How Your Business Type Decides How You Get Paid matters. Let’s break it down simple: the kind of business you run changes how you put money in your pocket. Here’s the deal:

✔️LLC or Sole Proprietor: If you’re flying solo, you usually take out chunks of the business’s earnings as your pay.

✔️Partnership: Partners get their share through “guaranteed payments” or profit shares called “distributions.”

✔️C Corporation: You get a paycheck (that’s your salary) and might also get a piece of the profits as “dividends.”

✔️S Corporation: You get a “reasonable salary” and can also get extra money as “distributions.”

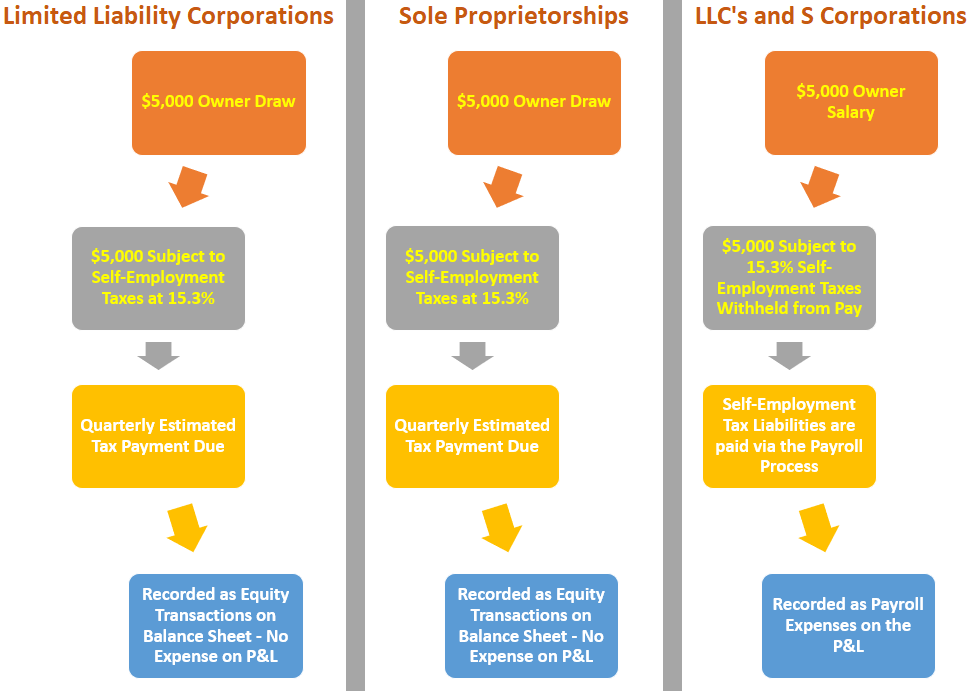

All these ways of getting paid come from your business making money. When you take money out as draws or distributions, that’s about owning a piece of the business, and it shows up on a special part of your books called the Balance Sheet. But if you get paid a salary or guaranteed payments, that’s more like regular wages, and it goes on a different part, the Profit and Loss Statement.

And don’t forget about taxes. If you’re on your own or in a partnership, you gotta handle taxes yourself every few months, including for Social Security and Medicare. If you’re with an S Corp, you pay income taxes, but not on the extra distributions. C Corps have a different setup, where the business itself doesn’t pay Social Security or Medicare taxes on what you take home.

Navigating Taxes for Sole Proprietors: What You Need to Know

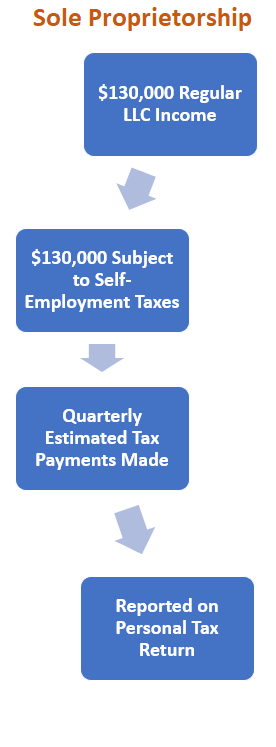

If you’re running your own show as a sole proprietor, here’s the scoop on taxes: The IRS sees you as a one-person business. You don’t give yourself a paycheck in the traditional sense, which means no salary deductions as a business expense. Instead, the money you make from your business is what you live on, and yep, it goes on your personal tax return.

Now, for taxes, you’ve got to cover federal and state income taxes on your business’s profits. Plus, there’s self-employment tax, which covers Social Security and Medicare. This self-employment tax is based on your business profits, and you should keep an eye on this because once your business starts making money (especially after the first year), you’ll need to start paying these taxes every quarter. For sole proprietors, LLCs, and partnerships, self-employment tax sits at 15.3%.

Breaking that down, the Social Security bit of self-employment taxes is 12.4% on up to $128,400 of your net income, and Medicare is an additional 2.9%. So, a good rule of thumb is to stash away 25% to 30% of your income to cover these taxes. This way, you won’t be caught off guard when it’s time to pay up.

