The most valuable service your accountant can provide is bank feed categorization for your QuickBooks Online account. If you have chosen this monthly service with Lend A Hand Accounting, your bookkeeping is in good hands! When your dedicated accountant manages your bank feed categorizations, they start to develop your accounting story. From day one your accountant will evaluate your business spending and money-making trends. This service saves business owners hours of time per month, eliminates bookkeeping errors, and reduces the time to reconcile the books. Our firm specializes in creating custom bank rules to automate the bank feed categorization process and utilizes our custom platform to clear uncategorized transactions.

Relax while your Accountant categorizes Bank Feed Transactions

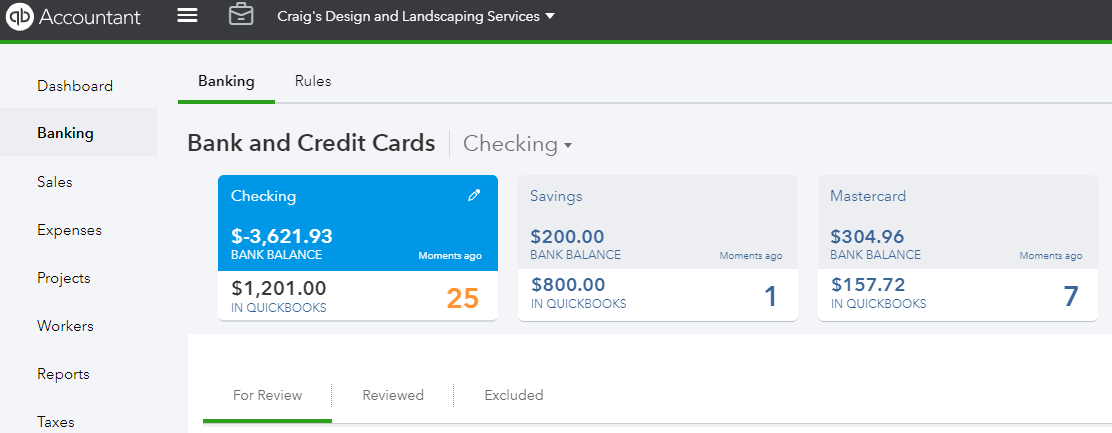

Once you have connected your business bank and credit card accounts, the stress begins. Your bank feed categorization can be a frustrating bookkeeping task to complete in your QuickBooks Online account. If your Banking dashboard in QuickBooks Online looks anything like the snapshot from the sample company below, there are serious problems to solve that will take time to research. The bottom line is that your QuickBooks Balance should always match your Bank Balance. The good news is you can relax while your accountant categorizes your bank feed transactions for you, if you have selected this service.

Your Accountant quickly masters managing your Bank Feeds

The goal of your dedicated accountant will be to quickly master how to categorize and match your business income and expenses within your bank feeds. We have developed a streamlined process for communicating with our clients on a recurring basis for their feedback and advice. Our clients receive weekly notifications when we need advice to categorize expenses. We developed a mobile friendly expense categorization tool that is connected to each of our clients QuickBooks Online books.

Your Accountant uploads missing transactions into Bank Feeds

Regardless of whether your bank or credit card company can successfully connect to your QuickBooks Online account, your accountant can upload any missing transactions into the bank feeds of your business bank and credit card accounts and categorize them for you. Your accountant will require an Excel file that includes the missing bank or credit card transactions that should include the transaction date, dollar amount, vendor name, and expense description.

Your Accountant records Equity transactions in your Bank Feed

Some business owners use business funds to pay for personal expenses from time to time. When this happens, your accountant will record these Equity-Out transactions that come through the bank feed as Balance Sheet transactions. When answering uncategorized expenses that are personal, the Ask My Accountant expense account is always selected, and notes are added.

Your Accountant records Principal and Interest Business Loans

Many businesses have bank and auto loans with recurring monthly principal and interest payments. When money spent comes through you bank feed it can include your monthly loan payments. Your accountant will review the monthly loan statements that you upload into your secure document upload portal and record a split payment between the principal liability balance on your Balance Sheet and the interest expense on your Profit and Loss Report. This will reduce your loan liability and record the monthly interest expense. Your accountant will also match the recorded payment to the bank feed transaction.

Your Accountant helps Separate COGS and Operating Expenses

Your Accountant can evaluate your business expenses to help you determine whether an expense is a COGS (Cost of Goods Sold) expense, or an operating expense. We want to help our clients understand the link between their business profit and their cost of goods sold. To determine the cost of goods sold for a product, you must add up the cost of materials and direct labor needed to create the product. Your operating costs are not directly tied to your cost of sales and are categorized to accounts such as marketing, advertising, bookkeeping, accounting, bank fees, taxes, building repair and maintenance, fuel, travel, office supplies, rent and utilities. These two expense types are reported separately on your Profit and Loss report.

Your Accountant matches Money Spent to Vendor Bills & Expenses

Even if you have not selected our A/P and Expense Entry service, your accountant will match the money spent that comes through your bank and credit card account feeds to the vendor bills and expenses that you have entered. If an expense is unknown and cannot be categorized, it will be included in your weekly uncategorized expense notifications.

Your Accountant matches Money Received to Invoices & Receipts

Even if you have not selected our Customer Invoicing or Sales Receipt service, your accountant will match money received that comes through your bank and credit card feeds to customer invoice payments or sales receipts that you have entered. They will additionally clear undeposited funds by creating matching QuickBooks Online bank deposits from sales receipts and received customer invoice payments. They can also create customer refund receipts as needed. Refund receipts are created when prior customer payments are rejected or returned, and your bank deducts this amount from your account. They can also be used to refund a customer payment by check or credit card.

Your Accountant helps you Avoid Tax Audits with Categorizations

Poor bookkeeping is the number one reason for IRS and State Tax audits. It is critical to record your income and expenses correctly in QuickBooks Online. Any uncategorized or miscategorized income or expenses can trigger an audit. State agencies such as the Department of Revenue and the IRS look for trends such as sudden increases or decreases to reported income or business deductions. It is important to keep your accounts reconciled and to maintain a verifiable bookkeeping audit trail. Your accountant will help reduce the likelihood of IRS and State tax audits with our Bank Feed Categorization service.

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.