Introduction

As the digital economy continues to expand, the integration of digital assets into business operations is no longer just an option but a necessity for many small business owners. With this integration comes the critical task of digital asset tax reporting, a responsibility that is becoming increasingly complex. By 2025, small business owners will face new challenges in reporting digital assets due to evolving regulations and the introduction of new tax forms. Understanding these changes and preparing for them is crucial to ensure compliance and avoid potential penalties.

Digital asset tax reporting involves declaring transactions involving cryptocurrencies, NFTs, and other blockchain-based assets to the tax authorities. The Internal Revenue Service (IRS) has been refining its guidelines to accommodate the dynamic nature of digital assets. The upcoming changes for 2025 include the introduction of Form 1099-DA, which will play a pivotal role in how businesses report their digital asset transactions.

This blog post aims to provide small business owners with the knowledge and tools necessary to navigate these changes successfully. From understanding new tax forms to leveraging technology for recordkeeping and calculation, we will cover essential aspects of digital asset tax reporting.

Understanding Form 1099-DA

Form 1099-DA is poised to become a cornerstone in the reporting of digital asset transactions. This form, introduced by the IRS, is designed to capture income from digital assets, providing both the IRS and taxpayers with a clearer picture of these transactions. It is essential for small business owners to understand the implications of Form 1099-DA to ensure accurate reporting.

Key considerations for Form 1099-DA include understanding what constitutes reportable transactions. These generally include sales, exchanges, and certain transfers of digital assets. The form will require businesses to report the fair market value of the digital assets at the time of the transaction, necessitating precise recordkeeping.

Small business owners should also be aware that failure to accurately fill out Form 1099-DA can lead to audits, penalties, and an increased tax liability. Therefore, familiarizing oneself with the form’s requirements and seeking professional advice if needed is crucial.

Importance of Accurate Recordkeeping

Accurate recordkeeping is the foundation of compliant digital asset tax reporting. With the volatility and complexity of digital assets, maintaining precise records of all transactions is more important than ever.

Best practices for recordkeeping include:

- Consistent Documentation: Record every transaction, including dates, amounts, asset types, and counterparties involved.

- Use of Spreadsheets or Digital Tools: While spreadsheets can be effective, digital tools tailored for cryptocurrency transactions can automate much of the process, reducing the risk of human error.

- Regular Updates: Update records regularly to avoid end-of-year bottlenecks and ensure that data is fresh and accurate.

- Backup Records: Store records securely and back them up to prevent data loss due to technical failures.

These practices not only help in accurate tax reporting but also provide valuable insights into business performance and opportunities for optimization.