Information on Self-Employment Tax can be found on the IRS website here:

https://www.irs.gov/individuals/international-taxpayers/self-employment-tax

https://www.irs.gov/businesses/small-businesses-self-employed/sole-proprietorships

https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

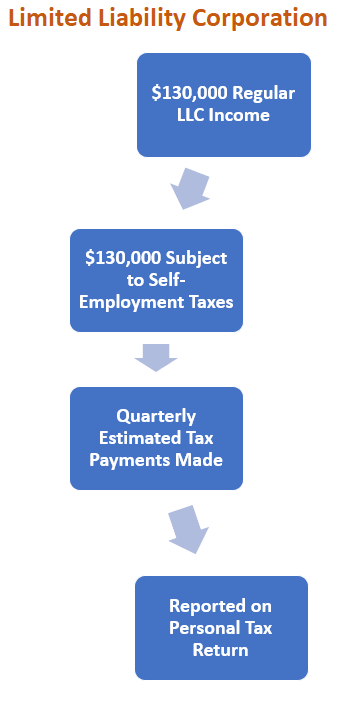

Limited Liability Companies are Considered Disregarded Entities

Setting up an LLC is something you do at the state level, and it’s mainly for shielding your personal stuff (like your house or car) from business-related lawsuits. To the IRS, though, your LLC isn’t seen as a separate entity from you, the owner. This means any money the business keeps at the end of the year is considered your personal income.

When it comes to paying yourself, the IRS won’t let you write off what you take out of the business (those are called draws) as a business cost. These pulls from the business go down as dips in your Equity on the Balance Sheet. As an LLC owner, it’s smart to save a chunk of your earnings for tax season. You’ve got options on how to pay yourself: either as a regular employee or by taking a share of the profits.

If you’re working in the business, you can pay yourself a salary, which counts as a business expense and can lower your taxable profit. For this, you’ll need to fill out a W-4 so the IRS knows how much tax to take out of your paycheck. You’ll get paid like any other employee, with taxes already taken out.

If you decide to take a share of the profits instead, you can do this in one go at the end of the year or pull money out as you go. These withdrawals are then taken off the business’s profit at the end of the year.

If you’re the sole owner of the LLC, you’ll pay income tax on these profits through a Schedule C on your personal tax return. If your LLC has more than one member, it’s treated like a partnership for tax purposes. Each member reports their share of the profit on their tax returns and pays taxes on it.

When it comes to splitting up the profits among LLC members, the LLC needs to file Form 1065. This form details how the profits are divided. Even if you’re getting a salary from the LLC, you’re still in line to get your share of the profits at the end of the year.

Now, if you decide not to pay yourself a salary or take any money out of the company’s profits, you’ve still got to pay income tax on those profits when you file your personal tax return. Basically, the IRS expects you to pay taxes on your share of the earnings, whether you’ve taken the money out of the business or not.

Information on Limited Liability Company Tax can be found on the IRS website here:

https://www.irs.gov/businesses/small-businesses-self-employed/limited-liability-company-llc

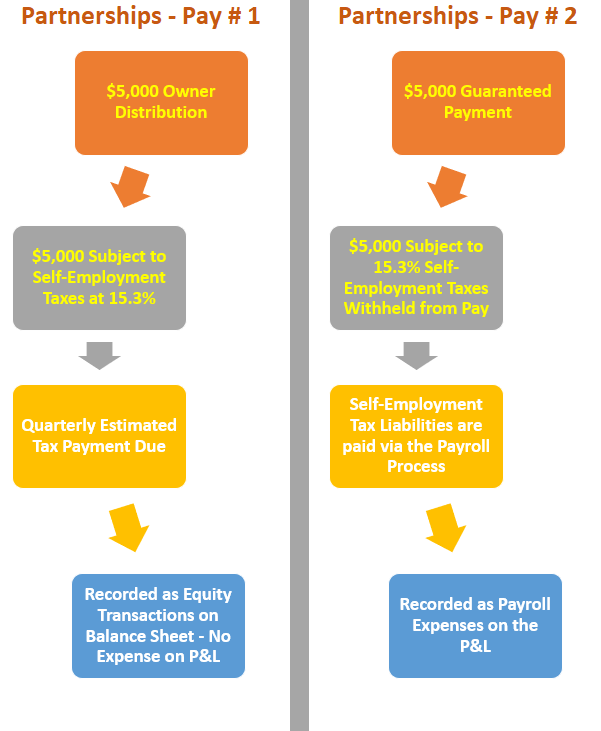

Partnerships are Taxed on the Full Profits of Their Business & Split

Partnership agreements lay out how profits are divided among the business partners. All the money the partnership makes is up for grabs by the taxman. Each partner pays taxes on their slice of the pie according to their ownership stake. So, if one partner owns more of the business, they take home a larger chunk of the profit and, yep, they pay more taxes on it.

Partners get their share through distributions, but they can also opt to leave some cash in the business to bump up their ownership stake. These moves—whether keeping money in the business or taking it out—are tracked on the Balance Sheet and don’t pop up on the Profit and Loss Statement.

