Small businesses with Product Inventory use the “Accrual Accounting Method” to record their Inventory Assets on their Balance Sheet. They may still use the “Cash Accounting Method” for everything else. If Product Inventory is required to account for your business Income, you must generally use the “Accrual Accounting Method” for Sales and Purchases.

The value of your Inventory is calculated into your COGS (cost of goods sold) expense to determine the Taxable Profit on Inventory Sold. If Inventory is unlikely to be sold, it may be written off or written down in value. Inventory is Property Asset that you are holding for Sale to your business customers.

At the end of the tax year, your business will be taxed on the Profits it made for the year. Your Inventory does indirectly affect your Profits. Your unsold Inventory is an Asset on your Balance Sheet. Your Gross Profits are calculated by deducting the COGS (cost of goods sold) expense from your Total Income. You increase your Gross Profits by decreasing your COGS (cost of goods sold) expenses. Inventory,

If You Use a Cash Accounting Method for Your Income; you Must Use a Cash Accounting Method for Your Expenses

Small businesses that use a “Cash Accounting Method” to calculate their business Income must also use this method to calculate their expenses. Businesses use the “Cash Accounting Method” to defer taxes until Income is received. Many of today’s small businesses choose to charge their customers for Products and Services sold at the time of Sale.

Many of today’s small businesses pay for Goods and Services at the time of purchase. These purchases may be business operating expenses, or the cost of goods or services sold. It is less common these days for small businesses to pay vendor invoices at-a-later-date with payment terms. Even credit card charges come through bank feeds as “Cash Basis” expenses. Many of today’s business expenses are recorded in the same month they are incurred.

