Millions of small business owners have switched over from QuickBooks desktop to QuickBooks Online since 2001. Many of these small businesses are saving thousands of dollars per year in operating expenses by utilizing virtual QuickBooks Online bookkeeping and accounting services offered by US accounting firms like ours. We are experiencing a gig-economy and the number of self-employed individuals is steadily rising with each passing year post covid. These entrepreneurs need help!

New owners that have signed up with a QuickBooks Online subscription need to start with these 5 critical beginning entries:

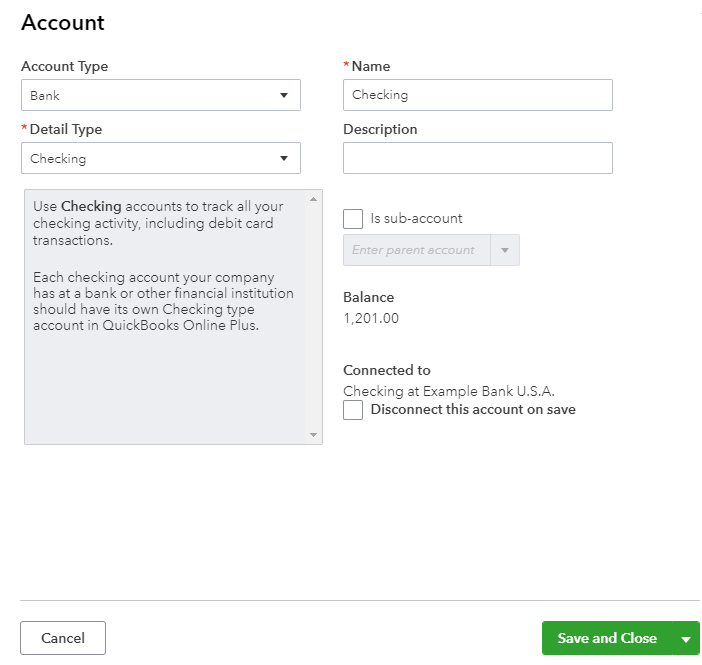

Customized Chart of Accounts

- This is one of the most important lists you will ever create in your new QuickBooks Online account

- It contains the accounts for your business income, expenses, assets and liabilities

- The Chart of Accounts needs to be “refined” and “customized” for your business

- This should be done BEFORE you start adding transactions into your new QuickBooks Online account

- A well-designed chart of accounts helps you make sense of your Company Financials

- It is important to setup these accounts correctly from the start of your business

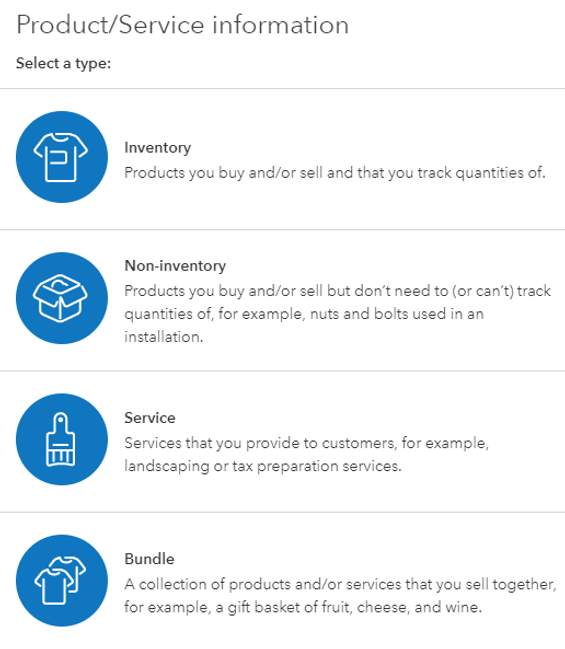

Customized Products and Services

- Add Products and Services you sell in QuickBooks Online before creating Purchase or Sales Forms

- These Products and Services appear on all Customer Invoices and Sales Receipts

- If you Purchase Products or Services for resale, they should be entered here as well

- Each Product and Service item you sell you can specify a sale price and purchase cost

- The purchase description shows on your Purchase Orders, Bills, Checks and charges

- It is important to establish the cost and price of the products and services that you sell

- Your beginning Product Inventory value is driven by the initial product inventory setup

- Your Company Sales Reports will contain the Products and Services that you have sold