Tools and Software Recommendations

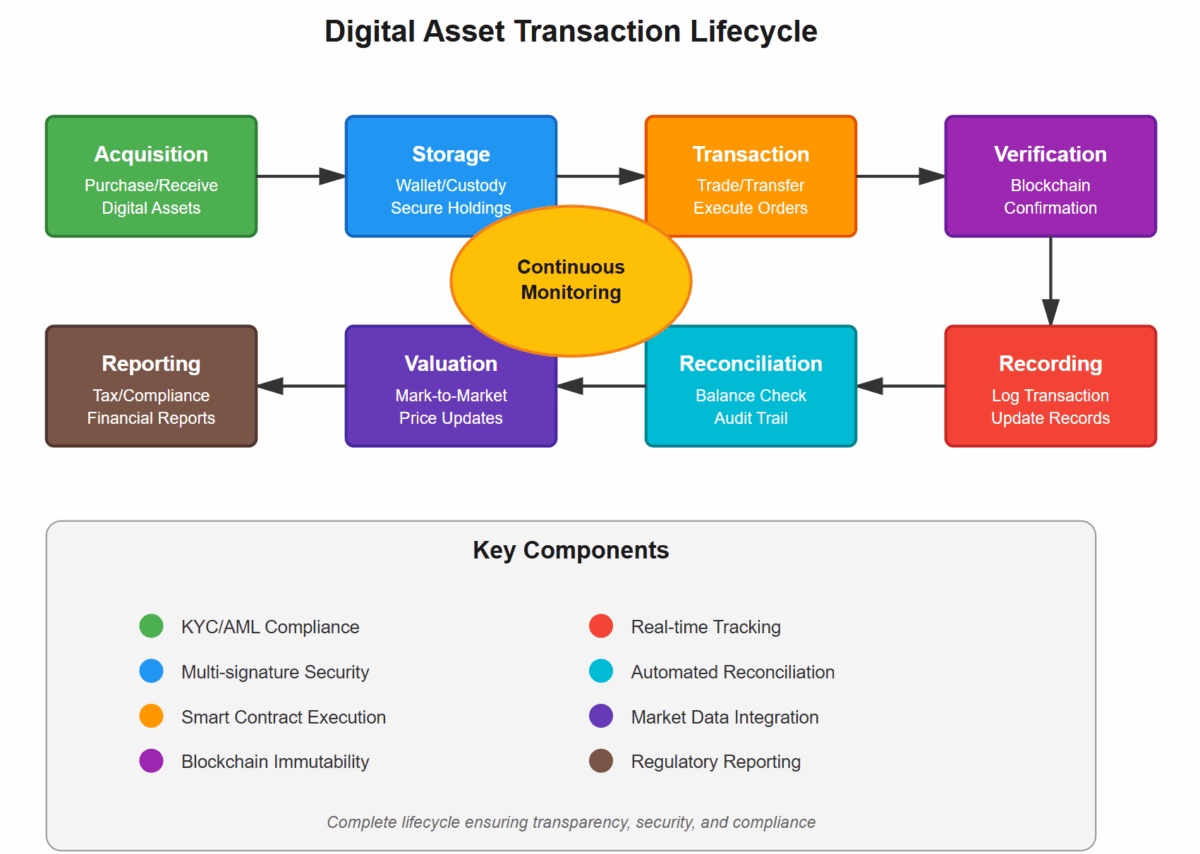

Managing digital assets can be streamlined with the right tools and software. While specific product endorsements are not the focus here, understanding what types of tools can assist in digital asset management is valuable.

- Accounting Software: Look for software that integrates with various cryptocurrency exchanges and wallets, offering real-time tracking of assets and automated reconciliation.

- Tax Calculation Tools: These tools can help calculate gains, losses, and income events, taking into account various cost basis methods.

- Blockchain Explorers: Use explorers to verify transaction details, ensuring that records are accurate and complete.

- Portfolio Management Tools: These provide a holistic view of digital asset holdings, helping in strategizing and reporting.

When selecting tools, consider factors such as ease of use, integration capabilities, and customer support.

