As a small business owner using QuickBooks Online Plus or QuickBooks Online Advanced, ensuring that your products and services are set up correctly is crucial for accurate financial reporting and tax compliance. Incorrect setup can lead to costly errors, affecting your financial statements and decision-making processes. In this helpful guide, we’ll walk you through the steps to set up products and services in QuickBooks Online the right way, helping you avoid common setup mistakes.

Understanding Item Types

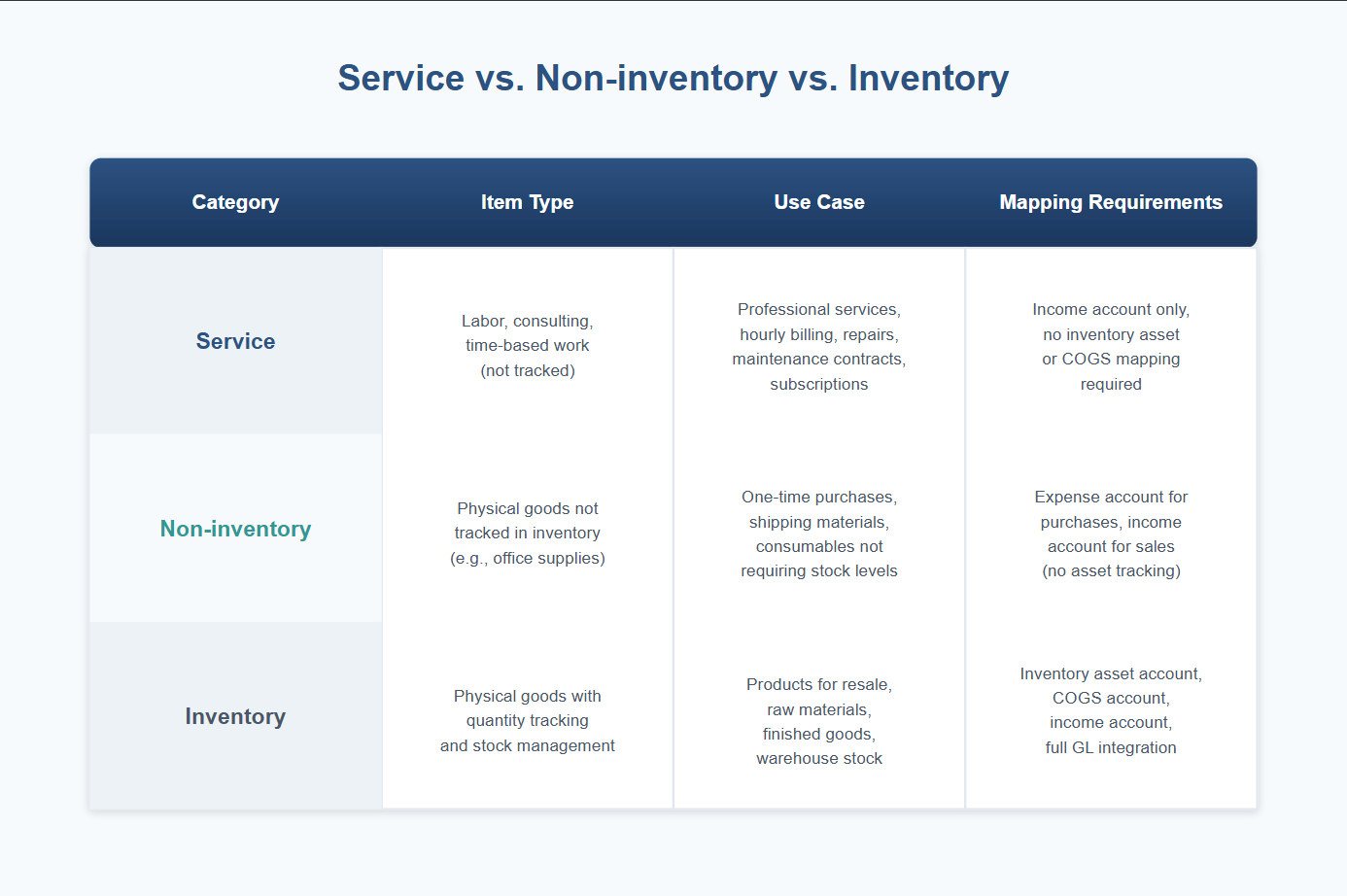

Your first step in setting up products and services in QuickBooks Online is to understand the different item types available and when to use each. QuickBooks Online offers three primary item types: Service, Non-inventory, and Inventory.