- Your Products and Services always have more detail than your income accounts

- You may have few high-level income accounts and hundreds of products and services

- Products and Services are mapped to your income and cost of goods sold accounts

- It is a priority to setup your Chart of Accounts before your Products and Services

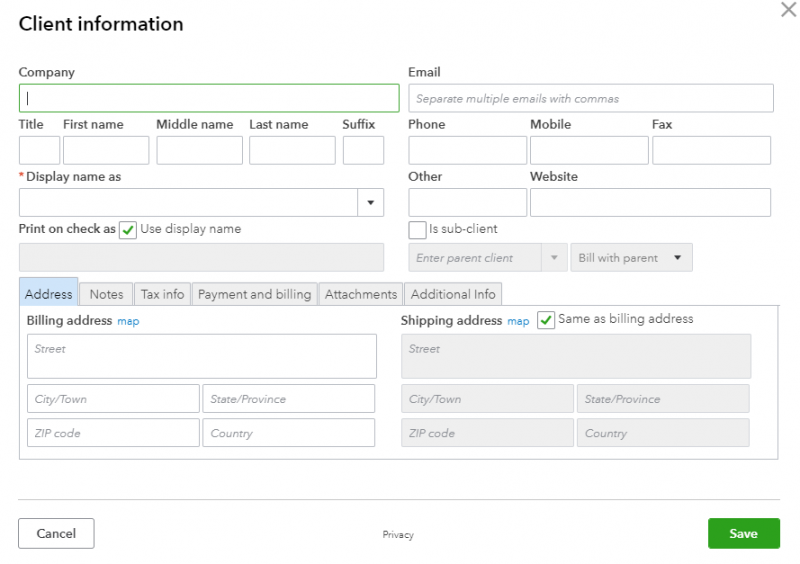

Customer and Vendor Lists

- You should setup your “Customers” and “Vendors” in QuickBooks Online before adding transactions

- When setting up your customers be sure to enter information in all the required fields

- Setup the default tax code, payment terms, invoice delivery and payment method

- Obtain a PDF copy of your vendor W-9 forms to attach to their vendor profile in QuickBooks Online

- Enter complete vendor information in QuickBooks Online, it will populate on the annual 1099 form

- Business owners must issue a Form 1099-MISC to each person they have paid at least $600

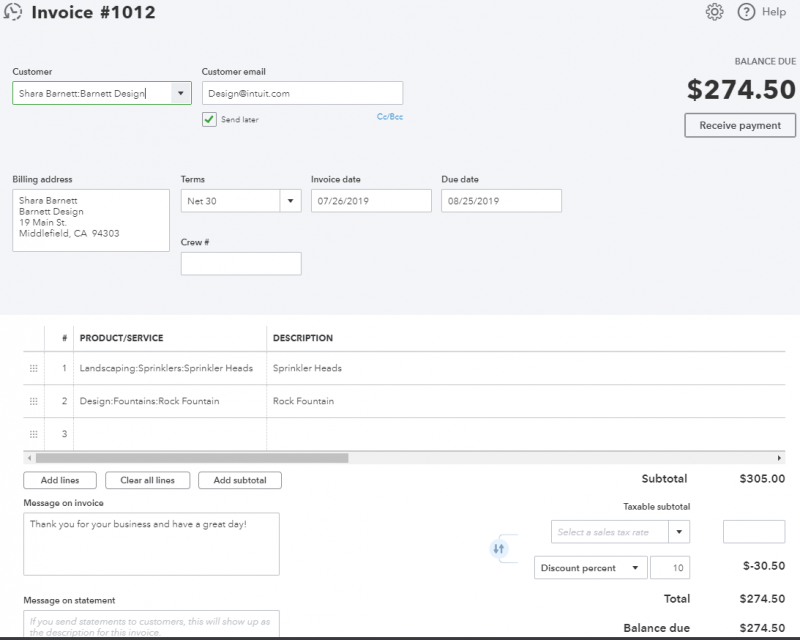

Outstanding Customer Invoices

- Enter any outstanding customer invoices into QuickBooks Online after completing entries noted above

- Use the original invoice date so that it will align with your prior accounting system data

- Some businesses use third-party applications for industry specific customer invoicing, be sure to match invoice numbers

- These invoices need to be “additionally” entered in QuickBooks Online to create the A/R balance

