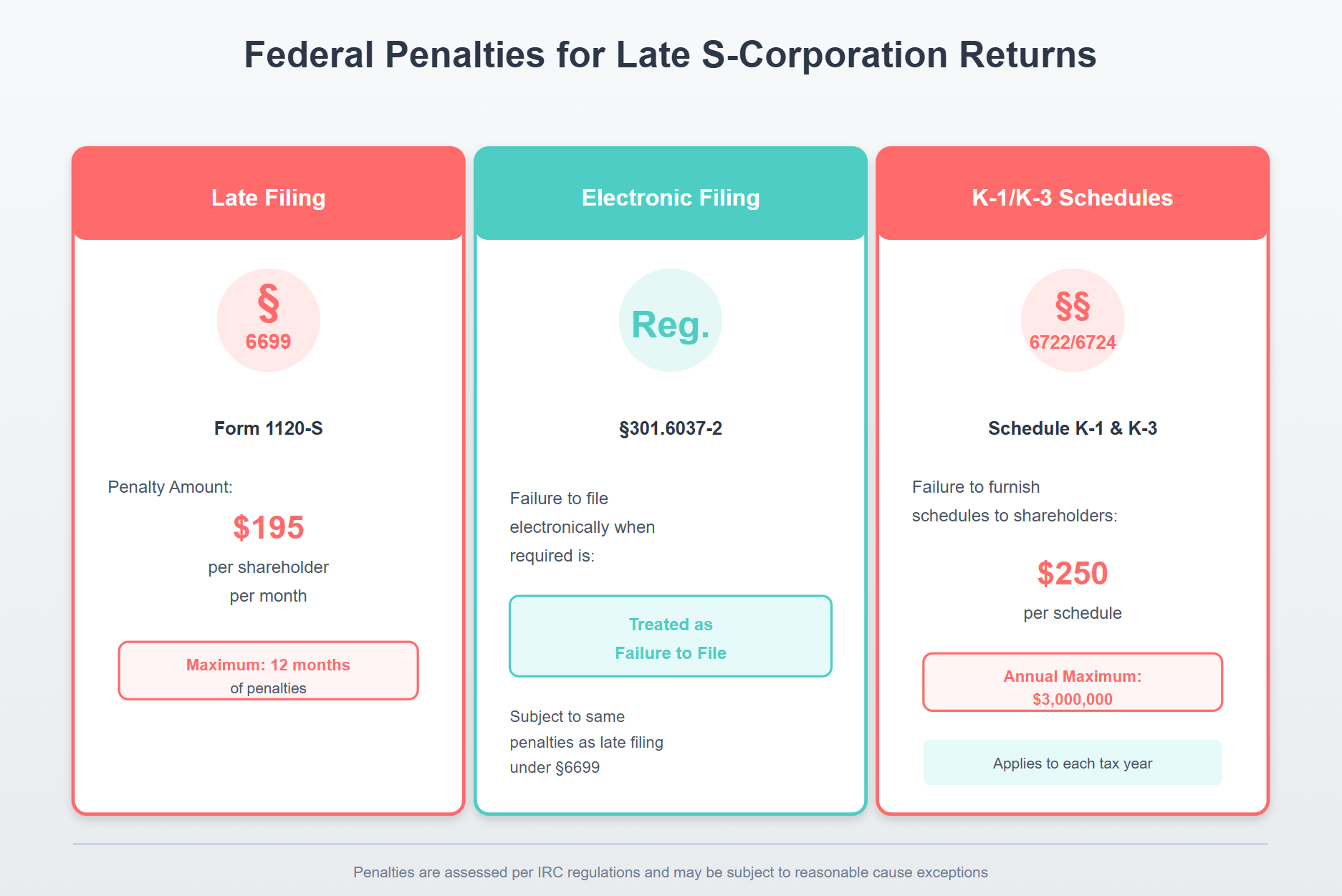

Penalties for Late Filing

Failing to file by the deadline can result in significant penalties. Generally, the IRS imposes a penalty of $210 ($195 potentially adjusted for inflation) per shareholder, per month, for up to 12 months. So, if you have five shareholders and file three months late, you could face a penalty of $3,150, as detailed in 26 U.S.C. § 6699 which covers the failure to file S corporation returns.

Moreover, per 26 U.S.C. § 6651, the IRS may charge interest on unpaid taxes, adding further financial strain. Thus, timely filing is key to avoiding these penalties.