Cost Basis Calculation Methods

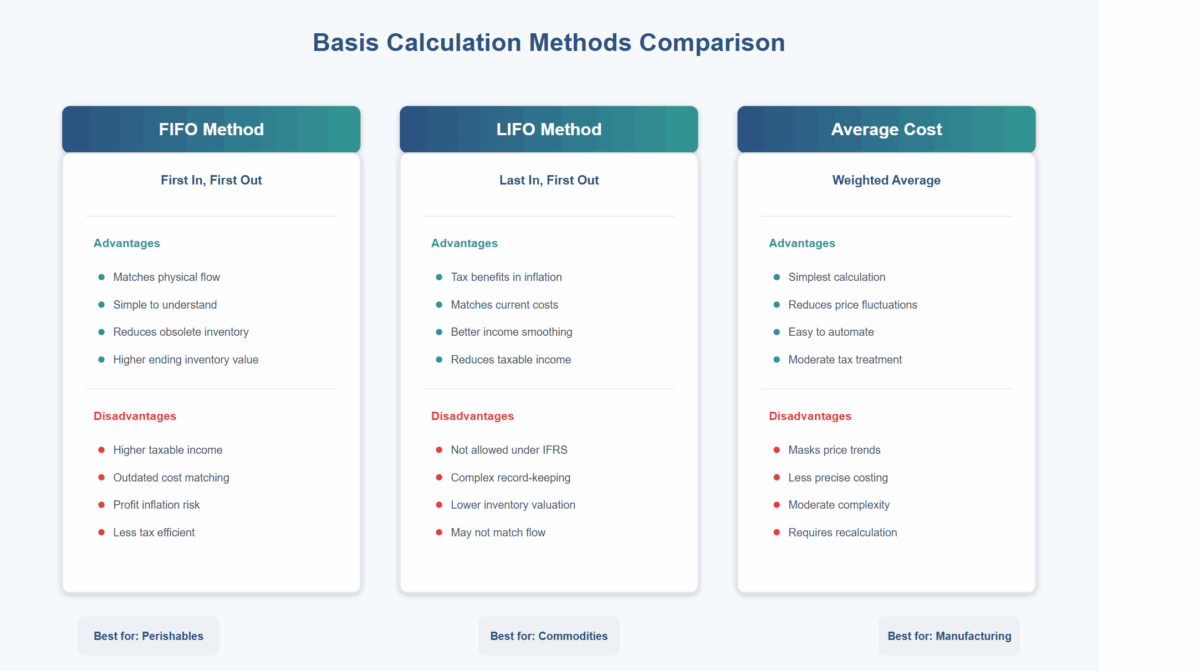

Cost basis is crucial in determining the taxable gain or loss on digital asset transactions. Different calculation methods can be applied, each with its implications:

- First-In, First-Out (FIFO): Assumes that the first assets purchased are the first sold. This method is straightforward and commonly used.Example: If you bought 1 Bitcoin at $30,000 and another at $40,000, and then sold 1 Bitcoin for $50,000, FIFO would calculate the gain based on the $30,000 cost, resulting in a $20,000 gain.

- Last-In, First-Out (LIFO): Assumes the last assets purchased are the first sold. This can be beneficial in a declining market.Example: Using the previous scenario, LIFO uses the $40,000 cost basis, resulting in a $10,000 gain.

- Specific Identification: Allows for selecting which assets are sold, offering flexibility and potential tax optimization.Example: If you choose the $40,000 purchase as the basis for the sale, you control the taxable gain.

Basis calculation methods

Each method has different tax implications, and consulting with a tax professional can help determine the most advantageous approach for your business.