- QuickBooks Online should have “matching” Products and Services to the third-party application

- You can turn-on “Custom transaction numbers” in the Company Settings

- This will allow you to create your own invoice numbers to match the 3rd party numbers

- Keep in mind that there are options to explore for “importing” invoices into QuickBooks Online

- Make sure all customer invoices, payments, deposits or sales receipts are in QuickBooks Online

- Be sure to enter any missing historical transactions in QuickBooks Online, some may not convert

- You need to verify the accuracy of your sales tax liability and payment history in QuickBooks Online

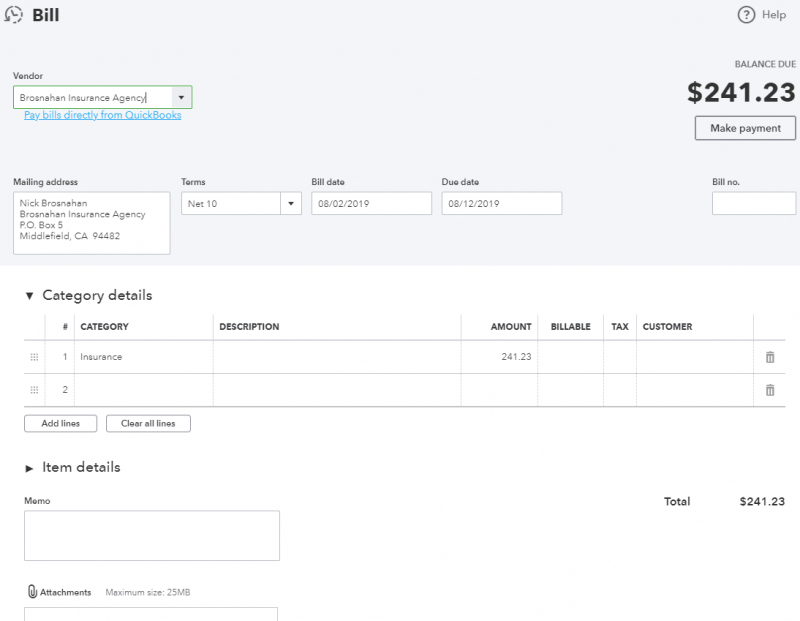

Outstanding Vendor Bills

- Enter any outstanding vendor bills & credits into QuickBooks Online after completing steps noted above

- Use the original date so that it will align with your prior accounting system data

- Verify the transaction history of bills, credits, expenses and bill payments in QuickBooks Online

- Be sure to enter any missing historical transactions in QuickBooks Online, some may not convert

- Purchase information from Product and Service items will populate in vendor bills

- Purchase information from Product and Service items will populate on purchase orders

- Note that you DO NOT manually enter connected credit card charges as bills in QuickBooks Online

- Note that connected credit cards have their own bank feed and account register

- You can categorize an expense directly in the connected bank account feed

- You can match an entered bill to a payment that comes through the bank feed

Your Personal Guide to Seamless Accounting: Advanced QuickBooks ProAdvisor at Your Service

Hey there! I’m Gina, and I’m the proud co-founder of Lend A Hand Accounting. Why did I start this? Well, I believe that everyone should have access to affordable, efficient, and flexible accounting and bookkeeping services. It’s all about making sure these essential services fit snugly into your budget without any fuss.

We’ve ditched the traditional hourly rate system and adopted a flat fee pricing. You might be wondering, “Why does this matter?” Well, this way, you know exactly what you’re paying for upfront and there are no unexpected surprises. You get to pick and choose the accounting services you need, like a customized menu. And the best part? You’re in complete control of when you start or stop using our services. We’re essentially just a call or a text away, no need for endless phone calls or draining trips to the accountant’s office.

I’m not just any accountant though. I’m an Advanced QuickBooks Online ProAdvisor. That means I’m equipped with advanced expertise and resources to help you leverage QuickBooks Online to its full potential. My goal is to make your accounting process smooth and efficient so you can focus on what you do best – running your business.

Ready to get started? Reach out to me directly at 360-637-4799. We can even kick things off immediately if you’re ready. Simply create a free account, and I can instantly take a look at your books and let you know where you stand.

At the end of the day, we’re here to serve you. We really appreciate the trust you place in us and we’re eager to meet all of your accounting and bookkeeping needs. Looking forward to being part of your team!

Take care,

Gina

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.