Switching from QuickBooks Desktop to QuickBooks Online can revolutionize how you manage your business finances. You’ll gain access to real-time data, multi-user access, and seamless integration with other apps. Moreover, it offers flexibility to manage finances from anywhere, anytime. This transition can enhance your efficiency and streamline your business operations.

QuickBooks Conversion Success Kit

Benefits of Transitioning to QuickBooks Online

Switching to QuickBooks Online provides several advantages. First, you can access your financial data from any device with internet connectivity. This flexibility means you can manage your finances on the go, enhancing your productivity.

Furthermore, QuickBooks Online allows multiple users to access data simultaneously. This feature is invaluable if your team needs to collaborate on financial tasks. Additionally, the automatic backup and updates mean your data is secure and your software is always up to date.

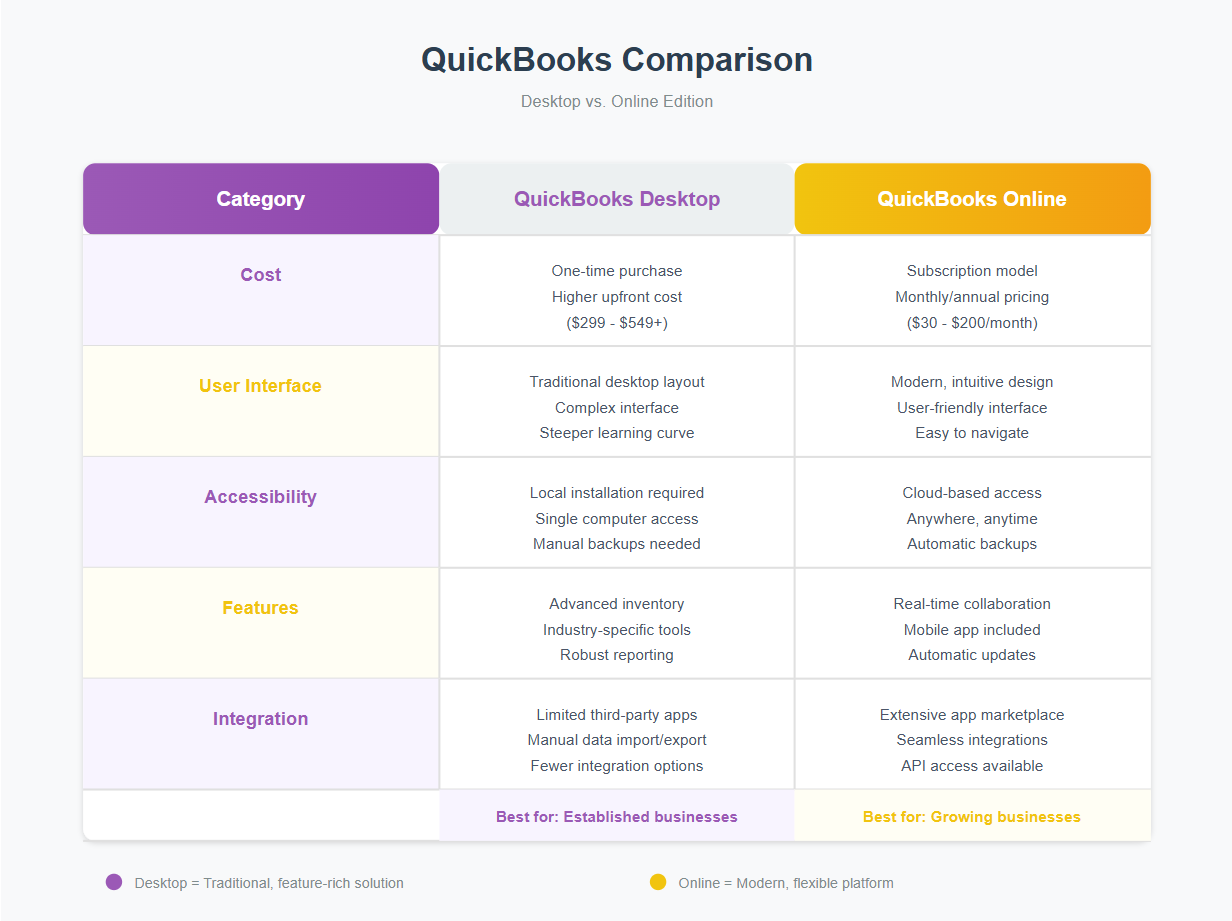

Comparison Chart of QuickBooks Online Vs QuickBooks Desktop

Practical Example

Imagine you’re traveling for a business meeting. With QuickBooks Online, you can check your financial reports, send invoices, and even manage payroll from your laptop or tablet. This level of accessibility can transform how you operate your business daily.