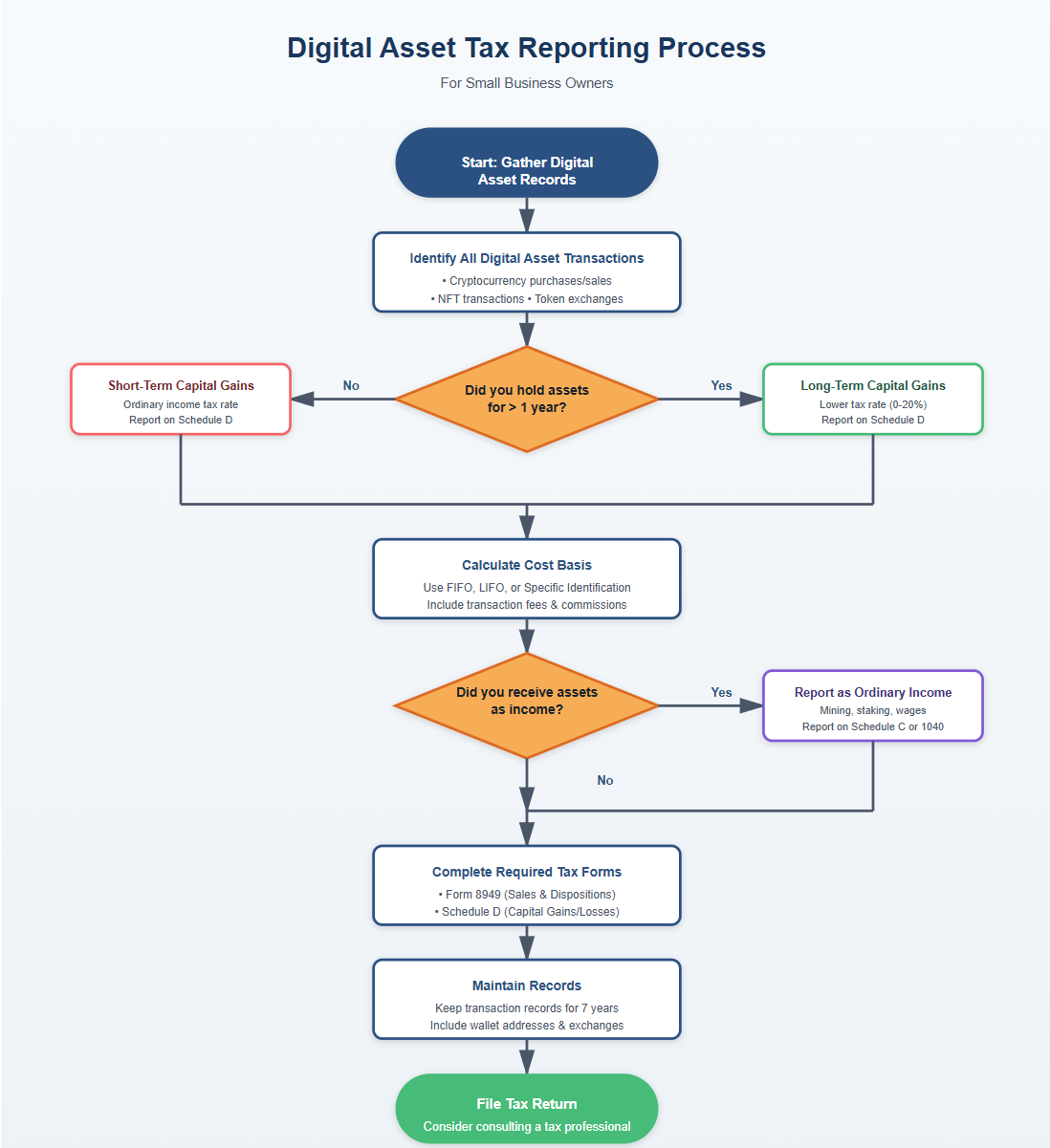

Income Events from Digital Assets

Digital assets can generate various income events, each with distinct tax implications:

- Trading: Profits from buying and selling digital assets are taxable as capital gains.

- Mining/Staking: Income from mining or staking is treated as ordinary income at the fair market value of the assets received.

- Airdrops/Forks: These events can create taxable income at the time of receipt, based on the asset’s market value.

Understanding these events helps in categorizing transactions correctly and ensuring accurate tax reporting.

The process of digital asset tax reporting

Special Considerations for DeFi Transactions

Decentralized Finance (DeFi) introduces unique complexities to tax reporting. Transactions such as lending, borrowing, and yield farming can create taxable events that are not immediately obvious.

- Lending/Borrowing: Interest earned may be considered taxable income.

- Liquidity Pools: Adding or removing liquidity can trigger capital gains or losses.

- Smart Contracts: Interaction with smart contracts can create taxable events, requiring careful analysis and reporting.

Given the complexity of DeFi, small business owners should consider consulting specialists familiar with blockchain technology and DeFi transactions.

Reconciliation of Transactions

Reconciliation of digital asset transactions is essential for ensuring that records across multiple platforms align. Here’s how to approach it:

- Gather Data: Collect transaction data from all exchanges, wallets, and platforms used.

- Use Reconciliation Tools: Employ tools that can aggregate and cross-reference data from various sources.

- Identify Discrepancies: Look for and resolve any discrepancies between records and actual transactions.

- Regular Audits: Conduct regular audits to maintain the integrity of your records and ensure ongoing compliance.

Proper reconciliation ensures that your tax filings are accurate and reduces the risk of audits and penalties.

Digital asset transaction lifecycle

Conclusion

Digital asset tax reporting for small business owners is a nuanced endeavor requiring diligence and proactive management. As we approach 2025, being prepared for changes such as the introduction of Form 1099-DA and understanding the intricacies of digital asset transactions is vital.

By maintaining accurate records, utilizing effective tools, and applying appropriate cost basis methods, small business owners can navigate the complexities of digital asset tax reporting with confidence. Staying informed about IRS guidelines and seeking professional guidance when needed will further bolster compliance and optimize tax outcomes.

For more detailed information on IRS guidelines and digital asset tax obligations, small business owners can visit the IRS website which provides comprehensive resources and updates on tax regulations related to digital assets.

As the landscape of digital assets continues to evolve, staying informed and prepared will empower small business owners to leverage the potential of digital assets while maintaining tax compliance.