Service Items

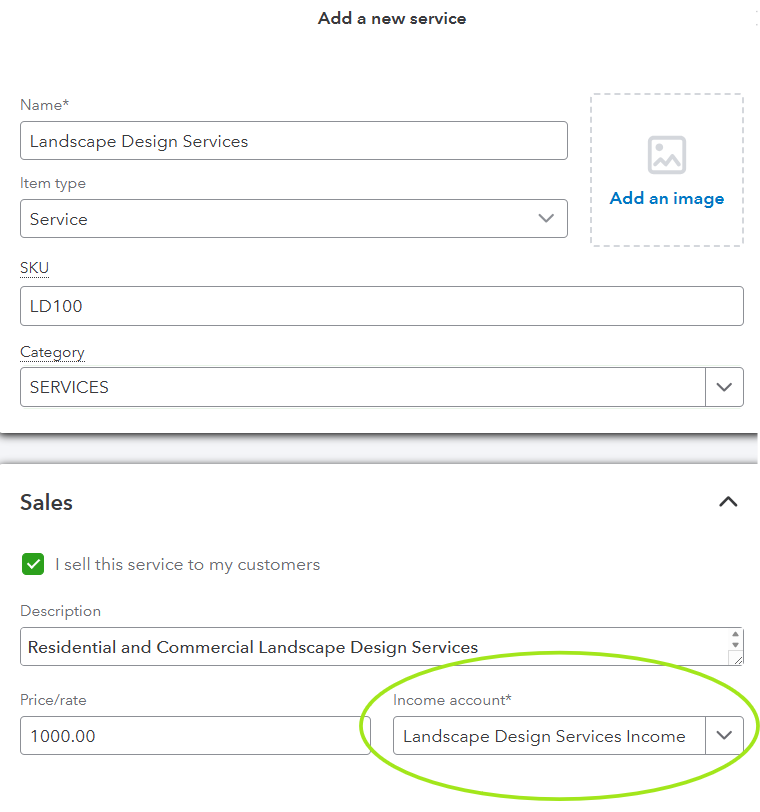

Service items are used for services you provide, such as consulting, repairs, or any labor-based offerings. When setting up a service item, you map it to an income account that reflects revenue generated from the services you provide.

Non-inventory Items

Non-inventory items are products you sell but don’t track quantities for. These are general supplies such as hardware (nails and screws that a contractor may use for a construction project). Non-inventory items are mapped to income accounts for use on sales forms such as invoices and can also be linked to expense accounts if you want to track the cost of these items.