Step-by-Step Guide to a Seamless Conversion Process

Transitioning from QuickBooks Desktop to Online might seem daunting, but with a structured approach, it becomes manageable. Here’s how you can do it effectively.

Step 1: Evaluate Your Current Setup

Before you begin, assess your current data. Ensure your QuickBooks Desktop files are updated and free of errors. This step is crucial as it sets the foundation for a smooth transition.

Step 2: Prepare Your Data for Export

Next, you need to prepare your data for export. Make a backup of your QuickBooks Desktop files. This action ensures you have a contingency plan if anything goes awry during the conversion.

Step 3: Start the Conversion Process

Log into QuickBooks Online and select the option to import your data. Follow the prompts to connect your Desktop account. This process typically involves exporting your company file and importing it into QuickBooks Online.

Step 4: Verify and Customize

Once the import is complete, review your data. Verify that all transactions and accounts have transferred correctly. QuickBooks Online offers customization options, so take this opportunity to tailor the interface to suit your needs.

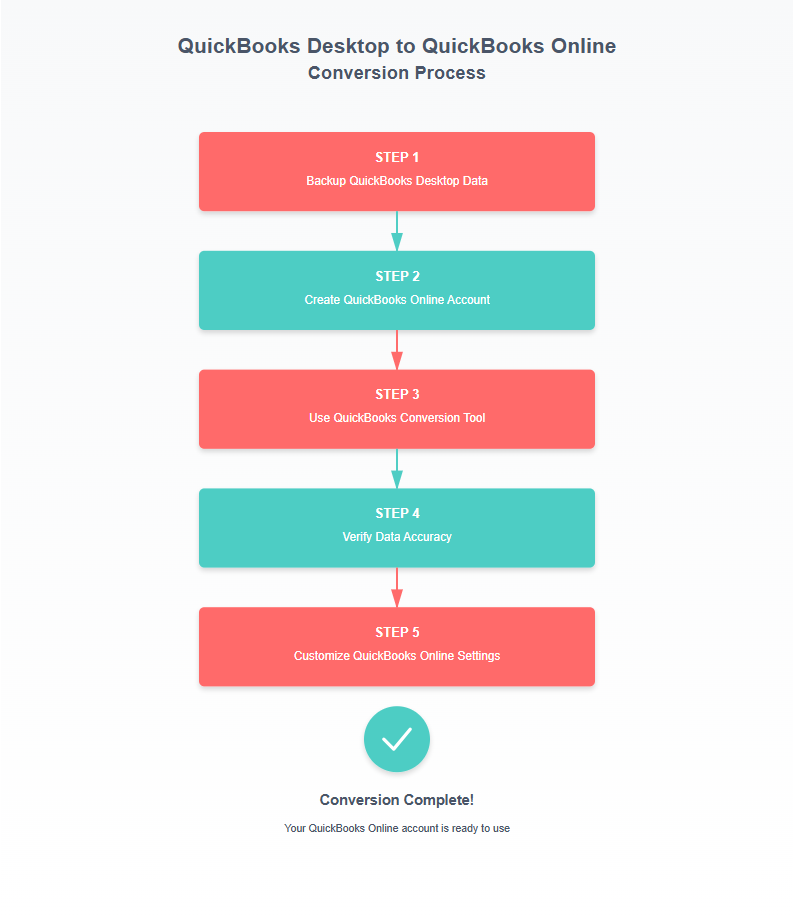

Flowchart of the Conversion Steps to Move from Desktop to Online

Importance of Separation: Business vs. Personal Finances

Keeping your business and personal finances separate is vital for maintaining financial clarity. Mixing these funds can lead to confusion and potential legal issues. Moreover, it complicates tax filing and financial reporting.

Risks of Combining Finances

Combining finances can result in inaccurate financial statements. This inaccuracy can hinder your ability to make informed business decisions. Additionally, it could flag issues during IRS audits, causing unnecessary headaches.

