The deadline to E-file your 2023 Annual 1099-NEC tax forms is 1/28/24. It is important that you 1) clear your uncategorized expenses and 2) collect W-9 forms from individuals and businesses that you paid more than $600 for services in 2023.

You must provide these W-9 forms, and select our one-time service for Vendor Setup, with 1099 filing for $200 by 12/15/23. These two steps must be completed in a timely manner if you would like us to prepare and E-file 2023 1099’s for your business.

What’s new for the 2023 tax year?

The limit on how many paper filings you can file with the IRS has been lowered in 2023 from 250 to 10. If you have 10 or more combined 1099s and W-2s, you must file them electronically. For the 2023 tax year, QuickBooks Online has updated its features to allow the submission of amended 1099-NEC or 1099-MISC forms electronically.

This capability will be available beginning in January 2024. Users who have e-filed their 1099 forms through QuickBooks Online, QuickBooks Contractor Payments, or QuickBooks Payroll will be able to utilize this feature for corrections.

You must file corrections for 1099s and W-2s the same way you filed the original forms. For example, if you have e-filed your 1099s or W-2s, you must also e-file your corrected form. If you have filed by paper, your correction must be on paper.

You Can Do This

It’s easy and fast to file your own 1099-NEC forms in your QuickBooks Online account.

Before you start:

- Enter the W-9 information from your US 1099-Eligible contractors into your vendor profile in QuickBooks Online. It’s easy, learn more about tracking payments to 1099 contractors throughout the year.

- When you start the process, you’ll be required to select the accounts that will be included in 1099 reporting.

Confused? Here’s an example:

- You have an expense account where you track the payments made to independent contractors. Let’s call this account “Contractor’s Expense Account”.

- When you start the process of E-Filing 1099s in QuickBooks Online, you’ll select this account because this is where QuickBooks Online will look to find the expenses or Vendor Bills exceeding $600.

- QuickBooks will show a report containing the vendors who were selected for 1099 tracking.

1099 Tutorial Video

What qualifies as non-employee compensation?

Look at your expense accounts and identify these payment types as potentially qualifying as non-employee compensation:

- Fees

- Commissions

- Prizes

- Awards

- Other forms of compensation for services

You must typically report a payment as non-employee compensation if these conditions apply:

- You made the payment to an individual who is not your employee.

- The payment was for services for your business.

- You made the payment to an individual or business that are not Incorporated.

- Payments to the payee were at least $600 during the year.

If you need to record payments of more than $600 for rent, prizes, attorney fees, or medical and healthcare payments, you should fill out a Form 1099-MISC.

Where can I get 1099 forms?

If you’re filing electronically, use the online form. You can easily E-file your 1099s with QuickBooks Online. If you plan on mailing in a 1099, you must order a hard copy. They cannot be downloaded on the IRS website. You can also order printed 1099s directly from QuickBooks or buy them at an office supply store. Before preparing a 1099, collect W-9 forms (the equivalent to Form W-4 for employees). It contains all the contractor’s identifying information, including their tax ID number. Note that Intuit does not E-file State or corrected 1099 tax forms. They are sent via mail.

How do I file a 1099 form?

If you’re filing a 1099 with QuickBooks, the correct 1099 form will be selected for you. A 1099 includes any wages you paid in the previous calendar year and must be submitted to the payee by January 31 (if January 31 lands on a weekend, then the deadline is the next business day). To avoid penalty, you must E-file a 1099-NEC with the IRS by January 31, 2024.

If you’re e-filing a 1099-MISC, you’ll have until March 31, 2024. However, the deadline to E-file with Intuit QuickBooks Online is 5 pm 1/28/24. QuickBooks will continue to let you e-file your 1099s until May 7, 2024.

