Because your small business bank account charges are “bank fed”, anomalies stand out. We can remember the first time an “anomaly” stood out in the QuickBooks Online bank feed of a business checking account like it was yesterday. A busy client had written a check out to a local car dealership for a friend to hold a car they were interested in purchasing. The client was specifically told that the check would not be deposited. She relied upon that promise. But this check was indeed cashed!

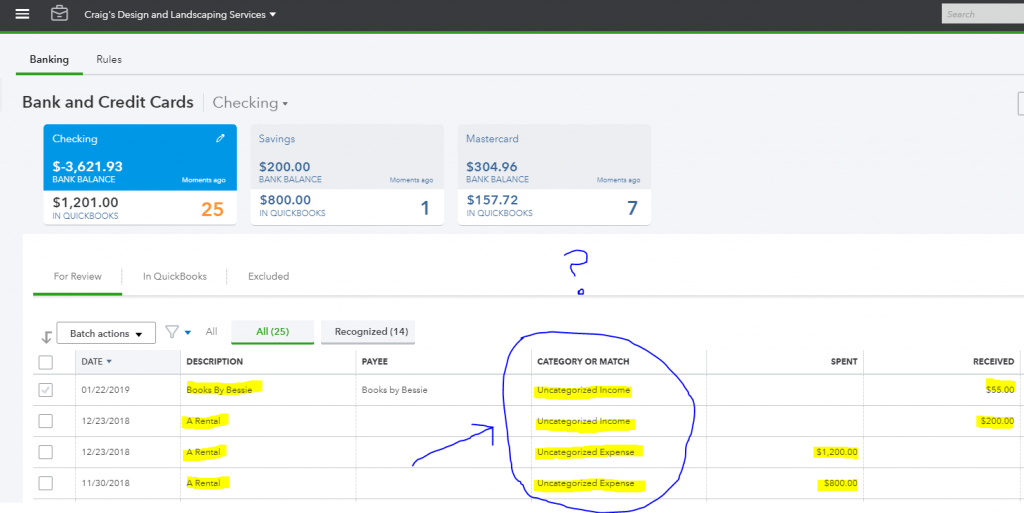

When the check came through the QuickBooks Online bank feed it was recognized as an “uncategorized expense”. This transaction stood out in the client’s bank feed because their usual expenses were for pet supplies, they purchased and sold to their customers. And while it was entirely possible that our client had purchased a company vehicle to use, it seemed unlikely considering the nature of the business operations. When we notified the client of the unknown expense, the client was grateful for the notification and was able to quickly recover her funds from the dealership. The daily bank feed categorization process in QuickBooks Online can help small business owners avoid fraudulent bank and credit card charges quickly and easily.

The QuickBooks Online credit card feed provides high visibility of personal credit card charges

Many small business owners have company credit cards they assign to their employees. Individual credit card account numbers are issued by the bank for each cardholder. These individual accounts are then connected to QuickBooks Online bank feeds. The main company credit card account is setup on the Balance Sheet as a “Master” account with the individual cardholder accounts setup as “Sub-accounts” to this account. At least this is one way to manage corporate credit card account connections.

Credit card charges rapidly come through the bank feed, which significantly increases the visibility of “personal credit card charges”. Unknown credit card charges can be placed into “uncategorized expenses” until they are resolved.

Small business owners need to know that credit card charges are not accrued in QuickBooks Online

With a cash accounting method, expenses are posted to your Profit and Loss report when they are paid. The only exception is with credit card charges. Even if you have not paid the balance of your business credit card account, the credit card account charges will post to your Profit and Loss report as soon as they are added to your credit card account register. Think of your credit card as a “Micro-Loan” that you got for your business to pay for your business expenses. Technically you are paying for these businesses expenses as soon as you charge them to your credit card account.

Credit card liability remains on the Balance Sheet while the expense on the credit card is immediately recorded on the Profit and Loss report. This is commonly referred to by the IRS as cash basis taxpayer credit card charges. The expense is recorded when the charge is incurred, and you don’t have to wait until you have paid off your credit card balance for these charges to be included in your current business expenses.

Monthly reconciliation of your connected QuickBooks Online accounts reduces fraudulent charges

Reconciling QuickBooks Online connected bank and credit card accounts provides small business owners and their accountants clear visibility to their bank and credit card account activity. It is easy to recognize duplicate, unexpected, and/or unauthorized charges during the reconciliation process. It’s critical to keep business credit card bank feeds connected at all times.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.