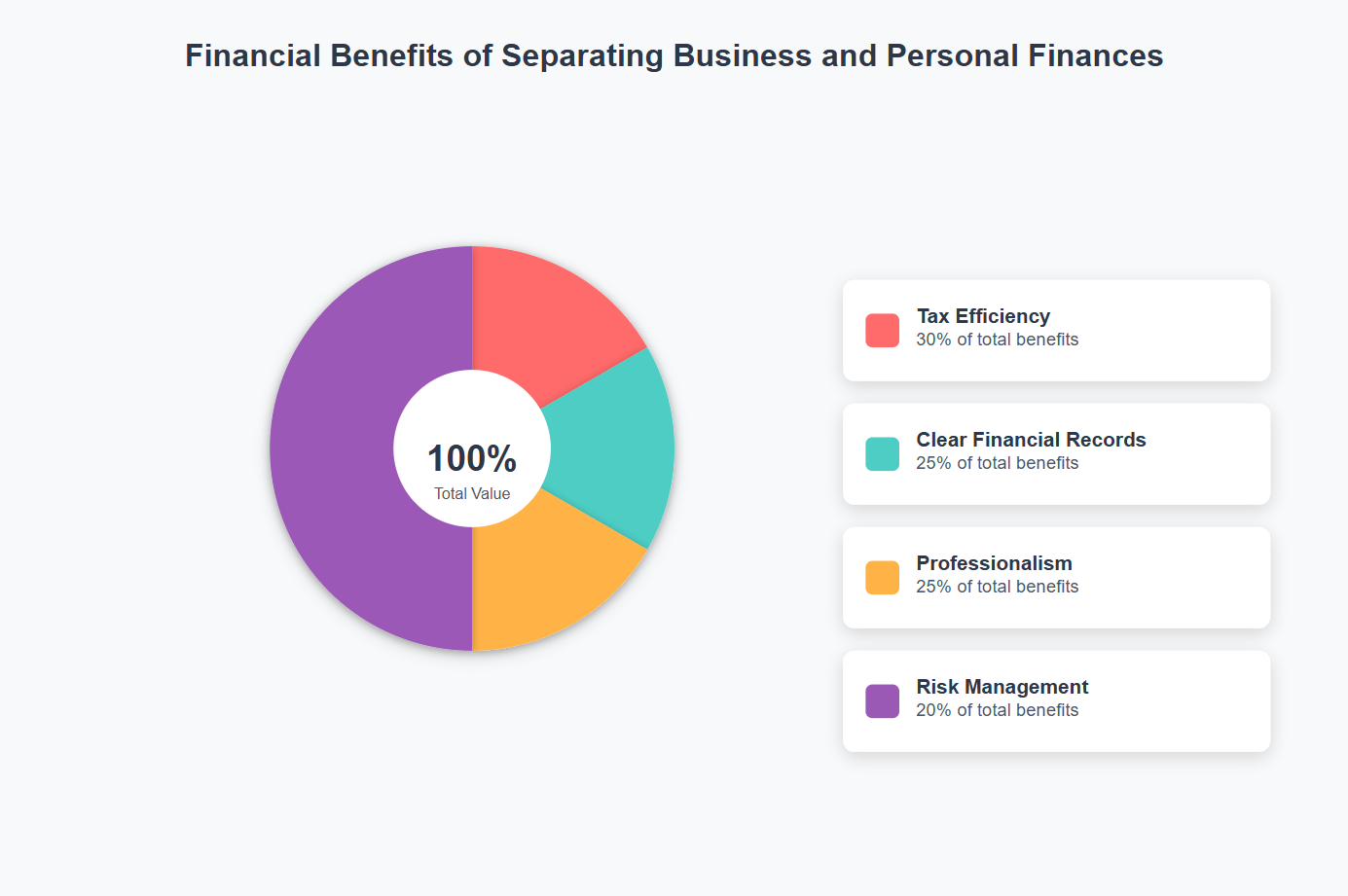

Percentages of Benefits of Separating Business from Personal Finances

Post-Conversion Tips: Maintaining Financial Clarity

After converting, maintaining financial clarity is crucial. First, regularly reconcile your accounts to ensure accuracy. This practice helps identify discrepancies early, allowing you to address them promptly.

Actionable Tip

Set a monthly schedule to review your financial reports. Doing so will keep you informed about your business’s financial health and help you make strategic decisions.

Common Mistakes and How to Avoid Them

During the conversion process, certain pitfalls can disrupt your transition. However, being aware of these mistakes ensures you can avoid them.

Mistake 1: Not Backing Up Data

Failing to back up your data before the conversion is a common oversight. Always create a backup to safeguard your financial information.

Mistake 2: Overlooking Software Compatibility

Ensure your QuickBooks Desktop version is compatible with the online version. Incompatibility can lead to data transfer issues.

External Links for Additional Guidance

For further guidance, consider reviewing the IRS guidelines on financial management. Additionally, the official QuickBooks conversion guide offers detailed instructions to aid your transition.

Explore Our Interactive Slideshow

Try Our Interactive Quiz

Conclusion

Transitioning from QuickBooks Desktop to Online can significantly benefit your small business. By following a structured conversion process, maintaining separate finances, and avoiding common pitfalls, you can enhance your financial management. Embrace the flexibility and efficiency QuickBooks Online offers, and watch your business thrive.

Free Downloadable Assets

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.