Here’s a breakdown:

- Submit Copy A to the IRS and Copy 1 to your state tax department

- Send Copy B and Copy 2 to the payee, who will use them for filing federal and state tax returns

- Keep Copy C for your records

Create Vendor Profiles in QUICKBOOKS ONLINE Before You Can E-File their Annual 1099

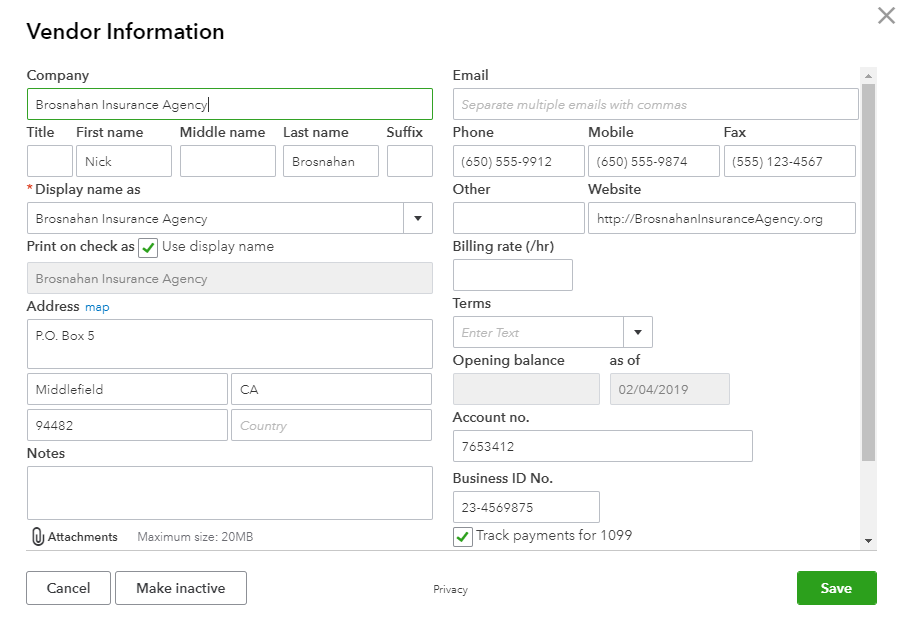

It is important to add your existing Vendors and Contractors in QuickBooks Online. If the vendor is 1099 eligible, you will want to check the box to “Track payments for 1099” as seen in the screenshot below. You must have the following information:

- Legal Business Name

- Legal Business Address

- US Tax Identification Number

- Email Address

- Cell Phone Number

You can Invite Your Contractors to Add their Own 1099 Tax Information into QuickBooks Online

You can now invite your contractors to add their own 1099 tax information securely into your QuickBooks Online account. Make sure that your contractors email address is current before sending an invitation. You will select “Workers”, “Contractors” and “Add a contractor”, enter the contractors name and email address, then select “Invite them to fill out the rest” and then “Add contractor”.

Note that you can also give your contractors free online access to their 1099’s during the E-Filing process.

Understanding 1099 Requirements for Vendor Paid via Third Party Networks

There was a change in the requirements for information reporting of payments made in settlement of payment cards and third-party network transactions such as PayPal. The new reporting requirements are in section 6050W of the Internal Revenue Code, and they are additionally referenced on IRS forms 1099-MISC and 1099-K. You will not be required to prepare a 1099-MISC for vendors paid by a credit card or third-party.

All payments made with a credit card or payment card and certain other types of payments, including third-party network transactions, must be reported on form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. For this reason, QuickBooks automatically excludes these kinds of vendor payments from your 1099-MISC tracking and reporting.

Consequences of Failing to File 1099s 🚨🚨🚨

Not filing 1099 forms with the IRS can lead to significant consequences for businesses, including financial penalties that vary based on how late the forms are submitted. If a business fails to file a required 1099 on time, the IRS can impose a penalty ranging from $50 to $280 per 1099, depending on the delay in filing. If the failure to file is determined to be intentional, the penalty jumps to $570 per form or, if greater, 10% of the amount required to be reported, with no maximum limit. Beyond financial penalties, not filing 1099s can also result in an audit, where the IRS closely examines your business records and transactions. This scrutiny can lead to additional fines and penalties if discrepancies or intentional non-compliance is found. It’s crucial for businesses to understand these risks and ensure all necessary 1099 forms are filed accurately and on time to avoid these penalties and maintain compliance with IRS regulations. 🔦🚨🔦

Helpful Resources:

https://www.irs.gov/businesses/understanding-your-1099-k

https://www.irs.gov/forms-pubs/about-form-1099-misc

https://www.irs.gov/payments/general-faqs-on-new-payment-card-reporting-requirements

https://www.irs.gov/pub/irs-utl/irdm_section_6050w_faqs_7_23_11.pdf

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.