Inventory Items

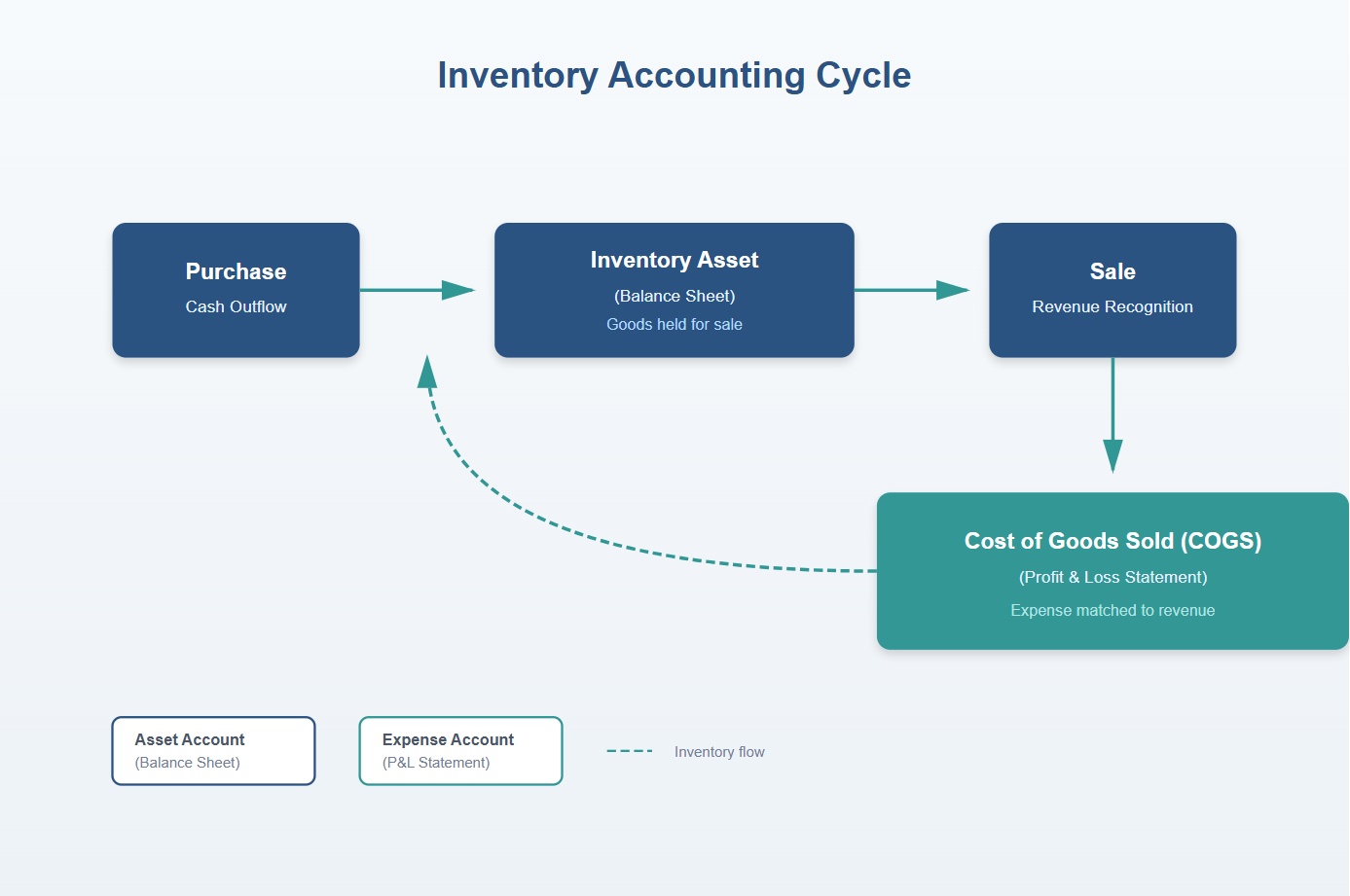

Inventory items are products you purchase and sell and want to track quantities for. This is crucial for businesses that manage stock levels. Inventory items are mapped to both income accounts (for sales) and Cost of Goods Sold (COGS) accounts (for costs associated with purchasing inventory). Proper inventory setup ensures accurate tracking of stock and cost of sales.

Mapping to Correct Accounts

One of the most critical aspects of setting up products and services is mapping them to the correct accounts. Proper mapping is essential for accurate financial records, impacting your profit and loss and balance sheet reports.

Income Accounts

When setting up a product or service, you must ensure it is mapped to the appropriate income account. This ensures that sales revenue is recorded correctly, reflecting your business’s financial performance accurately.

