Beneficial Ownership Reporting for LLC’s

🚨🚨Please see official information including the actual court case on the BOI injunction below. 🚨🚨

As of now, the BOI report filing is currently voluntary. You are not currently required to file.

Also, the FINCEN website is now updated with this information. 👇🏽🚨🔦

Beneficial Ownership Information Reporting | FinCEN.gov

Bloomberg Law

Starting January 1, 2024, the Beneficial Ownership Information (BOI) reporting rule requires most LLCs and other entities to file ownership information with FinCEN. This new regulation applies differently based on when your business was formed:

- For entities formed before January 1, 2024, the BOI report is due by January 1, 2025.

- For entities formed on or after January 1, 2024, the BOI report is due within 30 calendar days of formation.

Submitting your BOI report is free of charge. Be cautious of scams or bad actors who may reach out asking for payment to file your report. Only use the official FinCEN portal to submit your BOI filing.

👉🏽 Submit your BOI report here: BOI Reporting Submission Portal

👉🏽 Learn more: BOI Fact Sheet

The BOI report requires information about your company and its beneficial owners, including their name, date of birth, address, and a unique identifying number from an official document like a passport or driver’s license. Filing the report online is quick and easy, with a user-friendly web portal to guide you through the process. If you have any questions or need assistance with the filing, don’t hesitate to reach out to LHA Tax for support!

Failure to file on time can result in significant penalties, so make sure you understand your reporting responsibilities. Stay compliant to avoid unnecessary fines and legal risks!

1099-NEC and 1099-MISC Reporting

The deadline to E-file your 2024 Annual 1099-NEC tax forms is 1/28/25. It is important that you 1) clear your uncategorized expenses and 2) collect W-9 forms from individuals and businesses that you paid more than $600 for services in 2024.

You must provide these W-9 forms, and select our one-time service for Vendor Setup, with 1099 filing for $200 by 12/20/24. These two steps must be completed in a timely manner if you would like us to prepare and E-file 2024 1099’s for your business.

What’s new for the 2024 tax year?

Starting January 1, 2024, the IRS requires electronic filing for businesses submitting 10 or more combined information returns, such as Forms 1099 and W-2, within a calendar year. This is a reduction from the previous threshold of 250 returns. If you are filing 10 or more combined 1099s and W-2s for the 2024 tax year, electronic submission is mandatory.

For the 2024 tax year, QuickBooks Online has updated its features to allow the submission of amended 1099-NEC or 1099-MISC forms electronically.

Users who have e-filed their 1099 forms through QuickBooks Online, QuickBooks Contractor Payments, or QuickBooks Payroll will be able to utilize this feature for corrections.

You must file corrections for 1099s and W-2s the same way you filed the original forms. For example, if you have e-filed your 1099s or W-2s, you must also e-file your corrected form. If you have filed by paper, your correction must be on paper.

You Can Do This

It’s easy and fast to file your own 1099-NEC forms in your QuickBooks Online account.

Before you start:

- Enter the W-9 information from your US 1099-Eligible contractors into your vendor profile in QuickBooks Online. It’s easy, learn more about tracking payments to 1099 contractors throughout the year.

- When you start the process, you’ll be required to select the accounts that will be included in 1099 reporting.

Confused? Here’s an example:

- You have an expense account where you track the payments made to independent contractors. Let’s call this account “Contractor’s Expense Account”.

- When you start the process of E-Filing 1099s in QuickBooks Online, you’ll select this account because this is where QuickBooks Online will look to find the expenses or Vendor Bills exceeding $600.

- QuickBooks will show a report containing the vendors who were selected for 1099 tracking.

1099 Tutorial Video

What qualifies as non-employee compensation?

Look at your expense accounts and identify these payment types as potentially qualifying as non-employee compensation:

- Fees

- Commissions

- Prizes

- Awards

- Other forms of compensation for services

You must typically report a payment as non-employee compensation if these conditions apply:

- You made the payment to an individual who is not your employee.

- The payment was for services for your business.

- You made the payment to an individual or business that are not Incorporated.

- Payments to the payee were at least $600 during the year.

If you need to record payments of more than $600 for rent, prizes, attorney fees, or medical and healthcare payments, you should fill out a Form 1099-MISC.

Where can I get 1099 forms?

If you’re filing 1099s electronically, use an online platform like QuickBooks Online to e-file easily and meet IRS deadlines. For paper filing, you must order official pre-printed forms, as they cannot be downloaded from the IRS website. These forms are available directly from the IRS, through QuickBooks, or at office supply stores. Before preparing 1099s, ensure you have collected W-9 forms from contractors. These forms contain crucial identifying information, including their tax ID number, which is required for accurate reporting. Proper preparation ensures compliance and avoids delays or penalties!

How do I file a 1099 form?

When using QuickBooks, the platform automatically selects the correct 1099 form for you. 1099 reports payments made to contractors in the previous calendar year and must be provided to the payee by January 31. If January 31 falls on a weekend, the deadline moves to the next business day. To avoid penalties, ensure you e-file Form 1099-NEC with the IRS by January 31, 2025. QuickBooks simplifies this process to help you meet all deadlines with ease!

