Negative on-hand inventory in QuickBooks Online can disrupt your financial statements and lead to costly errors. As a QuickBooks Online Advanced ProAdvisor, I’m here to help you navigate this challenge with ease. By correcting negative inventory, you ensure accurate financial reporting and maintain healthy business operations. In this guide, you’ll learn how to fix negative on-hand inventory in QuickBooks Online and implement best practices for ongoing inventory management.

Understanding Negative On-Hand Inventory

Negative inventory occurs when you sell more of a product than you have in stock. This can happen due to data entry errors, timing issues, or inaccurate inventory counts. For instance, if you sell ten widgets but only have eight in stock, you create a negative inventory of two widgets.

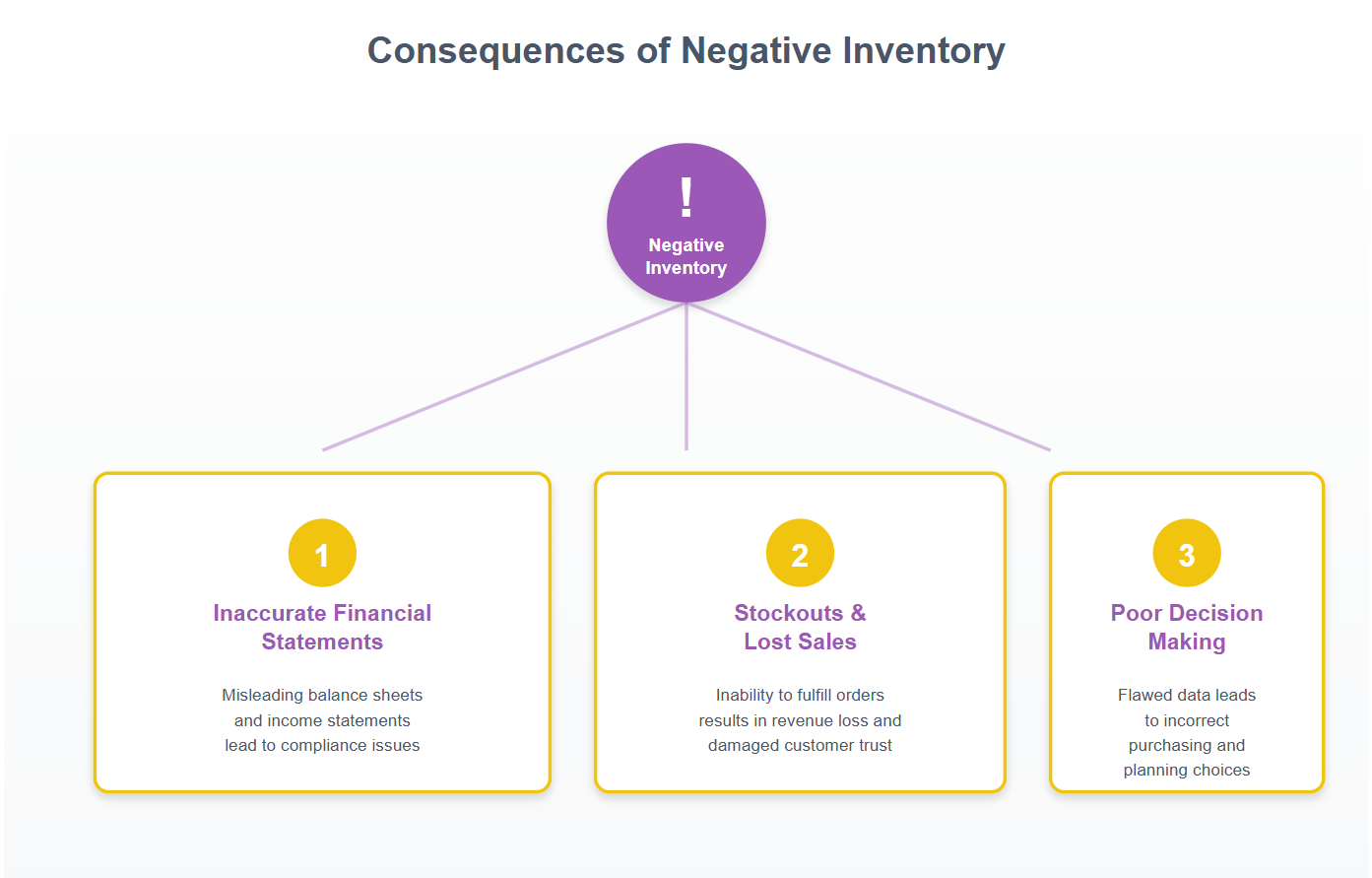

Moreover, negative inventory can skew your financial reports. It affects cost of goods sold (COGS), gross profit, and overall financial health. Therefore, understanding and correcting these discrepancies is crucial for your business’s success.