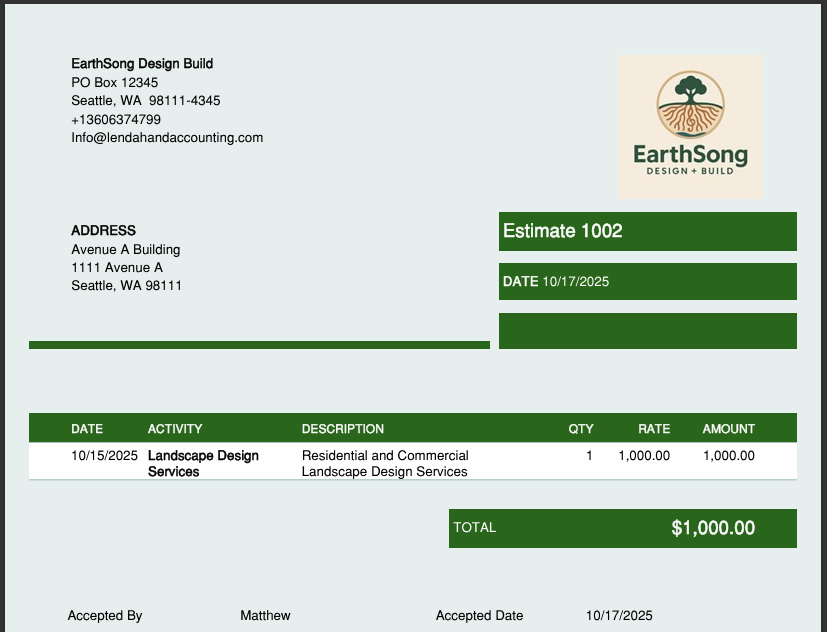

QuickBooks Online products and services setup screen

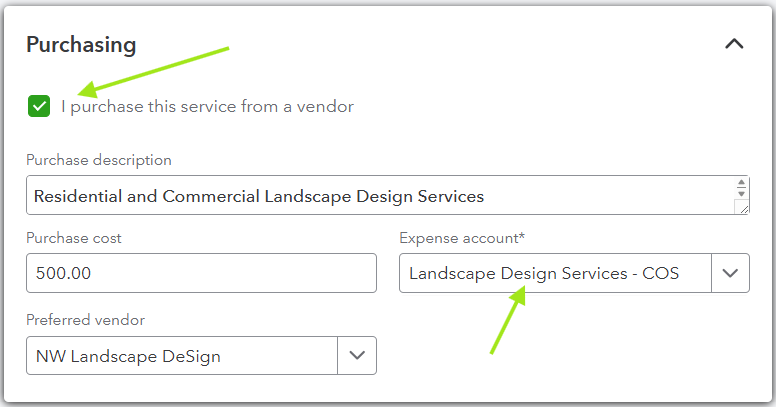

COGS Accounts

For inventory items, it’s crucial for you to map them to a COGS account. This allows QuickBooks Online to record the cost associated with selling inventory, providing insights into your gross profit margins and overall profitability.

Mapping COGS Account to Purchased Items in QuickBooks Online

Expense Accounts

For non-inventory items, you must link them to an expense account if you want to track the cost of these items. This setup helps in monitoring expenses related to specific products, aiding in more detailed financial performance metrics.

Inventory Tracking and Its Impact

Inventory management is a critical aspect of accounting for businesses that sell physical products. Proper inventory setup in QuickBooks Online ensures that you have accurate stock levels, preventing overstocking or stock shortages. You goal is to accurately record your cost of goods sold and inventory assets, not yet sold.

Benefits of Inventory Tracking

- Accurate Stock Levels: Avoid overstocking or stockouts by maintaining real-time inventory data.

- Financial Accuracy: Proper inventory tracking ensures that your financial statements reflect true business performance.

- Cost Management: Helps in identifying cost-saving opportunities and improving profit margins.

Common Setup Errors and Fixes

Even with the best intentions, mistakes can happen during setup. Here are some common errors and how to fix them:

Incorrect Account Mapping

Error: Mapping a service item to a COGS account instead of an income account. Fix: Review the account mappings for all products and services. Ensure service items are linked to income accounts and inventory items to both income and COGS accounts. You want to avoid overstating expenses or understating income and tax liability by incorrect account mapping.

Wrong Item Type Selection

Error: Setting up an inventory item as a non-inventory item. Fix: Determine the nature of the product and select the correct item type. Use inventory items for products you track quantities for.

Missing Tax Codes

Error: Not assigning tax codes to taxable products. Fix: Review your product list and ensure that all taxable items have the appropriate tax codes assigned. This is crucial for tax compliance and accurate sales tax reporting.

Testing Your Setup

Before you start creating estimates or invoices, it’s wise to test your setup to ensure everything is working correctly.

Steps for Testing

- Create Sample Transactions: Generate sample invoices and sales receipts to check if everything is recorded correctly.

- Review Financial Reports: Run your Profit and Loss and Balance Sheet report to verify that sales and expenses are accurately recorded.

- Check Inventory Levels: Ensure that inventory levels adjust correctly after transactions.

Testing your setup helps in identifying any discrepancies early on, allowing for corrections before they affect your financial statements. Creating a non-posting transaction such as an Estimate works well for this purpose.

Conclusion

Setting up products and services in QuickBooks Online correctly is essential for maintaining accurate financial records and avoiding costly errors. By understanding the different item types, mapping to the correct accounts, and testing your setup, you can ensure accurate financial reporting and tax compliance. With these strategies in place, you’ll be well-equipped to manage your business’s financials effectively.

For personalized guidance and support, consider consulting with a QuickBooks Online Advanced Certified ProAdvisor. They can offer insights tailored to your specific business needs, helping you optimize your QuickBooks Online setup for success.

By following this comprehensive guide, you’re taking a significant step towards mastering QuickBooks Online products and services setup, ensuring your business’s financial health and operational efficiency.

Free Downloaded Resources

Product and Service Mapping Accuracy Checklist

QuickBooks Resources

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.