Now, there’s a twist with “guaranteed payments.” These are set amounts paid to partners for the work they do, not based on how much of the business they own. These payments do affect the Profit and Loss Statement because they count as a business expense, lowering the overall profit.

After these guaranteed payments are taken out, the remaining net profit is what gets divided among the partners. And when it comes to these profit shares, partners need to handle self-employment taxes, usually by making quarterly tax payments.

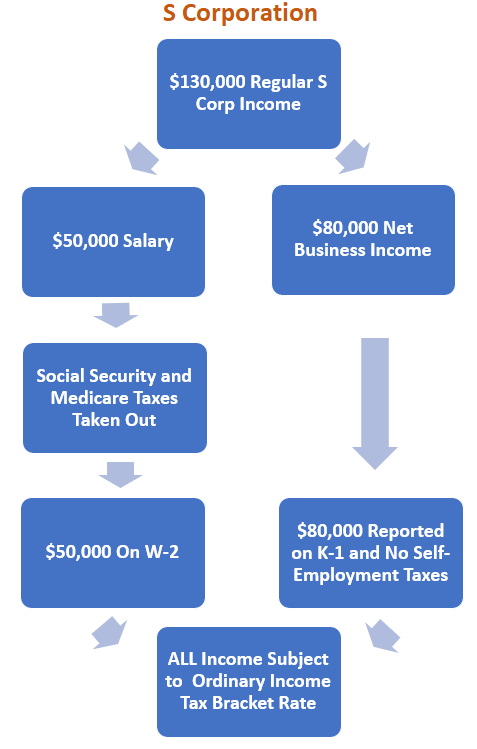

LLC’s and Partnerships Can Choose to Be Taxed as S Corporations

When an LLC or Partnership decides to be treated as an S Corporation for tax purposes, it means the company itself doesn’t pay taxes. Instead, the taxes are passed through to the owners (whether they’re called members or partners) according to how much of the company they own. The S Corporation doesn’t bear the tax burden directly.

In an S Corp, the owners often wear two hats: they’re both shareholders and employees. This setup means they get regular salaries, which the business reports as payroll expenses on its Profit and Loss Statement. However, any profit distributions to shareholders are recorded on the Balance Sheet, not the Profit and Loss Statement.

Shareholders on the company payroll have taxes taken out of their salaries just like any other employee, which includes the company covering part of the payroll taxes. This salary payment reduces the business’s overall profit. Any profit that’s left after salaries and other expenses is then divided among the shareholders based on their ownership stakes.

Shareholders have the option to leave their share of the profits in the business, boosting their stake or “equity” in the company. These retained profits get taxed differently, often at a lower rate than self-employment tax, making it a tax-efficient move for shareholders.

Maximizing Tax Efficiency with S Corporation Status

Choosing S Corporation status for your LLC can be a savvy tax strategy, offering a blend of salary and shareholder distributions that optimizes tax efficiency. By properly structuring your compensation as an owner-employee, you can balance between taking a reasonable salary, which is subject to payroll taxes, and receiving profit distributions, which are not.

This approach allows you to potentially reduce the amount of your income that’s subject to self-employment taxes, without compromising compliance with IRS compensation guidelines for S Corporation shareholders. It’s essential to work closely with a tax advisor to tailor this strategy to your specific business circumstances, ensuring you navigate the complexities of tax law while maximizing your benefits under the S Corporation framework.

Fair Pay for S Corp Shareholders is a Must

When you reinvest profits into your business, it can help lower your tax bill since you’re not pocketing that money as personal income; instead, you’re fueling your business’s growth. The IRS insists that shareholders of an S Corp get paid a “reasonable compensation” for their work, similar to what anyone else in their position would earn.

If an IRS auditor finds that what you’ve taken as distributions really should have been counted as wages, you could be on the hook for extra taxes, penalties, and interest. Being an S Corp also means you need to hold regular shareholder meetings and keep minutes of these meetings. S Corps face more scrutiny than LLCs, sole proprietorships, and partnerships, especially when it comes to mixing personal and business expenses. The IRS keeps a keen eye on S Corps, often auditing them to ensure expense deductions and taxes are on the up and up. So, it’s crucial to keep everything above board and well-documented.

The Double Taxation of C Corporations: Salaries and Profits

C Corporations aren’t typically the go-to choice for small businesses, mainly because of the “double taxation” hurdle. Here’s how it works: C Corps get taxed first on their profits at the corporate level. Then, when shareholders take out salaries or profit distributions, those payouts get taxed again on their personal tax returns.

However, there’s a silver lining for C Corp shareholders when it comes to self-employment taxes. Unlike sole proprietors or LLC owners, C Corp shareholders don’t pay self-employment taxes on the entire net earnings of the business. Instead, shareholder-employees only pay employment taxes (like Social Security and Medicare) on the salaries they receive, not on profit distributions. This structure offers a distinct tax handling compared to other business forms, highlighting the importance of strategic financial planning for business owners navigating the complexities of corporate taxation.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.