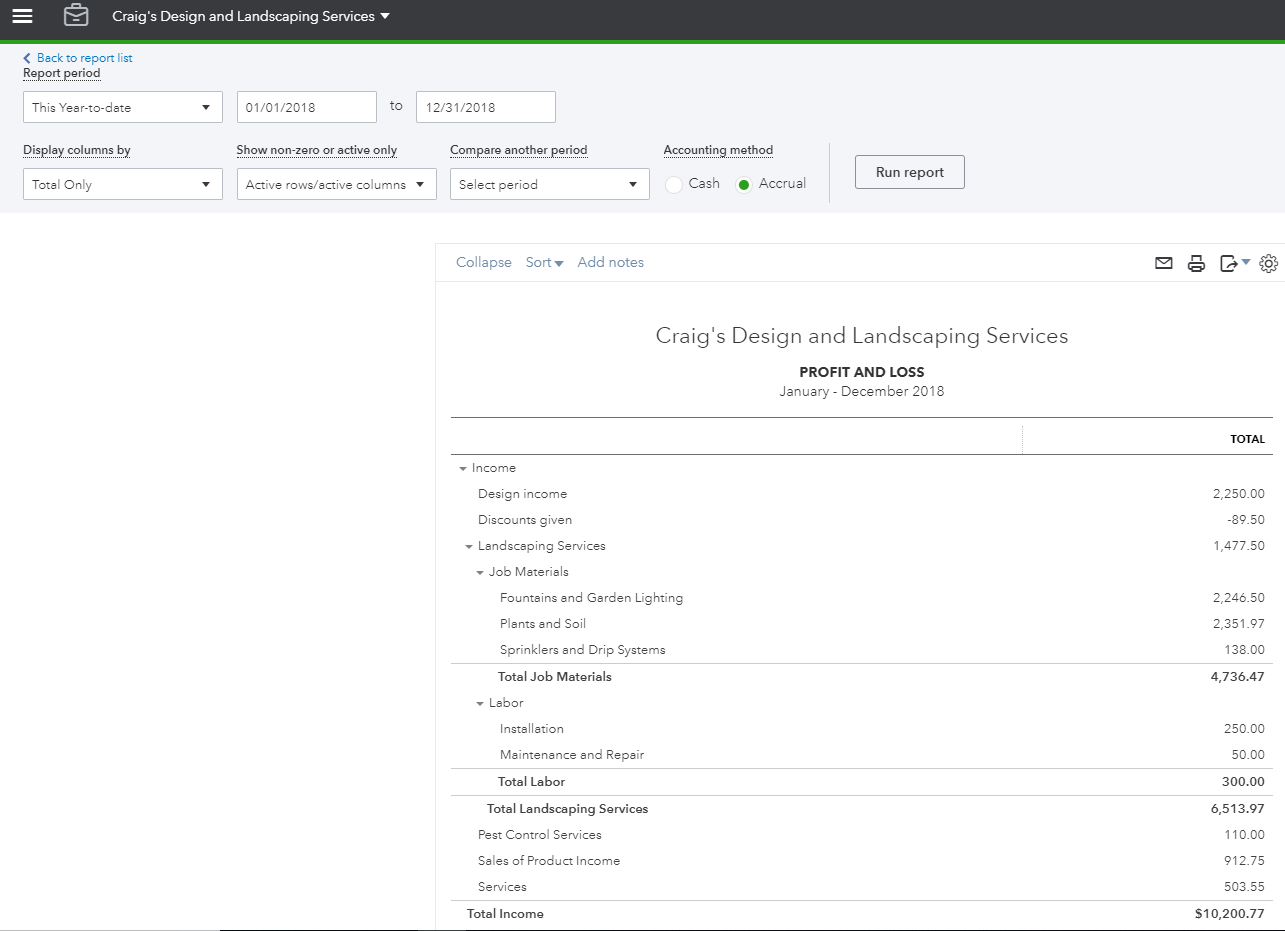

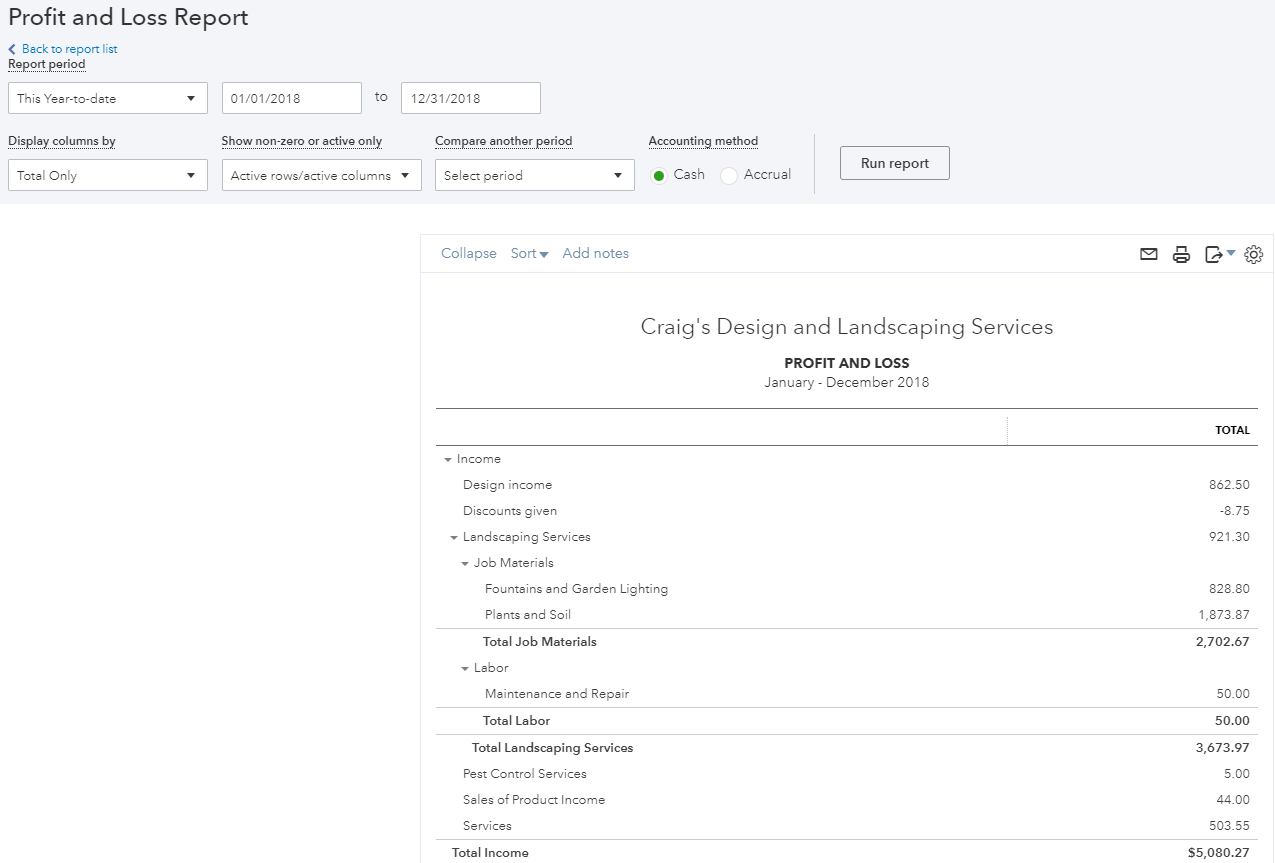

Looking at Profit & Loss Reports on a Cash and an Accrual Basis is Very Insightful to Small Business Owners

As a small business owner, you watch your “cash-flow” very closely. You need to know that you earn enough Income to operate your business, and that you are successfully replacing your Employment Income with your Business Revenues, assuming you had a job before you became self-employed. You also need to know if your Business is Profitable and if you can increase your “Equity” with “Net Profits“. Running your Profit & Loss Report on both a “Cash” and an “Accrual” basis will provide you with valuable insights.

Note that you can do this regardless of your QuickBooks Online Company Setup. If you customer invoices are not “automatically” paid, there can be a “significant” difference in your “Total Income” and “Net Income” when you compare the two report types. It is possible to have a “negative” Net Income on a “Cash” basis Profit and Loss Report while showing a “positive” Net Income on an “accrual” basis Profit and Loss Report. It is your unpaid customer invoices and unpaid vendor expenses that determine these differences. Review your cash and accrual basis reports each month so that you have a better understanding of your business cash flow, revenues and expense trends.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.