For the 2024 tax year, the IRS requires that Form 1099-NEC be filed by January 31, 2025, regardless of whether you file electronically or on paper. This is also the deadline for providing recipients with their copies.

For Form 1099-MISC, the deadlines differ:

- Recipient copies: Must be provided by January 31, 2025.

- Paper filing with the IRS: Due by February 28, 2025.

- Electronic filing with the IRS: Due by March 31, 2025.

Here’s a Breakdown of 1099 Copies:

- Copy A: Submit to the IRS.

- Copy 1: Send to your state tax department (if required).

- Copy B and Copy 2: Provide to the payee for their federal and state tax filings.

- Copy C: Retain for your records.

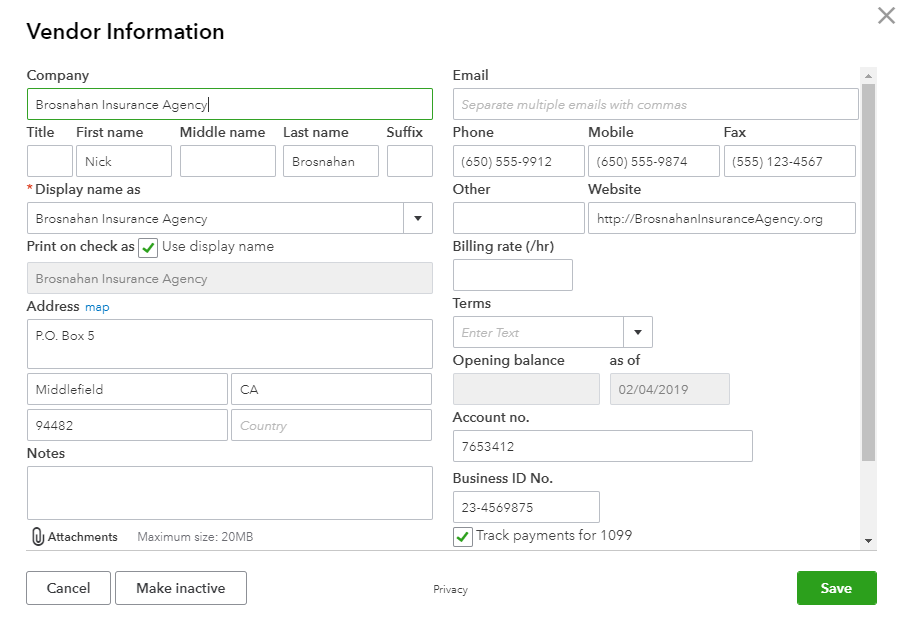

Create Vendor Profiles in QUICKBOOKS ONLINE Before You Can E-File their Annual 1099

It is important to add your existing Vendors and Contractors in QuickBooks Online. If the vendor is 1099 eligible, you will want to check the box to “Track payments for 1099” as seen in the screenshot below. You must have the following information:

- Legal Business Name

- Legal Business Address

- US Tax Identification Number

- Email Address

- Cell Phone Number

Invite Contractors to Add Their Own 1099 Information in QuickBooks Online

QuickBooks Online allows you to securely invite your contractors to input their own 1099 tax information. Before sending the invitation, ensure the contractor’s email address is up to date. To invite a contractor:

- Go to “Workers”, select “Contractors”, and click “Add a contractor”.

- Enter the contractor’s name and email address.

- Select “Invite them to fill out the rest” and click “Add contractor”.

Additionally, you can provide contractors with free online access to their 1099s during the e-filing process, simplifying document sharing and accessibility!

Understanding 1099 Requirements for Vendors Paid Through Third-Party Networks

Payments made via credit cards or third-party networks like PayPal are subject to different reporting rules under Section 6050W of the Internal Revenue Code. These transactions are reported on Form 1099-K by the payment settlement entity, not on Form 1099-MISC.

You are not required to issue a 1099-MISC for vendors paid through a credit card or third-party network. Instead, these payment methods fall under the responsibility of the payment processor to report. QuickBooks simplifies this process by automatically excluding such payments from 1099-MISC tracking and reporting, ensuring compliance with IRS regulations.

For more details, see IRS guidance on Forms 1099-MISC and 1099-K!

Consequences of Failing to File 1099s 🚨🚨🚨

Failing to file 1099 forms on time can lead to serious penalties:

- $60 to $310 per 1099 depending on how late you file.

- $630 per form or 10% of the reportable amount for intentional non-filing 🚨.

The IRS may also audit your business 🔦, increasing scrutiny on your records and potentially uncovering more fines. Protect your business by filing accurately and on time to avoid these penalties and maintain compliance! 🚨🔦

Helpful Resources:

https://www.irs.gov/businesses/understanding-your-1099-k

https://www.irs.gov/forms-pubs/about-form-1099-misc

https://www.irs.gov/payments/general-faqs-on-new-payment-card-reporting-requirements

https://www.irs.gov/pub/irs-utl/irdm_section_6050w_faqs_7_23_11.pdf

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.