Why Negative Inventory Happens

Several factors can lead to negative inventory. Common reasons include shipping errors, incorrect item setups, or failing to record inventory receipts promptly. Each of these can cause your inventory levels to fall into the negative.

To prevent such scenarios, analyze your inventory processes. Ensure that your staff is trained in accurate data entry and that your systems are updated regularly. By keeping a close eye on these elements, you can minimize negative inventory occurrences.

How Negative Inventory Affects Financials

Negative inventory impacts your financials in multiple ways. Firstly, it inflates your COGS, which can lead to inaccurate profit calculations. This, in turn, affects your business decisions and tax filings.

Additionally, negative inventory can mislead stakeholders. Investors and lenders rely on accurate financial data to assess your company’s value and performance. Negative figures can compromise their confidence in your business.

Examples of how Negative Inventory Impacts your Business

Steps to Correct Negative Inventory in QuickBooks Online

Correcting negative inventory requires a systematic approach. Follow these steps to ensure accurate inventory records in QuickBooks Online.

Step 1: Identify Negative Inventory Items

Start by generating a report to identify negative inventory items. Navigate to the Inventory Valuation Summary report in QuickBooks Online. Look for items with negative quantities.

Step 2: Adjust Inventory Levels

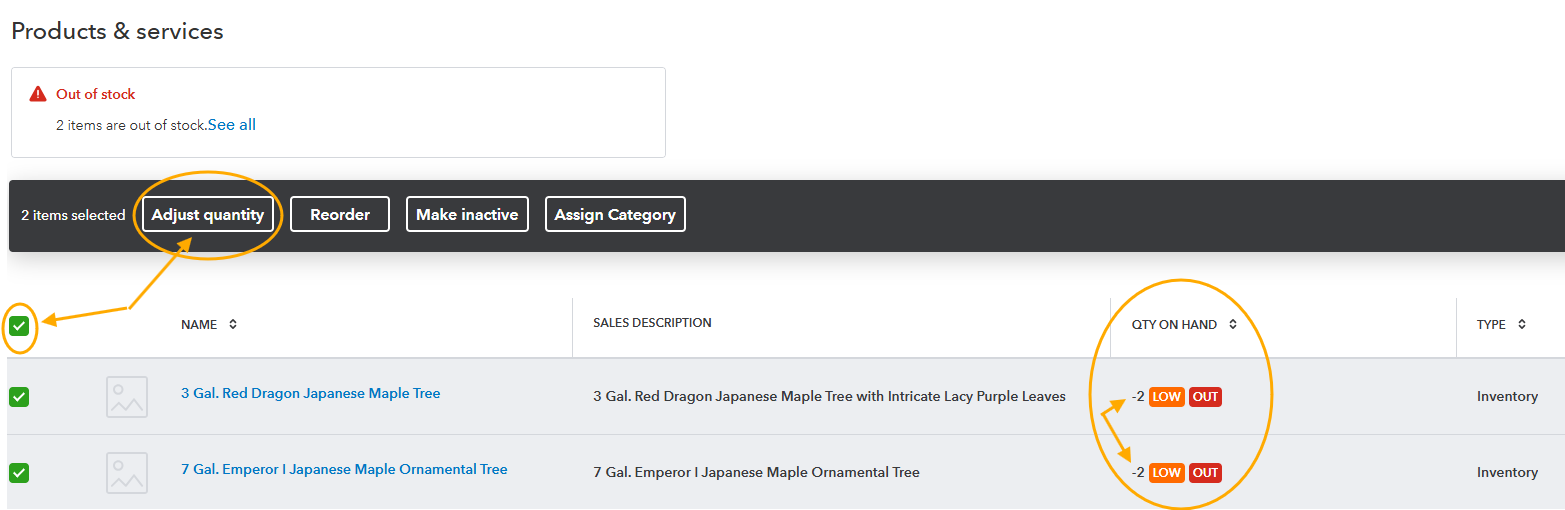

Once you’ve identified the items, adjust the inventory levels. Go to the Products and Services list, select the item, and adjust the quantity on hand. Ensure you have the correct purchase and sales data to support these adjustments.

