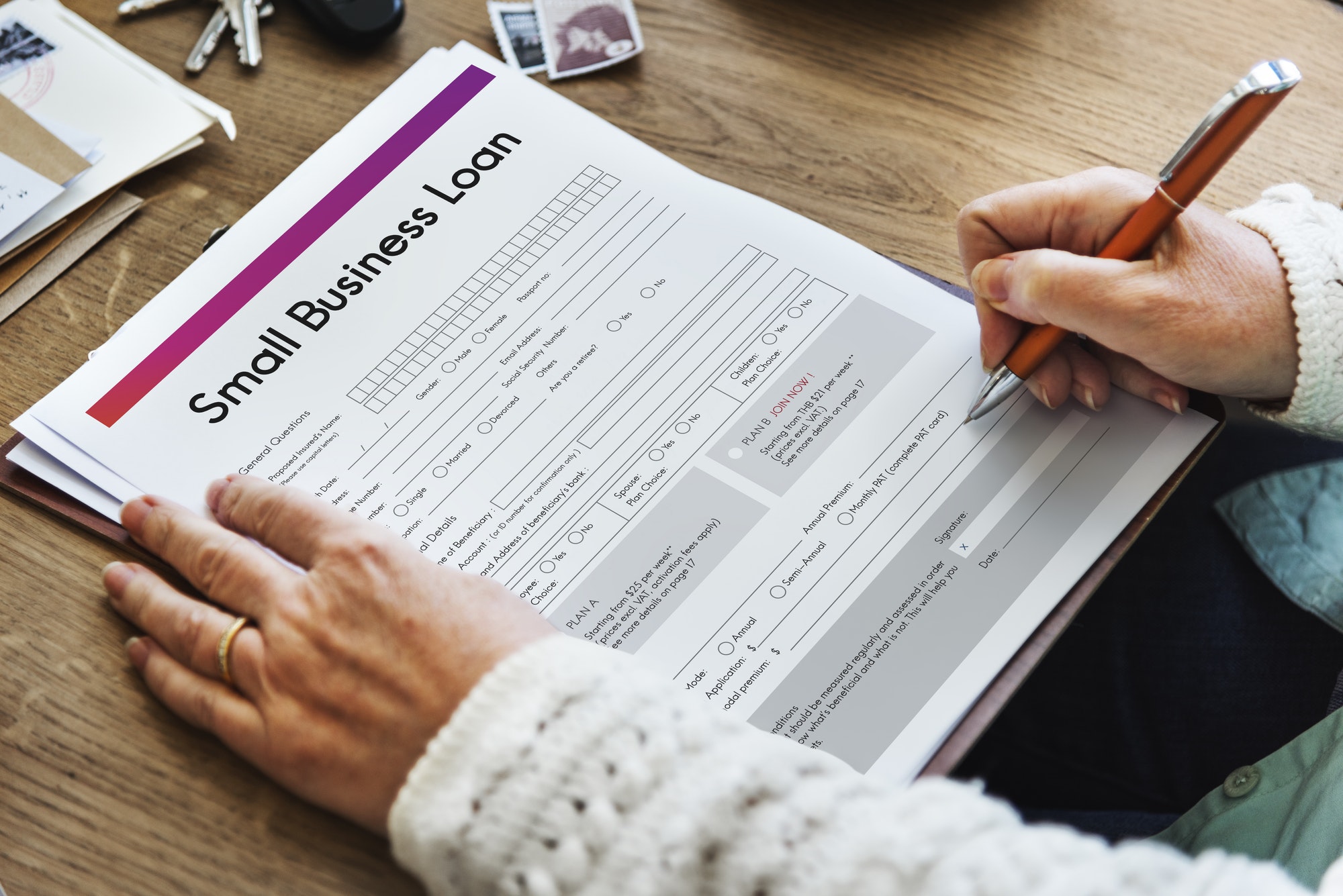

Small business owners need to understand when to “Split” transaction amounts in their QuickBooks Online bank feeds for money spent. Adding new “Liabilities” to your QuickBooks Online “Balance Sheet” involves the creation of two or more new accounts in your Chart of Accounts list. You will need a monthly loan statement to determine the Interest, Loan Fee and Principal Loan Amount due.

First, setup either a “Long Term Liability” (Loans over 12 months) or “Other Current Liability” (Loan under 12 months) account. Next, setup the “Loan Interest Expense” and/or “Loan Fee Expense” account.

Note that only the “Principal” payments should be posted to the “Liability” account. Each time a loan payment comes through your QuickBooks Online bank feed you will need to “split” the payment amounts between the “Liability” and the “Expense” accounts. The liability shows up on your Balance Sheet and the expense shows up on your Profit and Loss Report.

10 Liability Accounts that Will Not have an Interest Expense Entry

- Federal Income Tax Payable – Corporations or Limited Partnerships that track income tax liabilities on the “Accrual Basis”

- Insurance Payable – To track monthly recurring insurance expenses such as Workers Compensation

- Payroll Clearing – To track non-tax amounts that have been deducted from employee paychecks that are owed and forwarded to the appropriate vendor or creditor

- Payroll Tax Payable – To track payroll tax amounts owed to agencies as a result of paying wages and withholding taxes from employee paychecks

- Prepaid Expenses – To track items such as property taxes that are paid prior to the period in which you are paying them for

- Rents in trust–Liability – Amounts in these accounts are held on behalf of others. It is a type of contra account as you would have a Rents in trust-Asset account that offsets this account. The balances of the two accounts need to match

- Sales Tax Payable – This account is used to track sales tax collected from customers that has not yet been remitted to the State Agencies by your business

- State/Local Income Tax Payable – Corporations or Limited Partnerships that track state and local income tax liabilities on the “Accrual Basis”

- Trust Accounts-Liabilities – These accounts are typically used by Attorney’s to track money held by their business on behalf of others. This is a type of contra account as you would have a Trust Accounts-Asset account that offsets this account. The balances of the two accounts need to match.

- Undistributed Tips – To track tips that have not yet been distributed

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.