Federal Penalties for Late S-Corporation Returns

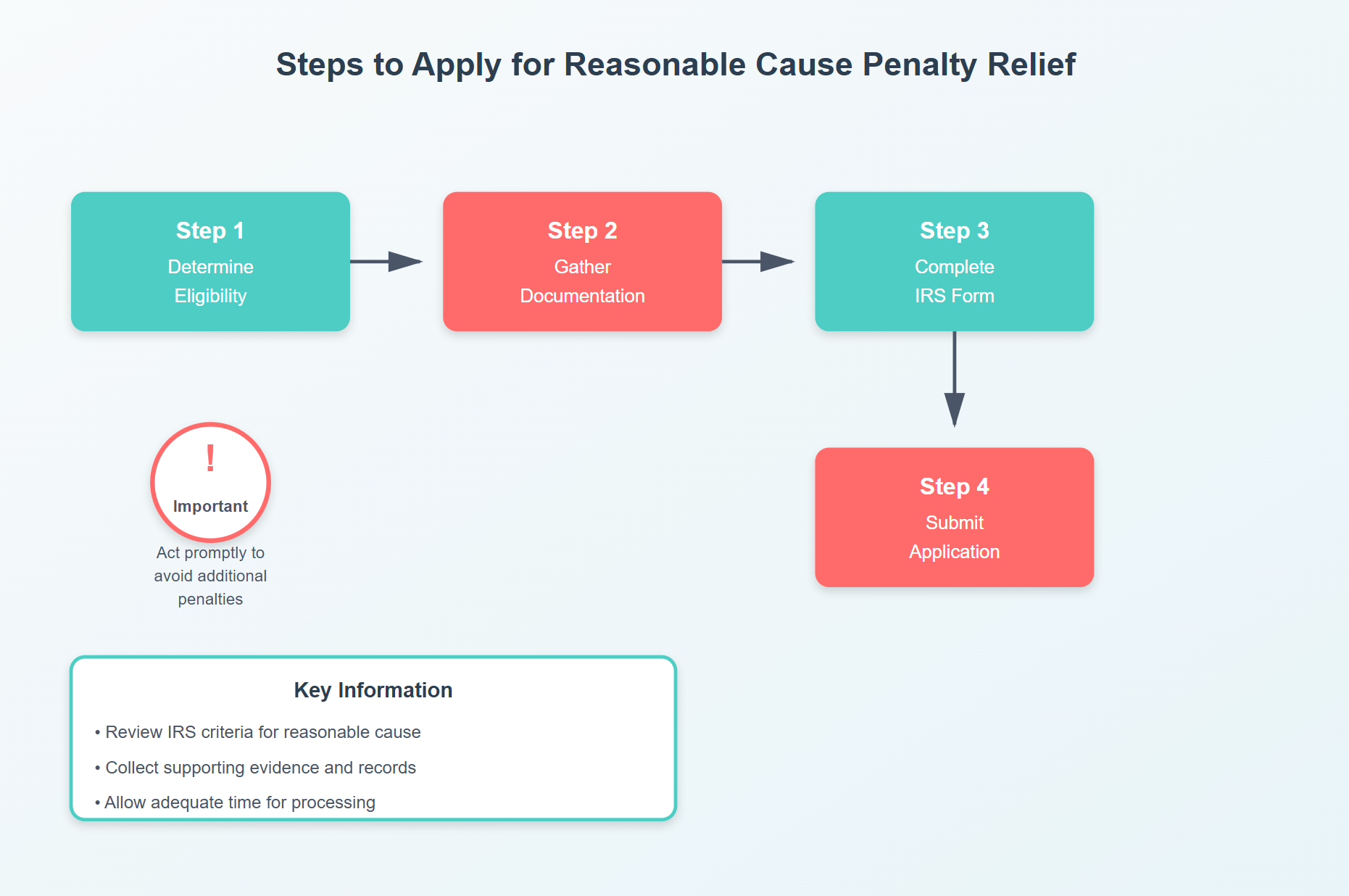

Options for Penalty Relief

If you miss the deadline, don’t panic. The IRS offers penalty relief options. The most common is the First Time Penalty Abatement. This relief is available if you have a clean compliance history and have filed all required returns. Additionally, IRS Notice 2022-36 provides administrative relief in certain situations.

Another option is the Reasonable Cause Penalty Relief. To qualify, you must provide a valid reason, such as a natural disaster or serious illness, explaining why you couldn’t file on time. You can find more details on penalty relief on the IRS Penalty Relief page.

Practical Example

Consider a scenario where a small business in Florida missed the deadline due to a hurricane. The owner can apply for Reasonable Cause Penalty Relief, citing the natural disaster as the cause. By providing documentation, they stand a good chance of having the penalty waived.

Steps to Apply for Reasonable Cause Penalty Relief

Substantial Understatement and Accuracy-Related Penalties

Beyond late filing, substantial understatement and accuracy-related penalties can also impact S-Corporations. If your tax return understates your income by more than 10% or $5,000, whichever is greater, you may incur a penalty of 20% of the understated amount as specified in 26 U.S.C. § 6662.

To avoid this, ensure accurate record-keeping and consult with a tax professional. They can help you understand complex tax rules and prevent costly errors. In a relevant case, ATL & Sons Holdings, Inc. v. Commissioner illustrates the importance of understanding tax obligations to prevent penalties.

State Rules and Penalties

Federal penalties are significant, but don’t forget state-level consequences. States have their own rules for S-Corporation filings, and penalties can vary widely. For example, California imposes a late filing penalty of $18 per shareholder, per month.

Therefore, it’s crucial to review your state’s filing requirements. Consult the relevant state’s tax department for specific guidance. Links to State Tax Departments can provide you with the necessary information.

Actionable Tips to Avoid Penalties

- Set Reminders: Use digital calendars or apps to remind you of key tax deadlines.

- Hire a Professional: Work with a tax advisor who specializes in S-Corporations. Their expertise can save you time and money.

- Keep Good Records: Maintain accurate and organized records throughout the year. This will simplify the filing process and reduce errors.

- Review State Requirements: Understand both federal and state filing requirements to avoid unexpected penalties.

- Plan for Emergencies: Have a backup plan for unforeseen circumstances that may delay your filing.

ℹ️Free Downloadable Presentation on Understanding Late S-Corp Returns

In conclusion, understanding the penalties associated with late S-Corporation returns and the available relief options is essential for small business owners. By taking proactive steps and utilizing available resources, you can manage your tax responsibilities effectively. Stay informed, seek professional advice, and prioritize timely filings to keep your business on track.