Step 3: Review Transactions

Investigate the transactions that led to negative inventory. Check for errors in sales, purchase orders, and receipts. Correct any discrepancies found, ensuring that all entries align with physical inventory counts.

Step 4: Reconcile Inventory

Finally, reconcile your inventory records with physical counts. This step confirms that your QuickBooks Online data matches your actual stock levels. Regular reconciliation prevents future negative inventory issues.

You can read more about this subject on the QuickBooks Help Support page here: How to Adjust Inventory Quantity on Hand in QuickBooks Online.

Best Practices for Inventory Management

Accurate inventory management is key to preventing negative inventory. Implement these best practices to maintain precise records and streamline operations.

Conduct Regular Audits

Perform regular inventory audits to catch discrepancies early. Schedule periodic counts and compare them with your QuickBooks Online records. This proactive approach helps you identify and correct errors promptly.

Train Your Team

Ensure your team understands the importance of accurate inventory data. Provide training on data entry, inventory processes, and QuickBooks Online functionalities. A well-informed team reduces the risk of errors.

How to Correct Negative Inventory with Batch Inventory Quantity Adjustments

Unlike single-item adjustments, batch inventory adjustments let you correct multiple items at once—ideal when several items share negative quantities or need corrections from a physical count.

Step 1: Open the Products and Services List

Navigate to:

Sales → Products and Services

This list provides visibility into:

-

Quantity on hand

-

Starting value

-

Inventory valuation

-

Negative quantities requiring correction

Sort by Quantity on Hand to bring negative items to the top.

Example of selecting multiple inventory items with negative inventory on-hand to adjust

Step 2: Select Batch Actions → Adjust Quantity

At the top of the list:

-

Check the box next to each inventory item you want to adjust (for your example: both tree items).

-

Choose Batch actions → Adjust quantity.

This opens the Batch inventory quantity adjustment window, which allows you to adjust up to 300 items at once.

ProAdvisor Tip:

If the batch adjustment form does not automatically populate the items you selected, clear your browser’s cookies and cache before reopening the form. QuickBooks Online relies heavily on local storage to load inventory item data, and when that cached data becomes stale or overloaded, the batch adjustment window may appear blank or fail to load multiple items. Clearing cookies and cache forces QBO to reload a fresh list of items into the adjustment.

Important Note on Adjustment Dates:

If an inventory item has a Starting Value / Starting Date that is later than the date you are using for the batch adjustment, QuickBooks will not allow the adjustment to process. You must first edit the item and update its Starting Date to be on or before the adjustment date. Once the starting date is corrected, return to the batch adjustment window and re-enter the quantity adjustment.

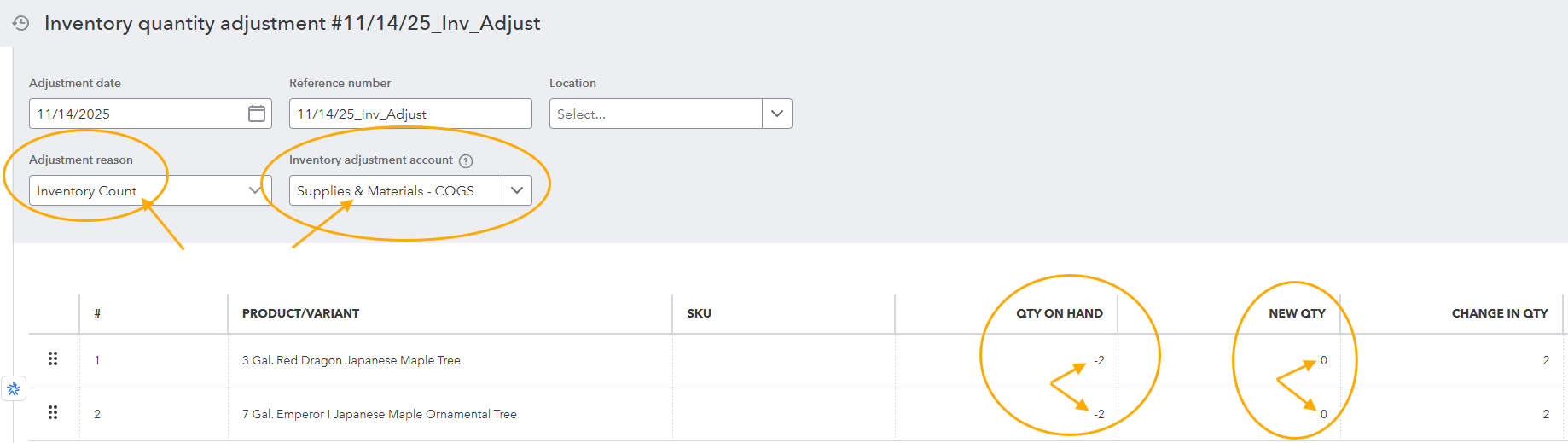

Step 3: Complete the Batch Adjustment Form

In the batch adjustment window:

-

Adjustment Type: Quantity

-

Inventory Adjustment Account: Sometimes, “Inventory Shrinkage,” but in this example, because the trees were sold but never entered into inventory, we used the account already mapped—Supplies & Materials – COGS—to accurately reverse the prematurely recognized cost and restore the correct Inventory Asset value.

-

New Quantity: Enter the correct actual quantity on hand

-

For your example, both tree items were adjusted from –2 to 0.

-

-

Add a memo explaining:

-

“Adjusted negative inventory to zero for items sold without prior inventory entry.”

-

Example of Batch Inventory Quantity Adjustment Form

The right-hand preview pane will show:

-

quantity changes

-

updated values

-

financial impact before saving

Step 4: Save the Batch Adjustment

Once saved, QuickBooks automatically:

-

increases the Inventory Asset account

-

decreases Supplies & Materials – COGS

-

clears the negative quantities

-

records each line as an individual quantity adjustment

Reviewing the Financial Impact

After the adjustment:

-

Run the Inventory Valuation Summary to confirm the items are no longer negative.

-

Run a Profit and Loss report filtered for the day of the adjustment to verify the COGS correction.

-

Review the Balance Sheet to ensure the Inventory Asset value increased appropriately.

Your batch adjustment restored:

-

correct on-hand quantities for both trees

-

accurate Inventory Asset value

-

appropriate COGS based on the posted adjustment

Example of Transaction Report from Inventory Quantity Adjustments

Best Practices to Prevent Negative Inventory

1. Enter Purchases Before Creating Sales

Always enter vendor bills or item receipts before invoicing.

2. Perform Monthly Product Count Reviews

Negative activity is easier to clean up when caught early.

3. Use Accurate Inventory Adjustment Accounts

Ensure each inventory shrinkage or correction is mapped correctly.

4. Train Staff on Proper Inventory Workflows

Most negative inventory stems from timing and data entry errors.

Common Inventory Errors and How to Address Them

Mistake: Creating sales before recording inventory receipts

Solution: Enforce a 2-step workflow

-

Enter purchase

-

Enter sale

Mistake: Ignoring negative quantities for long periods

Solution: Include negative quantity review in month-end procedures.

Mistake: Using the wrong account when adjusting inventory

Solution:

-

For missing items: Inventory Shrinkage

-

For items sold but never added to inventory: COGS correction account

Common Inventory Errors and Solutions

Despite best efforts, errors can occur. Here are common inventory mistakes and how to address them.

Mistake: Overlooking Returns

Returns can cause negative inventory if not recorded correctly. Ensure all returns are processed promptly and accurately in QuickBooks Online.

Solution: Streamline Return Processes

Establish a clear return process. Train your team to record returns immediately and verify the correct adjustment of inventory levels.

Mistake: Inaccurate Purchase Orders

Errors in purchase orders can lead to inventory discrepancies. Double-check all orders for accuracy before submitting them.

Solution: Implement a Review System

Introduce a system for reviewing purchase orders. Have a second team member verify orders to catch errors before they affect inventory.

Conclusion

Correcting negative on-hand inventory directly from the Products and Services list—with the QuickBooks Online batch inventory quantity adjustment tool—is the most efficient and accurate method for clearing negative quantities and restoring correct COGS and Inventory Asset values.

By identifying negative items early, adjusting quantities through batch actions, and selecting the proper adjustment accounts, you create clean, audit-ready financials that accurately reflect real activity. Your recent corrections to the two tree items illustrate how quickly financials can be restored once the proper workflow is applied.

Adopting disciplined month-end inventory reviews, consistent entry workflows, and proper account selection will prevent negative inventory and keep your books accurate all year long. Take action today: review your inventory processes and make necessary adjustments.

Top Four Benefits of Accurate Inventory Management

Free Downloadable Assets

Best Practices for Inventory Management in QuickBooks Online

Interactive Slide Show

Take Our Interactive Quiz

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.